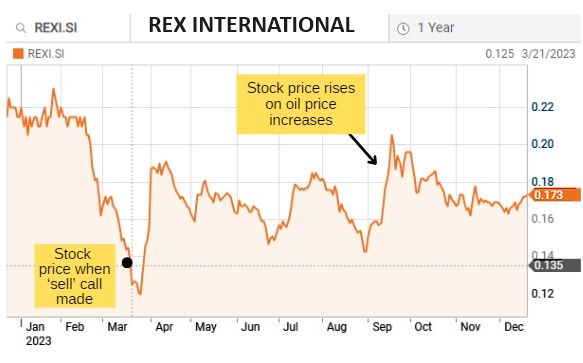

It's rare that a broking house (in Singapore) downgrades a stock to a "sell" and continue to provide regular analyst coverage. Rex International got a "sell" call for the first time in March 2023 from UOB KH. Its target price was 10 cents, which was about 30% lower than the traded price of 13.7 cents. The triggers for the downgrade (screenshot below) were a disappointing 2022 profit and two interested party transactions. |

Why the disappointingly low profit in 2022?

It had to do with the Yumna field in Oman seeing a y-o-y decline in production due to stoppages.

The stoppages were for:

| • planned major change-outs and upgrades to production facilities from Feb 22 to Apr 22, and • unforeseen operational issues in June 22 and Nov 22. |

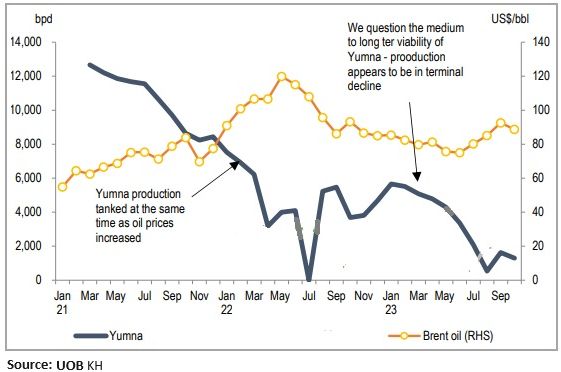

Going into 2023, these troubles continued impacting Rex's output in Oman.

In a chart (below) on 27 Nov 2023, UOB KH -- which is the only broking house covering Rex -- pencilled in a particularly dismal note: "We question the medium to long term viability of Yumna -- production appears to be in terminal decline."

UOB KH continued its 'sell' call in a report on 27 Nov 2023 (below).

Note the underlined comment regarding Yumna Field where production stopped from Oct 25: "At present, it is shut down with no visibility as to when production can resume."

Well, it wasn't going to be shut down for very long.

In its monthly update on 19 Dec 2023, Rex said production has restarted.

"Production had been shut in from 25 October 2023, due to damage to the internal pressure containing liner of the newly installed larger flowline, compromising the integrity of the flowline.

"A replacement flowline has been installed and production from the field restarted."

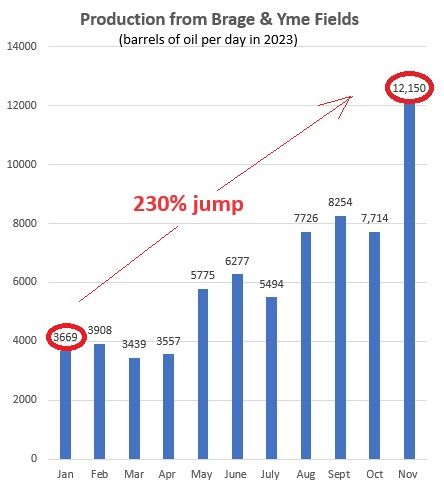

Equally important, Rex reported that its production from its Norwegian fields has "crossed the milestone of 10,000 barrels of oil equivalent per day (boepd), at 12,150 boepd."

The chart below shows the surge in aggregate production -- thanks to new production wells -- from the Brage and Yme fields in Norway, attributable to Lime Petroleum, the 91.65% subsidiary of Rex. * attributable to Lime Petroleum, a 91.65% subsidiary of Rex

* attributable to Lime Petroleum, a 91.65% subsidiary of Rex

Since the first "sell" call by UOBKH in March 2023, Rex stock price somehow had not followed a sharp trajectory downward.

In fact, it dipped initially before staying above 13.5 cents ever since. Did the market expect that the production problems were temporary?

Currently, the stock trades at 17-cent level (chart below).  Rex currently has a market cap of S$225 million. Chart: Reuters

Rex currently has a market cap of S$225 million. Chart: Reuters

The path forward depends on matters such as ....

| • Will Rex continue to be dogged by concerns over interested party transactions and investments in non-core ventures? • Will Rex be re-rated following the resumption of Yumna Field production (assuming no further hiccups) and the new elevated production from its Norway fields (assuming it stays high)? |