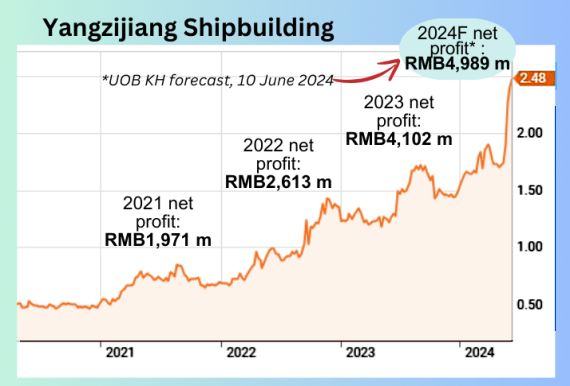

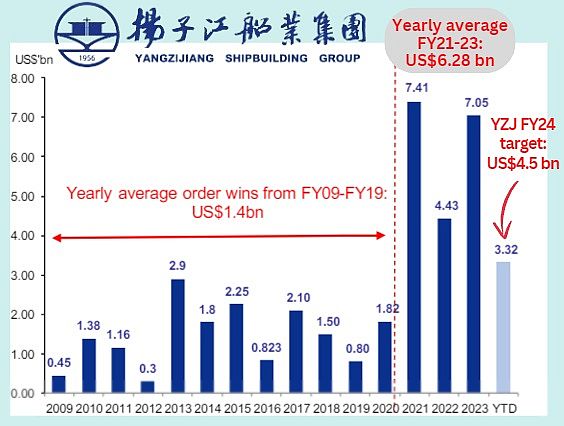

| • From 50 cents at the start of 2021 to $2.48 recently. That's a 5x jump in 4.5 years by the stock price of Yangzijiang Shipbuilding. Its nice uptrend correlated with Yangzijiang's profit streak amid a growing orderbook (chart below).  • The profit rise, in turn, arose from massive order wins in the past 3 years -- and it continues. That's why Yangzijiang's market cap is now nearing S$10 billion.  Source: CGS International, NextInsight Source: CGS International, NextInsightThe most recent update, in May 2024, from Yangzijiang is that its outstanding orderbook was a record US$16.1 billion. • If there's one area Yangzijiang can do better, it's in the dividend payout. Last year, it was 6.5 Singapore cents/share, translating into a 34% payout ratio. It's an improvement from prior years' 5.0 cents, 5.0 cents and 4.5 cents. The covering UOB KH analyst works out that the company can well afford a higher payout this year. Read more below ... |

Excerpts from UOB KH report

Analyst: Adrian Loh

Yangzijiang Shipbuilding (Holdings) (YZJSGD SP)

The Not-so-little S-chip That Could

| YZJ’s strong share price performance this year reflects its stellar operational and new order win performance by riding the shipbuilding upcycle, in our view. We have upgraded our earnings by 10-30% as well as our 2024 order win expectations from US$5b to US$7b despite the company maintaining its guidance of US$4.5b. Maintain BUY with a higher target price of S$2.86 (previously S$2.19). |

| WHAT’S NEW |

• Market giving due recognition to a solid business. Yangzijiang Shipbuilding’s (YZJ) strong share price performance since its 1Q24 business update on 28 Mar 24 reflects, in our view, the market recognising YZJ’s management which has driven its stellar operational and new order win performance in the past few years.

|

Yangzijiang |

|

|

Share price: |

Target: |

YZJ’s ability to execute well was demonstrated by its delivery of 28 vessels or 44% of its target of 63 vessels this year, despite the long Lunar New Year holidays in February.

Ytd, the stock is the best performer on the STI, up 62.4% and handily beating the STI’s 2.8% gain.

• Order wins continue to be robust. With US$3.32b in new orders ytd, YZJ has achieved 74% of its 2024 target of US$4.5b vs our higher expectation of US$5.0b.

Despite this outperformance, we note that management has remained particularly conservative and stuck to its original target while we have decided to upgrade our 2024 order win expectation to an admittedly high target of US$7b.

Note that its previous annual high was US$7.41b in 2021.

For 1Q24, the company won orders for 38 vessels comprising 14 oil/chemical tankers, 12 containerships, eight gas carriers and four bulk carriers.

| "After payout of its 2023 dividends amounting to around S$257m, the company has over S$1.74b in cash, or S$0.44 per share in cash (ie 18% of current share price). Without any onerous spending on the horizon, we believe that the company could pay out more dividends." |

• New order flows – what’s exciting? It was evident that management would continue to focus on oil tankers given that this segment is on an upswing globally and thus owners appear to be willing to put in orders.

Additionally, the company believes that greener ships will be in greater demand (ie replacement of older vessels that have high emissions of sulfur, nitrous oxide and carbon dioxide) and it will be in a strong position to fill its yard slots with high-margin low-emission vessels that are dual-fueled with LNG.

• Steel costs unlikely to increase, in management’s view. YZJ disclosed that it currently imputes a cost of Rmb4,000 per tonne for steel plates and does not believe that costs will increase in the near to medium term given that demand is weak from other sectors, particularly the property sector.

In our view, stable steel costs should benefit YZJ and enable it to generate higher shipbuilding margins which the company has guided for in 2024.

| STOCK IMPACT |

• LNG-fuelled vessels. LNG remains the fuel of choice for lower-carbon shipping with dual-fuel methanol and ammonia engines coming in second.

YZJ currently has orders for 35 LNG dual-fuel containerships (18% of its orderbook of 193 vessels) and 15 methanol dual-fuel containerships (8% of its orderbook).

We believe that LNG’s price competitiveness, abundant supply and well-developed infrastructure gives it an advantage over the alternatives. According to industry estimates, more than 2,400 vessels are equipped to operate on LNG globally, with another 1,000 vessels ordered that are yet to be delivered.

In our view, YZJ is well placed to win more of such vessel orders with many of such new ships able to be adapted to use alternative clean fuels, such as ammonia or methanol.

• With so much cash on its balance sheet and nothing material in terms of capex, we see potential for higher dividends.

As at end-23, YZJ had Rmb16.6b in cash (+54% yoy) and total borrowings of Rmb5.6b (+22% yoy), resulting in a net cash position of nearly Rmb11b, or over S$2b.

After payout of its 2023 dividends amounting to around S$257m, this still leaves the company with over S$1.74b in cash, or S$0.44 per share in cash (ie 18% of current share price).

Without any onerous spending on the horizon, we believe that the company could pay out more dividends.

| EARNINGS REVISION/RISK |

• Upgrading earnings by 10-30%. We have raised our earnings expectations for YZJ by 10- 30% for the 2024-26E period due to a greater conviction that the company will be able to maintain its 20% shipbuilding margins in the medium to longer term.

Our shipbuilding margins have been raised by 1.0ppt to 19% for 2024E, and by 1.5ppt to 18.5% for 2025- 26E.

We have left our gross margin assumptions for the shipping business at 42% for 2024, declining to 35% for 2025-26E.

• We maintain BUY on the stock with a higher PE-based target price of S$2.86 as we roll forward our valuation year to 2025 coupled with the earnings changes outlined above. |

SHARE PRICE CATALYSTS

• Better capital management.

• New orders in higher-margin shipbuilding segments, eg dual-fuel containerships, oil and/or LPG tankers.

• Safe and efficient execution of orderbook and evidence that the company can maintain its high shipbuilding margins of around 20%.

Full report here.