OSK-DMG maintains ‘Buy’ call on MTQ ahead of results CEO Kuah Boon Wee. NextInsight file photoMTQ’s 1QFY14 results will be announced this week, and OSK-DMG is expecting its net income to surge 40% to SGD 6.6 million, thanks to contribution from Neptune Marine Services. OSK-DMG analysts Lee Yue Jer and Jason Saw maintained their ‘Buy’ call on MTQ, with target price of S$1.76.

CEO Kuah Boon Wee. NextInsight file photoMTQ’s 1QFY14 results will be announced this week, and OSK-DMG is expecting its net income to surge 40% to SGD 6.6 million, thanks to contribution from Neptune Marine Services. OSK-DMG analysts Lee Yue Jer and Jason Saw maintained their ‘Buy’ call on MTQ, with target price of S$1.76.

”Since Neptune has net cash, is poised for robust growth and contributes at least SGD10 million of cash annually, MTQ’s DCF value has risen to SGD3.26/share. Its 4.0x FY14F EV/EBITDA and 6.8x P/E continues to indicate deep, fundamental value.

40% y-o-y jump in net income

”We expect MTQ’s 1QFY14F revenue of SGD80 million and net income of SGD6.6 million to constitute 24% of our FY14F figures. Meanwhile, cost-cutting measures at its subsidiary Neptune Marine Services should have a larger impact towards end-FY14. At the risk of being too conservative, we only assume margins similar to 4QFY13, when MTQ booked one-off general offer expenses for the acquisition of Neptune.

Neptune reveals more income sources and cost savings

”Neptune’s AGM slides indicate that there are plans for additional income streams in the near future on top of immediate cost-saving solutions. We understand that it will have a small interest in the Dryden, a 58-meter diving support vessel for Apache Corp, an oil and gas company. There are framework agreements with BP and Total, which we expect will lead to significant volumes of work. Moreover, its Gladstone service facility will reduce operational costs, serving as a staging ground for offshore work.

DCF value rises to SGD3.26

”In our initiation report, MTQ shares had a DCF value of SGD1.60 (adjusted for bonus shares), assuming zero income from Neptune and other far-too-conservative conditions. Neptune’s strong turnaround is the main driving force behind the doubling of the DCF value.

BUY before results announcement

“We continue to see deep value in MTQ, which is currently trading at only 4.0x FY14F EV/EBITDA. The industry’s forward average is 8.6x, and the trailing-12-month average is 9.8x, implying there is further upside to valuations.”

Related story: "MTQ Target Is $1.76, One Of 4 Oil & Gas Top Picks"

Uni-Asia Holdings - UOBKH believes worst is over

The shipping sector has been in a slump since 2009 due to a supply glut, but in an unrated note published on 19 July, UOB Kayhian analyst Loke Chunying expressed her belief that the worst is over for Uni-Asia Holdings.

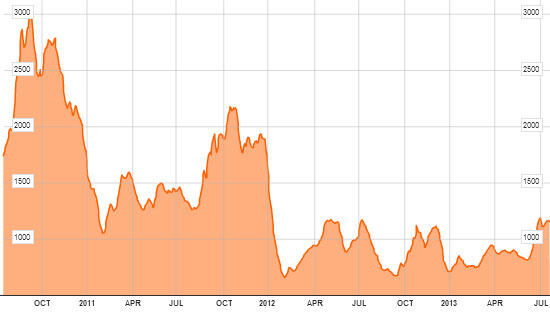

During the recent period when the Baltic Dry Index was trading near a 5-year low, Uni-Asia has been capitalising on the bargain prices of vessels to grow its fleet to generate a recurring source of income. The Baltic Dry Index has been depressed since the Global Financial Crisis in 2008. However, since the start of 2013, it has risen about 63%. Bloomberg data

The Baltic Dry Index has been depressed since the Global Financial Crisis in 2008. However, since the start of 2013, it has risen about 63%. Bloomberg data

There was zero net fleet growth among global Handysize bulkers in 1Q13 as new supply was fully offset by those that were scrapped. Current global orderbook for newbuilds of Handysize bulkers stands at 17% of existing fleet. In contrast, 20% of existing Handysize bulkers were over 25 years old as at 1 Apr 2013. In a shipping sector recovery, UOB Kayhian believes Handysize bulkers will be the first to pick up.

