CIMB analyst William Tng CFA and his Singapore research team produced a report yesterday (March 15) on a stock (GuocoLeisure, 76.5 cents yesterday) that is increasingly in the limelight because of an event that will take place in April .....

William Tng CFA. Photo: CIMBWe visited GuocoLeisure recently. This stock seems to offer deep value and is worth revisiting if management stays committed to unlocking value. Possible privatisation could be the jackpot.

William Tng CFA. Photo: CIMBWe visited GuocoLeisure recently. This stock seems to offer deep value and is worth revisiting if management stays committed to unlocking value. Possible privatisation could be the jackpot.

a) What is core, what is non-core?

William Tng CFA. Photo: CIMBWe visited GuocoLeisure recently. This stock seems to offer deep value and is worth revisiting if management stays committed to unlocking value. Possible privatisation could be the jackpot.

William Tng CFA. Photo: CIMBWe visited GuocoLeisure recently. This stock seems to offer deep value and is worth revisiting if management stays committed to unlocking value. Possible privatisation could be the jackpot.a) What is core, what is non-core?

Hotels still accounted for nearly 73% of its assets as at end-Dec 12. We sense that if there are opportunities to sell off its non-hotel assets, management will not hesitate much.

Non-hotel assets owned by GuocoLeisure include: 1) Clermont Leisure, a casino in the UK; 2) Bass Strait Oil Royalty; 3) land on the island of Molokai in the Hawaiian island chain; and 4) a property development in Denarau, Fiji.

Given that GuocoLeisure has been actively looking for buyers for its Fiji assets, transactions could be sooner than later.

b) Is there value?

Non-hotel assets owned by GuocoLeisure include: 1) Clermont Leisure, a casino in the UK; 2) Bass Strait Oil Royalty; 3) land on the island of Molokai in the Hawaiian island chain; and 4) a property development in Denarau, Fiji.

Given that GuocoLeisure has been actively looking for buyers for its Fiji assets, transactions could be sooner than later.

b) Is there value?

Yes! We reckon there is deep value in GuocoLeisure. It trades around a 30% discount to its book value per share of S$1.07. Come April, the investment community will get a better sense of the market value of GuocoLeisure’s assets, especially its hotels in the UK.

By then, the Independent Financial Adviser should have presented its findings to the Guoco Group (listed in Hong Kong) which has received a delisting offer from GuoLine Overseas Limited. Guoco Group owns an estimated 66% of GuocoLeisure.

By then, the Independent Financial Adviser should have presented its findings to the Guoco Group (listed in Hong Kong) which has received a delisting offer from GuoLine Overseas Limited. Guoco Group owns an estimated 66% of GuocoLeisure.

We suspect that its actual discount to book is likely to be higher than 30%, since GuocoLeisure carries its hotel assets at cost on its books and depreciates them.

c) What can be done to narrow its discount to asset value?

We see three catalysts:

1) An immediate one is the revaluation of its hotel assets in April. However, GuocoLeisure is not required to change its accounting policy and we do not expect any revaluation gains to be booked.

2) Next could be the divestment of its non-hotel assets. However, this is beyond management’s control as divestments would depend on market opportunities and negotiations. What is positive is that management appears at least willing to entertain such possibilities.

3) Extracting greater value from its hotel assets, through greater cost efficiencies and possibly more branding.

Michael Bernard De Noma had been hired as the new CEO of Guoman Hotels Limited on 1 Aug 12.

Michael Bernard De Noma had been hired as the new CEO of Guoman Hotels Limited on 1 Aug 12.

Given his previous experience in both the consumer and financial industries, we believe there will be initiatives to improve guests’ staying experience (and hence their stickiness).

Initiatives that have been put in place include free WiFi at the group’s hotels, a loyalty programme (‘Signature’) and new IT infrastructure including a new revenue-management system.

Thistle Charing Cross Hotel in London.

Thistle Charing Cross Hotel in London. Photo: InternetIn the UK, Guoman Hotels fall into the premium category and are located in central London.

Thistle, on the other hand, is an award-winning chain of quality full-service hotels throughout the UK and Malaysia. Given challenging economic conditions in the UK and the group’s current heavy reliance on its UK hotels, GuocoLeisure is turning to the Asia Pacific to balance its portfolio.

In Malaysia, Guoman Hotels operates two hotels under the Thistle brand in Port Dickson and Johor Bahru.

In its FY10 annual report, the group revealed its soft launch of its premier Guoman Hotel Shanghai.

News articles on Guocoland, the property arm of conglomerate Hong Leong Group (GuocoLeisure is also a member of the Hong Leong Group) suggest that it would build a new hotel next to the Menara Milenium, likely under the Thistle brand.

In its FY10 annual report, the group revealed its soft launch of its premier Guoman Hotel Shanghai.

News articles on Guocoland, the property arm of conglomerate Hong Leong Group (GuocoLeisure is also a member of the Hong Leong Group) suggest that it would build a new hotel next to the Menara Milenium, likely under the Thistle brand.

In Singapore, Guocoland is developing an integrated development at Tanjong Pagar. Located above the Tanjong Pagar MRT station, the 1.7m sf development will feature premier Grade-A office and retail space, an international hotel and exclusive residential apartments. The hotel portion could involve GuocoLeisure.

d) Privatisation possibility?

Not impossible but we sense that management is focusing on improving hotel operations and the potential divestment of its non-hotel assets so that investors can clearly identify GuocoLeisure as a hotel owner and manager.

Not impossible but we sense that management is focusing on improving hotel operations and the potential divestment of its non-hotel assets so that investors can clearly identify GuocoLeisure as a hotel owner and manager. At the same time, its major shareholder is busy with the privatisation offer for Guoco Group in Hong Kong.

That said, Bloomberg data does not suggest any shareholder with enough of a shareholding to thwart any privatisation attempts.

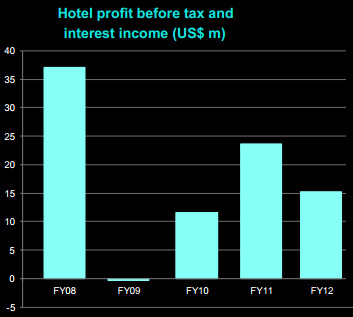

e) Hotel operations not loss making

Lastly, we would also point out that the hotel operations are not your money losing type that is usually associated with companies trading below their asset values.

Recent articles:

HIAP HOE & GUOCOLEISURE: Catalysts for re-rating

GUOCOLEISURE: Possible revaluation exercise with positive outcome

e) Hotel operations not loss making

Lastly, we would also point out that the hotel operations are not your money losing type that is usually associated with companies trading below their asset values.

Recent articles: