UOB Kay Hian says REX has multiple catalysts this year

Analyst: Loke Chunying

With renewed interest in E&P companies following the surge in RH Petrogas’ share price, we see a possible re-rating for E&P companies trading at a steep discount to asset value.

Mans Lidgren, CEO of REX.

Mans Lidgren, CEO of REX.Photo: Company With six more exploratory wells to be drilled for the rest of the year, 2014 will be a busy year for Rex with multiple catalysts in sight. Investors can expect cash flow and profitability to improve as Rex prepares for early well production in Oman and its Cory Moruga concession. Maintain BUY.

Busy year with potentially multiple catalysts. Rex spudded its first onshore well in its Cory Moruga concession in Trinidad and Tobago (T&T) in end-April.

This is the first of a five onshore well-drilling programmes planned for T&T in 2014. The results of the drilling will be announced when all five wells have been drilled.

Another two exploratory wells will be drilled in 4Q14 at RAK Offshore and in Norway. Thus, 2014 will be another news-packed year for Rex, providing potential multiple price catalysts along the way.

The money is coming in... In addition to the five well-drilling programmes in T&T, Rex will also be putting an already discovered oil well in the Cory Moruga block (discovered in early-11 by the previous concession holders) into production later this year, after using its Rexonics well stimulation technology to optimise production flow.

Rex is projecting oil production from the wells in T&T to top 500 bopd by end-14 and even more in 2015. With the oil discovery in Oman, Rex is also preparing for early production by sourcing for equipment and obtaining the necessary approvals from the authorities.

Early well production is expected to commence in 1Q15. Based on a 48-hour flow test conducted at the start of the year, the well has a light oil flow rate of up to 3,000 stock tank barrels per day.

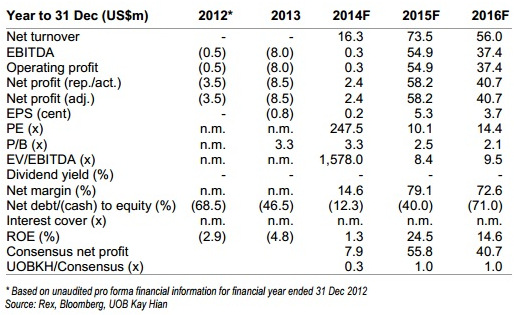

Maintain BUY and target price of S$1.27, based on the expected monetary value of Rex’s exploration assets using forecasts from traditional geologist findings.

Recent story: REX International -- Target price S$1.19, says London broker

OSK-DMG keeps 'overweight' call on offshore & marine sector |