Photo: Andrew Vanburen

Essence: CHU KONG SHIPPING Initiated ‘Buy’

Essence International in Hong Kong, a wholly-owned subsidiary of Essence Securities in China, initiated coverage of Chu Kong Shipping (HK: 560) with a “Buy” recommendation and a six-month target price of 1.38 hkd, calling it “the only defensive shipping play” among Hong Kong-listed firms.

“Chu Kong Shipping Enterprise (Group) Co Ltd (CKS) is the sole shipping stock which enjoys defensive fundamentals. In 2011, CKS only posted a single-digit drop in net profit versus massive drops by sector peers,” Essence said.

The research house said it is forecasting CKS to see 2011-14E earnings CAGR of 19.5%.

Currently CKS 2012E/13E P/E ratio is only 6.1/4.6x, and 12E P/B is 0.5x, at a “relatively low valuation,” Essence added.

Investment Highlights

CKS enjoys a “balanced business model” with cargo and passengers, Essence said.

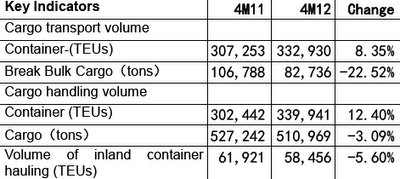

In its cargo business, CKS operates both containers/bulk cargo transportation and port terminal cargo handling services.

Owning over 20 inland trade ports, CKS operates 30 container routes and 13 bulk routes with 80 vessels. CKS also operates passenger traffic.

Compared with other shipping peers, CKS manages a more diversified business.

“Despite a bleak market condition for the shipping sector in 2011 with spiraling bunker costs and deep drops in international freight rates, CKS’s diversified business model maintained stable earnings with a mere 8.3% profit drop in 2011,” the brokerage said.

Port Business Profit Stabilizer for Cargo Business

The key differentiation of CKS versus traditional shipping companies is the ownership of key inland cargo port terminals in the Pearl River Delta (PRD).

"The port business is growing steadily with a gradual pick-up in handing fee income. In 2011, cargo handling and storage business contributed about 48% of total profit, which greatly stabilized the profit base,” Essence said.

Passenger Business up on Rising Provincial Tourism

Thanks to closer economic and social links within the PRD, daily PRC tourist arrivals rose 24.1% to 76,389 in 2011 with about 55% of overnight tourists from Guangdong Province.

“We believe CKS’s passenger business will benefit from the growing popularity of provincial tourism as the number of tourism spots in Hong Kong and Macau are increasing.

“Also, various tourism bureaus are promoting ‘one-journey, multiple stops’ trips with the ‘Convenient visa for 144-day Stay’ scheme. CKS's passenger business will meet the demand growth and remain the earnings driver.”

Strong Parental Support Boosts Earnings

CKS’s parent has been seeking various ways to support sustained earnings growth for CKS including acquisitions, which occur almost every year.

The most recent acquisition took place in 2011 with an asset swap, offloading the loss-making toll-road business for profitable port assets.

“We believe CKS will continue supportive actions in the future,” Essence said.

Photos: CKS

CKS’s share price is currently near to its historic trough.

“We initiate with a ‘Buy’ as its business model is more defensive compared with other shipping stocks.

"Its share valuation should enjoy a premium over its peers,” Essence International added in the note to investors.

Chu Kong Shipping Enterprise (Group) is the flagship listed company of Chu Kong Enterprises (Holdings) Company Ltd.

CKS mainly engages in shipping operations between Hong Kong and the PRD and high-speed waterborne passenger transport.

CKS also operates passenger traffic, managing 7 passenger terminals, 17 routes and 52 high-speed ferries.

The passenger business accounts for about 9% of revenue and contributes 39% to profit.

Competitive Advantages

The PRD has the largest nationwide trade port terminal network in China.

CKS, being focused on this region, is set to reap tremendous benefits.

“With a dense population and strategically located trade ports, PRD is positioned as the center for international shipping, logistics, trade, conferences and exhibitions and tourism’ under the 2008-20 national plan.”

And with Guangdong Province being responsible for a full 25% of China's exports, Chu Kong Shipping certainly picked the right spot to set up shop.

See also:

Singapore's THT, Chu Kong Shipping Ink Major Logistics Tieup

CHU KONG In Ship Shape With ‘Buy’

CHU KONG SHIPPING: ‘All In Same Boat’ With Fuel Prices

Bocom: HK-listed Container Shipping Sector ‘Underperform’

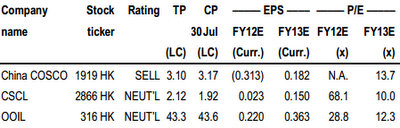

Bocom International said it is maintaining its “Underperform” call on container shipping sector plays listed in Hong Kong.

"We believe most of the listed container shipping companies should report improvement in financial performance in 2Q12, compared with 1Q12. However, despite the improvement in 2Q12, we believe that some companies will still be in a net loss position in 1H12,” Bocom said.

These include China COSCO and CSCL.

"We forecast only OOIL and SITC could report a net profit in 1H12, which, however, will still be smaller than last year, according to our estimates.”

Compared with 1Q12, Bocom said it believes the container shipping companies have benefited from improved freight rates, especially on the Asia-Europe and Transpacific tradelanes, and lower bunker cost in 2Q12.

The freight rate on the Asia-Europe tradelane has increased 130.0% YoY to US$1,888/TEU on 30 June 2012, or up from US$1,660/TEU as at the end of March.

“We observe that the forecast ranges for most of the listed container shipping companies are large. This will entail significant forecast risk, in our view.

“In case the announced results deviate significantly from the consensus forecast, we expect volatility of share price will increase accordingly.”

The research house is maintaining its “Sell” recommendation on China COSCO (1919 HK, T/P HK$3.1) and “Neutral” call on CSCL (2866 HK. T/P HK$2.12) and OOIL (316 HK, HK$43.3).

“At the moment, China COSCO has issued a profit warning that the net loss in 1H12 will be at least 50% YoY higher than last year.”

See also:

Ship Shape: CHU KONG Ups Revenue 18% Despite ‘Difficult Year’

COURAGE MARINE Bolsters Fleet

YANGZIJIANG: BOA Stays ‘Buy’, Credit Suisse Keeps ‘Outperform’