This is good news for Uni-Asia as all its vessels are Handysize bulkers.

Recurring income to gain momentum

"In FY2012, Uni generated a pre-tax profit of US$3.3m from its three vessels. Two vessels will be added to its portfolio by 2QFY13, and we expect recurring income from its chartering business to increase by more than 40% in FY2013. It will take delivery of another three Handysize bulkers between 2014 and 2016."

A better 2013

"Besides contributions from ship chartering, property development projects in Japan and Hong Kong are expected to boost Uni-Asia’s earnings for FY2013. It has a 10.2% interest in an office building redevelopment project in Kowloon East, Hong Kong from which Uni-Asia could recognise US$1 million to US$2 million of profit. It will also be selling four small residential projects in Tokyo, Japan, which are expected to be completed by end-2013.

"Hotel operations, which had been a drag on past years’ performance, have also seen an improvement, with management guiding the segment to achieve a breakeven in FY13.

"Its steep discount to NAV (P/B: 0.6x) also provides a huge margin of safety for value investors."

Related story: STAMFORD TYRES, UNI-ASIA SHIPPING: Latest Happenings...

NRA Capital initiates coverage on Triyards with ‘Overweight’

On 19 July, NRA Capital initiated coverage on Triyards with a ‘Overweight’ recommendation and a $0.97 fair value, based on 7x PER FY14 (30% discount to its peers in the marine and offshore industry to account for its smaller size).

Analyst Joel Ng of NRA Capital wrote:

“Triyard is one of only three Singapore yards (the other two being Keppel and Sembcorp) capable of designing and building its own proprietary drilling jack-ups and SEUs, with the Class 400 HPHT (high pressure, high temperature) drilling jack-up rig, TDU-400. We note that this is a positive step for the group to differentiate its products and services from other Singapore and China yards that are coming into this space. Triyards has a yard in Houston (above) and two yards in Vietnam. Company photoA mini Keppel Shipyard in the making

Triyards has a yard in Houston (above) and two yards in Vietnam. Company photoA mini Keppel Shipyard in the making

"Triyards is a fabrication and ship construction company mainly for the offshore and marine industries. It has two yards in Vietnam and one yard in the US. The two yards in Vietnam focus on marine and offshore fabrication works and vessel construction, constructing vessels such as its proprietary SEUs and Offshore Support Vessels, while the Houston, US yard produces equipment such as specialty cranes and A-frames, which are installed on SEUs and OSVs.

Good track record and experience

"It has built a total of six SEUs for clients around the world, all delivered on time and within budget. These SEUs are now operating in regions such as Asia Pacific and the Middle East for oil majors including Shell and Pertamina. It recently commenced construction for two of its latest and largest SEU models, the BH 450. In addition, it has an established track record for building OSVs and construction vessels.

Expanding around the region

"As part of its expansion plan, it is in the process of acquiring an Australian company with a well-sited logistics and supply base within the shipbuilding and marine-related region of Western Australia (WA) for A$6.75m. The site is located near the port of Remantle, WA’s largest and business general cargo port. The acquisition is likely to be funded by cash and issuance of 8.9 million new ordinary shares to the seller. It plans to complete the acquisition by end 2013.

Repair and maintenance to supplement income

"Its newly commissioned floating dock (that will cater mostly to repairs of offshore vessels) will begin contributing in 4Q13.

Oil and gas capex remains robust

"Strong growth in demand from non-OECD countries is expected to keep oil prices steady. Infield Systems estimates that offshore oilfield infrastructure capital expenditure will grow by more than 70% for the period 2012-2016 compared to 2007-2011."