YOU COULD say that Jaya Holdings took a few steps forward in 2Q2013 (Oct-Dec 2012) but was made to retreat a little too by unexpected developments.

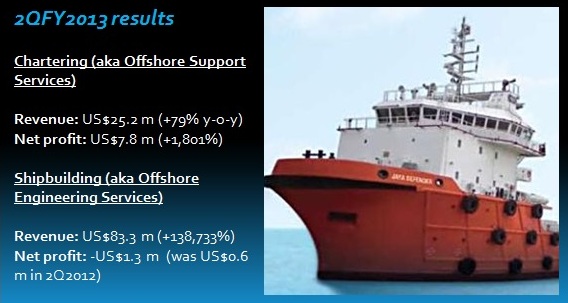

> Net profit: There's really good news from its chartering division: Net profit from chartering its vessel fleet to the oil & gas sector reaped US$7.8 million net profit compared to the paltry US$0.4 m in the same quarter a year ago.

In its other core business, ship building, it sold two vessels but had to record a US$1.3m impairment charge on cost overruns relating to a 16,000 bhp Anchor Handling Tug Supply (AHTS) vessel.

Deducting this impairment charge from the US$7.8 million chartering profit, Jaya recorded a US$6.5 million net profit in 2Q2013 - a sharp improvement from US$1.0 million in 2Q2012.

> Utilisation rate: The jump in chartering net profit came from Jaya's charter fleet enjoying an 80% utilisation rate in 2Q2013 versus 62% a year earlier.

The higher demand came with higher averge daily charter rates: US$12,685 versus US$9,222.

The seas, however, have turned choppy. Jaya is expecting its fleet utilisation rate to sink somewhat in the current 3Q2012.

A key reason is the implementation (long-deferred) of cabotage rules by Indonesia effective 1 Jan this year, which has led to the cancellation of charters for 3 Jaya vessels in Indonesian waters. That's 3 out of 28 vessels in Jaya's fleet.

The revelation of this turn of events at the results briefing last Thursday elicited a number of questions from analysts, as follows:

Q: How many of your vessels were affected? Can you give us a sense of what is happening with the sudden exodus offshore support vessels. How do the oil majors there cope?

Jaya CEO (Shesh): Three of our AHTS vessels were affected and have come out of Indonesian waters. The foreign-flagged vessles had to leave. The oil majors? They are suffering -- that's my brief answer and to the point.

The operators are desperate. They are talking to us about setting up joint ventures in Indonesia to supply the vessels back to them.

Q: Does it make sense to sell the vessels to Indonesian operators?

Shesh: Indonesia is a vibrant and important market for us. Selling vessels will lead to gains on a one-time basis, but what we want is to establish a method to benefit in the long term and on a recurring basis.

Q: What is the difference between the charter rates you were getting in Indonesia and outside?

Shesh: For the lower-end assets, there wasn't much difference but for higher-spec vessels, the difference can be 10-15-20%. Rates in Indonesia were decent in terms of return on investment.Now the rates there are probably climbing upward because now there is a serious shortage of vessels there.

NextInsight file photo

Dividend: Jaya has declared an interim dividend of 0.5 cent a share, a small yield considering the 52-week stock trading range of 50-73.5 cents.

There's a good chance of a final dividend 6 months on, which is not an illogical interpretation of CFO Chong Chow Pin's comment that "our intent is to signal that we will pay dividends going forward."

What will Jaya's dividend payout ratio be? Shesh did not give any indication on that.

It's the first dividend payout in four years, during which the company was not allowed to pay any dividend by a Scheme of Arrangement that supported it in the midst of serious financial difficulties.

On 5 Dec last year, Jaya terminated the Scheme, and repaid the debt after successfully arranging for a new loan with new creditors.

Another cause for pride: As at end-2012, Jaya has turned net cash to the tune of US$26.5 million.

"We are one of the few offshore companies in the world with a net cash position," said Shesh.

There was strong cashflow coming from the 2 vessel sales in 2Q amounting to S$83.3 million in revenue.

Click on the above video to watch the Jaya Supreme being launched into the sea off Jaya's shipyard in Batam. The Jaya Supreme (16,000 bhp Ice-Class) is the largest and most advanced vessel built by Jaya, which sold it in Nov 2012.

Jaya is currently busy building 9 vessels for its charter fleet at it yards in Singapore and Batam. The cost to complete the building is about US$220 million which will be funded by operating cashflows from vessel sales/disposals and chartering income. The schedule for the 9 vessels to be completed can be found on Jaya's website.

Venture with IHC Merwede: Jaya's shipbuilding business has acquired added sparkle since it announced a tie-up with IHC Merwede in July 2012. The first and most visible result showed up this month when the IHC-Jaya venture unveiled Packhorse design for PSVs and subsea support vessels.

Analysts were interested to know more:

Q: In the Jaya-IHC cooperation, will you just be a builder?

Shesh: In that alliance, we will be a shipbuilder. But if our offshore support services business requires a vessel, the IHC cooperation will bid to build it on an arms length basis, and we will get quotation from other yards. If it's apples to apples, then we will give a preference to the IHC cooperation.

George Horsington, Jaya President - Busness Development: The cooperation will boost our capabilties as a yard. At the moment, we are focused on smaller vessels under 100 metres.

IHC's expertise lies in large sophisticated construction vessels. IHC's yard is in The Netherlands, a high-cost location. Jaya's yards are in SE Asia with a skilled workforce in low-cost locations. The ambition is for the Jaya-IHC cooperation to build sophisticated vessels over 100 m with Asian costs.

Q: How will the cooperation work? Is this a subcontract agreement?

Shesh: We will be bidding together on a case by case basis. For example, if a client wants a traditional PSV, then IHC does not step in at all. It's something Jaya does well.

Where IHC comes in with Jaya is in the building of higher-end vessels -- large construction vessels, diving and ROV vessels where their technology and their equipment packages fit in perfectly with our yards and our production facilities. And it's an offer that very few can make.

Q: How will the profit-sharing be like?

Shesh: It's entirely on a case by case basis.

Chong Chow Pin: The arrangement is kept loose as each project will have different levels of contribution from each party.

Q: If you get a contract today, when can you start construction?

Shesh: We can start work as soon as we get a contract. And we will deliver the vessels two years later.

What DBS Vickers and CIMB say: Following the 2Q results briefing, DBS Vickers analyst Jeremy Thia, CFA, cut his forecast FY13F earnings by 19% on the 2Q impairment charge and expectation of a weaker 3Q with fleet utilisation rate falling to 72%.

His recommendation: "Stay invested for the longer term recovery; Maintain BUY with TP unchanged at S$0.85, pegged to 1x blended FY13/14F P/BV (prev 1x FY13 P/BV)."

Jaya stock closed last week at 69.5 cents, translating into a market cap of S$535 million.

CIMB analyst Yeo Zhi Bin cut his FY13-14 EPS by 3-12% and trimmed the target price to 88 cents, still pegged at 1x CY13 P/BV or its 4-year mean.

"Maintain Outperform. Continued excellence from chartering and higher-value shipbuilding orders are catalysts."

For more on Jaya's results, click for its Powerpoint slides.

Previous stories:

KEVIN SCULLY: Three Value Stocks which I recommend now

JAYA HOLDINGS: Full steam ahead to expand charter fleet

Comments