Excerpts from analysts' reports

CIMB raises target price of Jaya Holdings to 90 c

Jaya CEO Venkatraman Sheshashayee taking questions from analysts and fund managers at a briefing. NextInsight file photoJaya started 1QFY6/14 in the same fine fashion that it ended 4Q13, sustaining its fleet utilisation at 91%.

We expect the stock to be re-rated as its endeavour to change its earnings profile from a lumpy to a recurring one has started to bear fruit.

At 25% of our full-year numbers, 1Q core earnings were in line with our expectation but 20% below Bloomberg consensus.

We keep our FY14-16 EPS and maintain an Outperform rating with a higher target price as we roll forward to 1x CY14 P/BV (its 4-year mean).

Catalysts could come from stronger chartering operations, shipbuilding wins and clarity from the strategic review.

Maintain Outperform

We see value in Jaya as it trades at 0.8x CY14 P/BV against growing and recurring chartering earnings streams, and 60% to its RNAV. The company has clearly righted its course, which we think has not been fully appreciated by the market.

Recent story: JAYA: Stock surged on strong earnings and surprise dividend

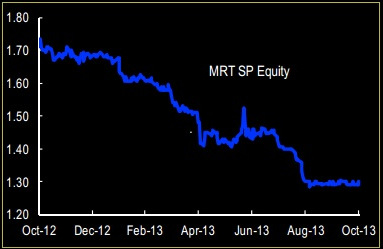

Maybank says SMRT's earnings continue to surprise on the downside; Sell.

Analyst: Derrick Heng.

SMRT reported a 57% decline in net income to SGD14.4m for 2QFY14. Profitability of the group’s fare based business continues to suffer from the lack of fare increase in an escalating cost environment.

SMRT reported a 57% decline in net income to SGD14.4m for 2QFY14. Profitability of the group’s fare based business continues to suffer from the lack of fare increase in an escalating cost environment. With reduced profitability for 1HFY14, SMRT lowered its interim dividend to 1.0 cent (FY13: 1.5 cents).

Ø While a change to the business model appears imminent, we caution against turning positive on the stock as terms for the transition remains highly uncertain.

Our key source of concern centres on the asset buyback terms for the existing rail lines that were awarded under the old rail financing regime. Hence, we opine that it is highly speculative to buy on hopes that the transition terms would be favourable to SMRT.

Ø Maintain Sell with TP of SGD0.80. With structurally higher leverage and poor dividend yield support, we argue that SMRT should de-rate from its historical levels.

Despite a 26% decline in its stock price over the past year, SMRT continues to trade at expensive valuations of 30x FY14E P/E and yields merely 1.6%.