Excerpts from analysts' reports

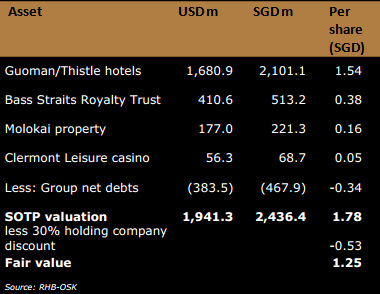

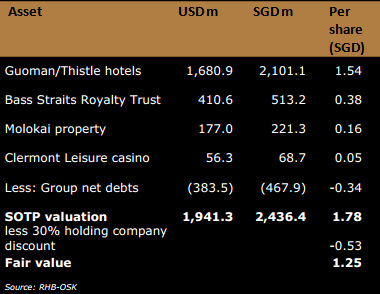

RHB-OSK is first to issue rated report on GuocoLeisure with $1.25 target

Analysts: Goh Han Peng & Edison Chen

We value GuocoLeisure (GLL) using a sum-of-parts methodology to best capture the disparate nature of its various investments.

We value GuocoLeisure (GLL) using a sum-of-parts methodology to best capture the disparate nature of its various investments.

We value its Guoman/Thistle hotel portfolio at EUR250,000 per key for its London hotels, a 21% discount to the average transaction of EUR316,000 per key in 2012.

We use net present value to value the cash flow stream from Bass Straits Royalty Trust, without factoring in upside from future reserve growth.

Our valuation yields a SOTP of SGD1.78. We apply a 30% holding company discount to derive a TP of SGD1.25.

In our view, GLL offers a compelling asset play with imminent catalysts from restructuring

RHB-OSK is first to issue rated report on GuocoLeisure with $1.25 target

Analysts: Goh Han Peng & Edison Chen

We value GuocoLeisure (GLL) using a sum-of-parts methodology to best capture the disparate nature of its various investments.

We value GuocoLeisure (GLL) using a sum-of-parts methodology to best capture the disparate nature of its various investments. We value its Guoman/Thistle hotel portfolio at EUR250,000 per key for its London hotels, a 21% discount to the average transaction of EUR316,000 per key in 2012.

We use net present value to value the cash flow stream from Bass Straits Royalty Trust, without factoring in upside from future reserve growth.

Our valuation yields a SOTP of SGD1.78. We apply a 30% holding company discount to derive a TP of SGD1.25.

In our view, GLL offers a compelling asset play with imminent catalysts from restructuring

within the group and greater transparency on its hotel assets. Reiterate BUY.

Recent stories:

There's Deep Value in GUOCOLEISURE, says CIMB after company visit

GUOCOLEISURE: Possible revaluation exercise with positive outcome

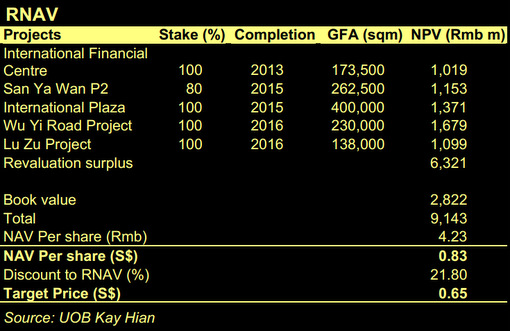

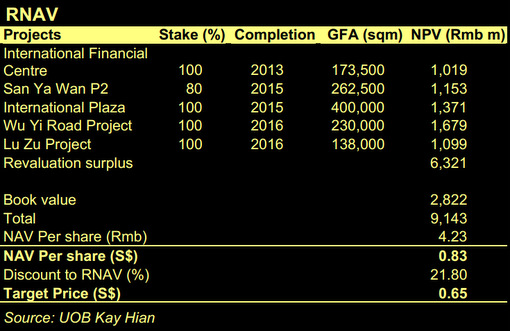

UOB Kay Hian says selldown of Ying Li stock is unwarranted

Analysts: Brandon Ng, CFA & Andrew Chow, CFA

Ying Li chart : Yahoo!Ying Li’s share price declined 9% after China announced several cooling measures for the residential property sector.

Ying Li chart : Yahoo!Ying Li’s share price declined 9% after China announced several cooling measures for the residential property sector.

These measures include higher down payment, increases in residential land supply and accelerated development of social housing.

We think the sell-down is overdone as the company’s current portfolio of developing properties comprises less than 15% in residential properties (mainly International Plaza, where more than 95% is sold in all the four phases).

The financial impact of these new policies to Ying Li appears limited.

Recent stories:

There's Deep Value in GUOCOLEISURE, says CIMB after company visit

HIAP HOE & GUOCOLEISURE: Catalysts for re-rating

GUOCOLEISURE: Possible revaluation exercise with positive outcome

Out of the 8,280 rooms in UK that GuocoLeisure operates, 5,110 rooms are in London. The company operates under two hotel brands, namely, Guoman and Thistle.

Out of the 8,280 rooms in UK that GuocoLeisure operates, 5,110 rooms are in London. The company operates under two hotel brands, namely, Guoman and Thistle.

Photo: Company

UOB Kay Hian says selldown of Ying Li stock is unwarranted

Analysts: Brandon Ng, CFA & Andrew Chow, CFA

Ying Li chart : Yahoo!Ying Li’s share price declined 9% after China announced several cooling measures for the residential property sector.

Ying Li chart : Yahoo!Ying Li’s share price declined 9% after China announced several cooling measures for the residential property sector. These measures include higher down payment, increases in residential land supply and accelerated development of social housing.

We think the sell-down is overdone as the company’s current portfolio of developing properties comprises less than 15% in residential properties (mainly International Plaza, where more than 95% is sold in all the four phases).

The financial impact of these new policies to Ying Li appears limited.

• “REITing” the retail malls to recycle capital. Ying Li has plans to transfer its retail malls into a trust vehicle for listing to monetise the assets and recycle the capital.

This is positive as the proceeds could be recycled into accretive new investments as management believes in the long-term growth prospect of Chongqing and sees opportunities to

secure good land parcels for commercial property developments. This is positive as the proceeds could be recycled into accretive new investments as management believes in the long-term growth prospect of Chongqing and sees opportunities to

Maintain BUY with a target price of S$0.65 (unchanged). Our targeted price is based on a 21.8% discount to our RNAV of S$0.83/share. The discount is in line with the average discount for Chinese developers under our coverage.