Nomura: Still Room for LENOVO Market Share Growth

Nomura Equity Research said that top PRC computer play Lenovo (HK: 992) still has the potential to grow its market share.

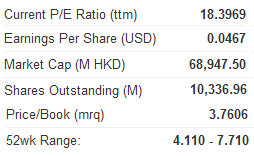

“There is some room for market share gains, but we’re less likely to see a big jump in margins. We remain ‘Neutral’ on Lenovo but raise our target price to 7.4 hkd (from 6.5 hkd) after our earnings estimate revision of +14/+10% in FY13/14F,” Nomura said.

The research house said it considers the Hong Kong-listed computer maker’s valuation “fair” at present.

“Lenovo’s shares have increased 29% YTD, and we believe this mostly factors in the better-than-expected 4QFY12 results and market share gains. We see limited catalysts near term and regard further progress in the emerging markets as re-rating opportunities.”

Nomura added that as the Street already has a high OPM estimate of 2.3% for FY13F: “We think further upside for consensus earnings estimate upgrades may be capped.”

Better-than-expected 4QFY12 results

Lenovo reported 4QFY12 net profit of USD67 million, 8% higher than consensus.

The 4QFY12 gross margin declined by 0.6ppt q-q given HDD supply tightness and unfavorable product mix on a higher contribution from consumer products.

“Nonetheless, 4QFY12 OPM came in at 1.4%, better than consensus of 1.2%, thanks to stringent opex control. We saw rising margin pressure in China for Lenovo due to softening demand in mature cities and intensifying competition,” Nomura said.

Opportunities in emerging markets, Europe

In 4QFY12 Lenovo’s market share in emerging markets reached 7.6% (+2.1 ppt y-y), while the OPM was –1.6% vs –2.4% in 3QFY12.

“While we see less room for market share gain in China’s PC market as Lenovo already enjoys 30%+ share, we believe emerging markets and Europe could provide room for growth in the future.

“However, it may take time to see profitability improvement, in our view, due to intense competition, lack of economies of scale and investments in channel partnerships.”

See also:

China IR Firm BlueFocus Nearly Triples Its 3Q Revenue

VST: Making ‘IT’ Happen In PRC; Shares Soar 26%

Mirae Asset: LENOVO Kept ‘Buy’

Mirae Asset Research said it is maintaining its “Buy” recommendation on Lenovo (HK: 992) while hiking the target price to 7.93 hkd from 6.78.

“Emerging markets are still driving growth for Lenovo in FY2013. It still managed to beat consensus revenue forecast by US$300-400m in the March quarter even though it was hit by HDD shortage in January,” Mirae said.

The corporate market has also been slowing down since March.

“Low-tier cities in China and other emerging markets are still driving strong growth for Lenovo this year, which will likely offset a slightly weaker corporate PC market.

“Although the gross margin was weaker in the March quarter, due to higher HDD cost and a richer mix of consumer products, Lenovo expects margins to expand again in the current quarter as component costs come under control,” the research house said.

Lenovo has the highest PC shipment exposure of 39% to the commercial PC segment in emerging markets and the lowest exposure of only 11% to the weakest consumer segment in the developed market among the top five leading PC brands in the world.

“Lenovo is very different from Dell and HP in product mix. There is a significant difference on the PC shipment exposure to various market segments between Lenovo and its competitors in the US.

“The current weakness in the PC market is mostly coming from the consumer segment, followed by the commercial segment in the developed markets. Lenovo can still do well given its relatively high PC shipment exposure in emerging markets while Dell and HP have been losing market share with weakening traction there,” Mirae added.

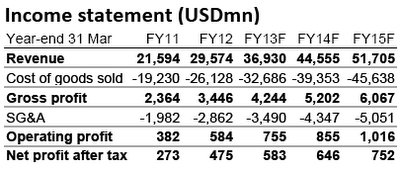

The researcher is raising its FY2013 revenue forecast to US$35.98 billion from US$34.56 billion and EPS to HK$0.454 from HK$0.449.

See also:

HK Bourse Aggressively Courting Beijing's 'Silicon Valley’ Firms

PICO Site Visit: IT Security Firm’s A-Shares Near 52-Wk Low... Undervalued Gem?

Bocom: PRC INTERNET SECTOR ‘Outperform’

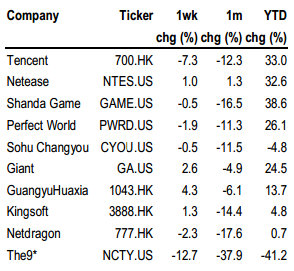

Bocom International said it is reiterating its “Outperform” recommendation on Mainland China’s Internet sector, with Tencent (HK: 700) -- owner of the popular QQ social network portal -- still its “Top Pick.”

“The search volume of Tencent’s new game LoL (英雄联盟) continued to grow by 14% in April, ranking 4th.

"However, all other Tencent games experienced decreases, mainly due to the strong base in the first quarter of Tencent’s advanced casual games,” Bocom International said.

The search volume of Kingsoft’s JX3 increased 18.6%, attributable to the launch of the new expansion pack, while the search volume of Netdragon’s major game Eudemons (魔域) increased by 11% during the period.

Anticipated new games boosted searches of operators.

“The major operators’ 1Q12 results were relatively stable sequentially, while Tencent and PerfectWorld saw significant increases as their market shares grew to 43.6%/7% from 42%/5%, respectively.”

Tier 3 operators Kingsoft and Netdragon are expected to generate game revenue of RMB190 million each in 1Q12, in line with Bocom’s expectations.

Netdragon added users, implying the growing ability to generate revenue from attractive games.

“The rankings of most of the game companies remained similar, while their market caps shrank due to the equity market volatility. Tencent’s share price drop was mainly a result of correction from its previous strength driven by news of Facebook’s IPO.

“However, we remain positive on Tencent’s outlook given its solid fundamentals and businesses,” Bocom added.

See also:

TENCENT, NETEASE Are Top Net Picks

PRC INTERNET STOCKS: What Analysts Now Say...