Jefferies: ‘Strong’ China developers on right track

Jefferies said that despite the 17% m-o-m decline in April presale volume, “strong” Hong Kong-listed developers are on good track to achieve their target.

“COLI (HK: 688), China Resources Land (HK: 1109) and China Greentown (HK: 3900) led the pack while Hopson (HK: 754), Agile (HK: 3383) and Evergrande (HK: 3333) lagged behind.

Photo: Agile Property“We reaffirm our positive sector view, given the liquidity easing on the back of accelerated onshore lending,” Jefferies said.

Photo: Agile Property“We reaffirm our positive sector view, given the liquidity easing on the back of accelerated onshore lending,” Jefferies said.

The research house said that sustainable growth in presales, ASP hikes and NAV expansion should drive valuation expansion.

Estimated April presales for major developers declined 17% m-o-m and grew 24% y-o-y on average, according to company releases and Jefferies Channel Checks.

Among developers that published April presales, Greentown (+22% m-o-m) and R&F (+8% m-o-m) were the only two with m-o-m growth.

Due to a high base in March, CR Land (-34% m-o-m) and Shimao (-25% m-o-m) saw larger drops.

In terms of YTD ASP growth vs. 2012, Hopson led the camp with a 12% hike, followed by Shimao (+11%) and CR Land (+10%).

“In our view, the m-o-m decrease in presales is expected since property sales were front-loaded in 1Q ahead of new policies.”

Photo: COLIStrong vs. weak

Photo: COLIStrong vs. weak

Despite the drop in April presales, Jefferies said stronger developers are on track to reach their full-year targets.

Major developers already locked in 32% of their 2013 targets (vs. 23% last year) and 62% y-o-y growth YTD.

“We believe COLI would top the league at 46% lock-in ratio, followed by CR Land (41%) and Country Garden (37%). On the contrary, we are concerned about Hopson, Agile and Evergrande with barely c24% of sales targets achieved, substantially behind the leaders.”

Jefferies 2013 “Top Picks” are COLI, CR Land, COGO, CMA and Shenzhen Investment.

Bocom: China property well-prepared for weaker volume ahead

Bocom International said that April saw steady contracted sales performance in general for Chinese developers listed in Hong Kong.

“The loose implementation of the ‘National Five Measures’, especially the capital gains tax by local governments, prolonged the solid property markets in April," Bocom said. Source: Bocom International

Source: Bocom International

However, the price control measures imposed on some major cities such as Guangzhou and Shenzhen reined in the property price uptrend.

The research house said developers generally recorded “in-line” sales performances in April.

Having said that, the m-o-m growth rates decelerated given the high base of comparison in March, with six out of nine developers showing m-o-m declines in April sales revenue.

“Developers are set to encounter thin transaction volume and constraint on selling price growth going forward.

“While the policy fear has hastened the increase of user demand in March, transaction volumes in major cities, such as Beijing and Guangzhou, have actually experienced significant declines since April,” Bocom said.

It added that on the other hand, local governments are expected to keep property prices in check following the implementation of the new measures.

“We expect average selling prices to become steady going forward, instead of maintaining the uptrend in 1Q13. After the traditional peak selling season in March and April, we anticipate contracted sales momentum to take a breather in the short term.”

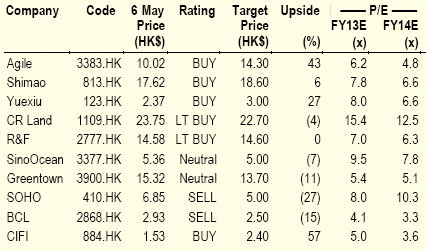

Bocom said it still prefers Shimao (HK: 813), Yuexiu Property (HK: 123) and Agile (HK: 3383) within its coverage universe.

“The sector is currently trading at a 40% discount to NAV, which is fair, in our view. Given the lack of catalysts in the short term, we maintain our ‘Market Perform’ sector rating.”

See also:

PRC HOUSING, HOPS