A Good Bet: Chu Kong High-Speed Ferry tied up with Cotai Ferry in 2012 to shuttle passengers to and from gambling mecca Macau. Photo: Chu Kong Shipping

A Good Bet: Chu Kong High-Speed Ferry tied up with Cotai Ferry in 2012 to shuttle passengers to and from gambling mecca Macau. Photo: Chu Kong Shipping

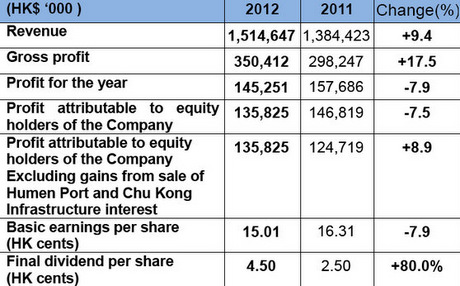

CHU KONG Shipping Enterprises (Group) Co Ltd (HK: 560), a major passenger and shipping services/port logistics provider serving South China, Hong Kong and Macau, boosted its 2012 top line 9.4% to 1.5 billion hkd.

This led to a core net profit growth of nearly 9%.

CKS Vice General Manager Huang Shuping (left) responds to an investor query. Photo: Aries ConsultingGross profit jumped 17.5% to over 350 million hkd with CKS offering a final dividend of 4.5 hkd, up 80% year-on-year.

CKS Vice General Manager Huang Shuping (left) responds to an investor query. Photo: Aries ConsultingGross profit jumped 17.5% to over 350 million hkd with CKS offering a final dividend of 4.5 hkd, up 80% year-on-year.

Hong Kong-listed CKS also managed to boost its gross profit margin to 23.1% from 21.5% in 2011 despite a less than ideal economic operating environment last year in the region and globally.

Profit attributable to equity shareholders decreased by 7.5% to 136 million hkd due to non-recurrence of a one-off gain arising from the disposal of equity stakes in Dongguan Humen Great Trade Containers Port and Chu Kong Infrastructure Investment which owned interest in Guangzhou-Foshan Expressway Ltd.

Excluding the impact of this one-off item, the core net profit increased by 8.9% to 135.8 million hkd.

Speaking to investors in Hong Kong, management said the nearly double-digit revenue growth was all the more impressive given the somewhat slower than customary GDP growth in China and its neighbors last year, and pointed to key port projects as well as higher revenue from the Macau passenger ferry operations as critical.

“Our Nansha Port logistics operations have been a very key growth area for us and a prime revenue driver,” said CKS Vice GM Huang Shuping.

Vice GM Huang said he expected “policy stability” toward passenger and cargo shipping sectors from the new national government which just took office.

As for growth for CKS going forward, “new projects under development” would be a major expansion strategy.

However, asset injections from the parent of CKS into the listed unit would also be part of the multi-pronged future growth strategy, he added.

CKS Managing Director Huang Liezhang said: “CKS overcame the challenges originating from the global economic downturn and achieved good results with steady growth. We will continue its strategy of implementing port business transformation and will consider acquisitions or strategic alliances to increase profit.”

He added that CKS planned to develop the current “healthy business trends” for the firm’s passenger transport operations to further strengthen cooperation with various passenger transport terminals in an effort to boost passenger numbers.

“CKS will also echo its parent group Guangdong Province Navigation Holdings Co Ltd’s ‘Specialized Operation and Core Business Transformation and Upgrade’ strategy as well as seek innovative business development opportunities, to bring CKS’s profit and asset size to new heights.”

CKS Chairman Liu Weiqing said cost control discipline was largely responsible for the company’s respectable 2012 financial results.

CKS executives and investors meet high above Hong Kong's Victoria Harbor in the Chu Kong Shipping Tower. Photo: Aries Consulting

CKS executives and investors meet high above Hong Kong's Victoria Harbor in the Chu Kong Shipping Tower. Photo: Aries Consulting

“In 2012, CKS responded to the weak global economy by expanding its sources of income, reducing expenditures and enhancing management. Hence, it achieved better operating results.”

He added that CKS was busy expanding last year, both organically and otherwise.

“In 2012, our investment strategy was to refine our layout of cargo terminals and to moderately increase the investment in passenger travel industry which is asset-light with high returns.”

Some of the acquisition highlights last year include a 23% equity stake in Zhaoqing New Port, resulting in 100% control over the terminal.

And last summer, Chu Kong High-Speed Ferry Co Ltd, a wholly-owned subsidiary of CKS – along with Cotai Ferry Co Ltd, a company indirectly owned by Sands China Ltd (HK: 1928) – inked a deal on the provision of management and operation services for Cotai Jet’s fleet.

