Excerpts from analyst reports...

BOCOM: PRC Internet sector OUTPERFORM, TENCENT, SINA top picks

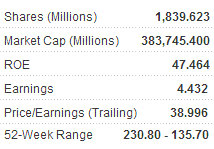

BOCOM International is maintaining its OUTPERFORM call on Mainland China’s rapidly growing Internet sector, with Tencent Holdings Ltd (HK: 700) – owner of top chat portal QQ – along with Sina Corp (Nasdaq: SINA) getting top pick honors from the brokerage.

Sina’s daily visitors reached 151 mln, approaching QQ’s 153 mln.

“Despite strong performance of Sina Weibo, visitors to QQ as well as QQ's Mainland China market share (37%) still ranked at the top.

"Also, taking Weibo’s data into account, Sina still saw fast-growing unique users per day of 151 mln in June vs 142 mln in May while its market share was flat at around 34%,” said Bocom.

In social networking services (SNS), Weibo’s unique users per day reached 47 mln in June, up 20% from May, while its total users were 140 mln by the end of April.

“Traditional SNS websites didn’t see an increase on their users/day while Weibo had a big jump.

"Weibo had around 60% of the market share since it was launched in April, followed by renren, kaixin and pengyou which were 21%/13%/8%, respectively.

"Pengyou had a flat market share, implying that there were more active users on the site,” Bocom added.

Mainland China’s total online population surged 15.5% year-on-year to 485 mln as of end-June, by far the largest global online user base.

See also: CHINA HIGH PRECISION: HK Listco’s 1H Off Charts On Indicator Sales

Morgan Stanley: Initiating CHINA FLOORING with OVERWEIGHT on PRC urbanization

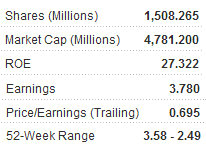

Morgan Stanley said it is beginning coverage of China Flooring Holding Company Ltd (HK: 2083) with an OVERWEIGHT rating thanks to tremendous opportunities in Mainland China on the mass exodus of people from the countryside to the cities.

“China Flooring is well-positioned to capture the growth in China’s home improvement market amid rising affluence and urbanization. We believe its growth potential is under-appreciated – the current share price implies negative growth beyond 2015,” Morgan Stanley said.

As the PRC’s leading wood flooring brand, Morgan Stanley said it is initiating China Flooring with a price target of 4.10 hkd, and on China’s home improvement industry with an ATTACTIVE view.

“China Flooring’s Nature brand was the #1 wood flooring brand by retail sales value in 2009 and #2 by retail sales volume.”

Morgan Stanley added that the Nature brand leads in key categories – solid wood flooring (#1), multi-layered engineered flooring (#1) and laminated flooring (#2, behind Power Dekor).

“We expect a strong growth outlook for China’s wood flooring industry, driven by low penetration (70% of floor space in China is uncovered), growth in floor space supply, growing renovation demand, urbanization, and rising affordability.

“With its strong brand and large distribution network in China, CF is a good play on the long-term growth; we estimate an 18% recurring operating profit CAGR in 2010-13.”

Deutsche Bank's target price for Yangzijiang is $2.30

Over the past three months, Yangzijiang Shipbuilding's share price has declined 27% on the weak drybulk market (dry-bulk vessels account for about half the group's order book) and investor concerns over the company’s financial asset investments.

Deutsche Bank analyst Kevin Chong said that at current valuations, YZJ is trading 24-36% below its P/E and P/B averages (since listing) and "we feel this share price drop is excessive."

Chairman Ren Yuanlin recently bought 500,000 shares, and "we think any further decline may prompt the group to buy back shares based on its actions in 2008. Reiterating Buy on valuation."

Deutsche Bank has a 12-month target price of $2.30.

See also: YANGZIJIANG, CHINA RONGSHENG: What Analysts Now Say...