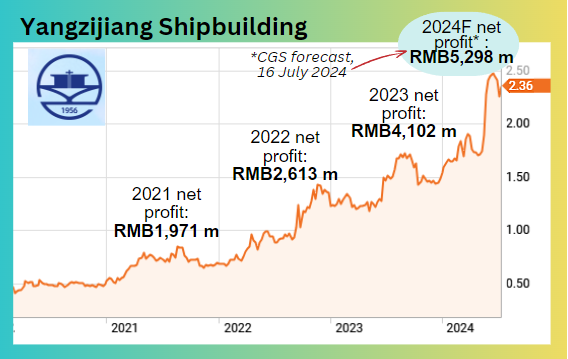

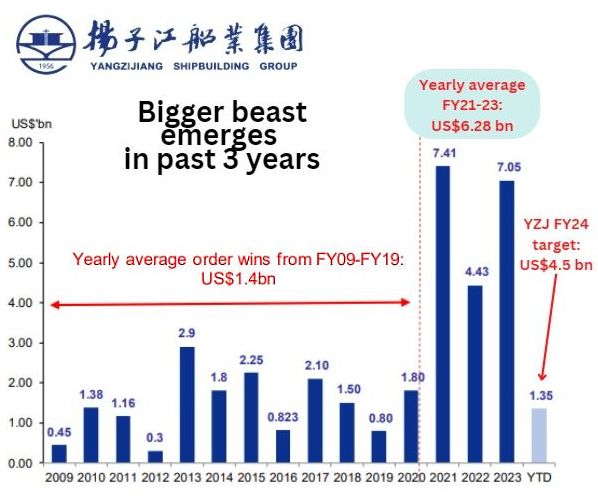

| • This year marks the 17th year of listing on the Singapore Exchange for Yangzijiang Shipbuilding, one of the largest non-state-owned shipbuilding companies in China. • Its longevity and, more notably, its business performance, are remarkable -- very much unlike the many S-chips that turned out to be weak performers or outright frauds. The chart below captures the recovery of the stock post-pandemic in tandem with its profit growth.  • Yangzijiang (market cap: S$9.5 billion) currently sits on a record orderbook of US$16.1 billion. • The orderbook, whose progression is shown below, is not only massive but reflects a shipbuilder that has made a quantum leap in its order-clinching ability over the past 3 years. It's a bigger beast.  Source: CGS-CIMB, Company, NextInsight Source: CGS-CIMB, Company, NextInsight• To deal with the orderbook and future growth, Yangzijiang has made moves to acquire land for expanding its shipyard capacity. Read more in excerpts from CGS's latest report below ... |

CGS analysts: Lim Siew Khee & Meghana Kande

■ We estimate YZJSB’s potential new yard investment to increase capacity by c.10%, boosting deliveries by 5-6 vessels p.a. or orders of US$850m-1bn p.a.

■ We expect positive share price movements on this news. Reiterate Add call and TP of S$2.50. Stronger-than-expected orders are key catalysts. |

|||||

| Capacity expansion framework agreement |

● Yangzijiang Shipbuilding (YZJSB) today (15 Jul) entered into a framework agreement with the local government of Jingjiang City, Jiangsu Province, China, for the land use right of c.1,300 mu (or 210 acres) of land at Xinqiao Park of the Jingjiang Economic and Technological Development Zone.

YZJSB said it is currently conducting a feasibility study on the yard project and will provide further updates upon finalisation.

● YZJSB intends to use the yard as a new clean energy ship manufacturing base for the group.

Construction of the yard will cost Rmb3bn and is subject to Chinese government approval, YZJSB said.

If approved, construction of the yard will take two years to complete, or, in our estimate, by 2026F.

The land is located adjacent to YZJSB’s existing Jiangsu Yangzi Xinfu yard, which spans c.2,200 mu (c.360 acres).

| New yard could deliver 5-6 vessels p.a. or US$850m-1bn in orders |

● Based on the area and investment amount, we estimate the new yard will be about 60% the size of the Xinfu yard, which focuses on the construction of mid-to-large-sized vessels.

Recall that YZJSB had invested Rmb650m for the remaining 20% equity stake in Xinfu yard in 2021, implying a total value of Rmb3.25bn for the entire Xinfu yard.

● According to Clarksons, Xinfu yard delivered 12 containerships in 2023, which we estimate to be about US$1.3bn worth of contracts.

It is also scheduled to deliver 12 vessels in 2025F (7 units of 16k TEU containerships, 3 units of 31.8k DWT bulk carriers, and one LNG carrier). We use Xinfu as a benchmark and expect the new yard to deliver 5-6 vessels of similar size p.a.

Assuming US$170m per vessel (based on YTD average prices for 13k TEU newbuild LNG dual fuel containerships), we estimate the new yard could add about US$850m-1bn in new order wins p.a.

This represents about 15-18% of our 2024F order win target of US$5.5bn.

|

Full CGS report here.

DBS has raised its target price to $2.75.