“This cooperation has run well for the past five months,” Mr. Liu said of the five-year contract.

Chu Kong Passenger Transportation Co Ltd (CKPT) achieved fast business growth in 2012, with passenger business contributing profit of 74.6 million hkd, representing year-on-year growth of nearly 21%.

Ridership of Guangdong-Hong Kong routes rose 3% to 6.2 million, and CKPT was able to raise ferry ticket fares, resulting in positive contribution to financial results.

Patronage of Macau-Hong Kong routes rose by 20% last year to 7.36 million.

An aggressive expansion strategy has helped push CKS shares higher in 2013.

An aggressive expansion strategy has helped push CKS shares higher in 2013.

Late last year, Chu Kong Passenger Transport Co Ltd, a wholly-owned subsidiary of CKS – along with One Media (HK: 426) – teamed up to form a high-speed passenger transportation advertisement company called Connect Media Co Ltd (CMC).

CMC is a high-speed passenger advertising platform for routes between Guangdong, Hong Kong and Macau which leverages on combining the complementary advantages of both companies to serve a captive audience onboard watercraft.

On the cargo side, MD Mr. Huang said CKS was able to boost operations despite the economic slowdown.

“Amid a slow global economic recovery, CKS’s cargo business maintained a resilient expansion strategy in response.

In 2012, we continued to roll out our ‘Port-based Logistics’ business strategy during which cargo handling volume increased 14.1% to 1.13 million TEU,” he said.

Revenue from the cargo handling business increased 10.9% last year.

“In 2012, Guangdong-based Chu Kong Cargo Terminals (Gaoming) Co Ltd in particular made significant contribution to CKS’s port-based logistics business, with its profit contribution of 41.2 million hkd showing a 12.8% year-on-year growth,” MD Mr. Huang said.

CKS recently 1.49 hkdMr. Liu added that for CKS’s terminal logistics, last year saw that firm continue to promote “professional operations” to improve its competitiveness by taking advantage of terminal resources and teamwork.

CKS recently 1.49 hkdMr. Liu added that for CKS’s terminal logistics, last year saw that firm continue to promote “professional operations” to improve its competitiveness by taking advantage of terminal resources and teamwork.

“We are aggressively promoting logistics industry upgrades by engaging in integrated logistics business of warehousing in cooperation with large-scale groups.”

The company’s container transportation volume increased by 5.6% last year while container handling volume jumped 14.1%.

Container throughput at Gaoming and Sihui Terminals reached 252,000 TEU and 113,000 TEU, respectively, representing increases of 22.5% and 40.8%.

Looking ahead, the Chairman said CKS will seek another growth point in addition to expanding and improving on the two major business segments, i.e. terminal logistics and high-speed passenger transportation.

“For terminal logistics, we will focus on the following: intensifying professional operations, integrating logistics resources, combining economies of scale and operational capabilities, and expanding our container handling capacity logistics efficiency.”

Mr. Liu added that CKS would speed up construction of Zhongshan Huangpu Terminal, Nansha Chu Kong Terminal, Dawang Terminal and Qingyuan Terminal to bring them into full revenue contribution mode as soon as possible.

“We will also speed up construction of overseas freight marketing networks in Southeast Asia.”

Chu Kong Shipping Enterprises (Group) Co Ltd. (HK: 560) is held by Chu Kong Shipping Enterprises (Holdings) Co Ltd with a strategic orientation of being ”based in Hong Kong, backed by the mainland and facing the world.” CKS is principally engaged in port-based navigation logistics, high-speed waterway passenger transportation and tourist business between Hong Kong, Macau, the Pearl River Delta Region (PRD) and coastal areas. After 15 years of development, CKS owns equity shares of 20 PRD inland barge terminals and operates more than 35 container barge routes, as well as 18 bulk freight routes between Hong Kong and PRD inland terminals. CKS operates a total of 18 passenger routes with 16 passenger destinations in Hong Kong, Macau and Guangdong Province. CKS is a market leader in the PRD waterway logistics and high-speed waterway passenger transport markets.

See also:

CHU KONG SHIPPING: Delta Dynamo's 3-Pronged Growth Gambit

CHU KONG SHIPPING Parent Boosts Stake; Target Price Hiked

CHU KONG, ONE MEDIA Ink Strategic 20 Mln Hkd Ad Tieup

CHU KONG SHIPPING: Strong Interim Sales Despite Choppy Waters