Excerpts from analysts' reports

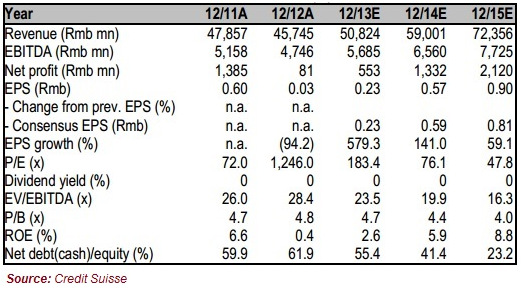

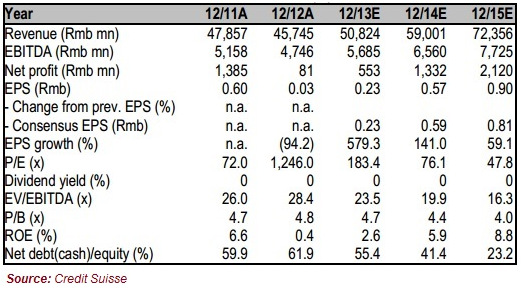

Credit Suisse initiates coverage of BYD with 'outperform' rating

Analysts: Bin Wang and Mark Mao

BYD's new plug-in hybrid model, Qin: According to BYD, the first 100 vehicles were sold within “two seconds" of being available via its online site. Photo: http://insideevs.comInitiate with OUTPERFORM, TP HK$74 implies 36% upside. BYD is China's most competitive EV (electric vehicle) maker, thanks to its technology leadership with an integrated EV solution, strong EV product pipeline and longest EV operation experience.

BYD's new plug-in hybrid model, Qin: According to BYD, the first 100 vehicles were sold within “two seconds" of being available via its online site. Photo: http://insideevs.comInitiate with OUTPERFORM, TP HK$74 implies 36% upside. BYD is China's most competitive EV (electric vehicle) maker, thanks to its technology leadership with an integrated EV solution, strong EV product pipeline and longest EV operation experience.

Analysts: Bin Wang and Mark Mao

BYD's new plug-in hybrid model, Qin: According to BYD, the first 100 vehicles were sold within “two seconds" of being available via its online site. Photo: http://insideevs.comInitiate with OUTPERFORM, TP HK$74 implies 36% upside. BYD is China's most competitive EV (electric vehicle) maker, thanks to its technology leadership with an integrated EV solution, strong EV product pipeline and longest EV operation experience.

BYD's new plug-in hybrid model, Qin: According to BYD, the first 100 vehicles were sold within “two seconds" of being available via its online site. Photo: http://insideevs.comInitiate with OUTPERFORM, TP HK$74 implies 36% upside. BYD is China's most competitive EV (electric vehicle) maker, thanks to its technology leadership with an integrated EV solution, strong EV product pipeline and longest EV operation experience.● Non-consensus bullish on China EV growth. We estimate a 113% CAGR in 2014/15 versus the overall auto sector's 16% CAGR, because of the recent big jump in government commitment on subsidy area expansion (from 25 to 86 cities), volume (from 50K to 330K), charging pole (from 12K to 200K), and a wave of appealing EV models' debut to spur private customers' appetite such as Tesla and BYD "Qin".

The market is concerned about EV penetration hurdles, i.e. cost and infrastructure.

● Catalysts: (1) New EV model "Qin" sales spike after supply bottle neck eased, and

(2) more favourable EV related policy release

(2) more favourable EV related policy release

● Risk: Upside risk is better-than-expected customer acceptance of its EV models including "Qin", "E6" and "K9"; downside risk is EV penetration hurdles, especially slower infrastructure construction.

Recent story: GOLDPOLY NEW ENERGY, BYD: Latest Happenings...

Recent story: GOLDPOLY NEW ENERGY, BYD: Latest Happenings...

|

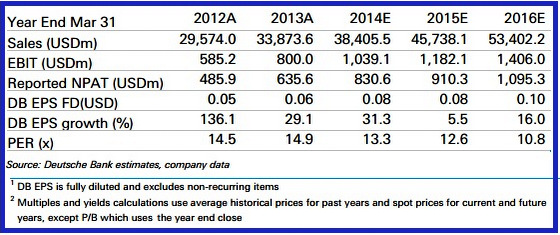

Deutsche Bank positive on Lenovo's acquisitions but lowers target price to HK$10.4 Analysts: Andrew-C Chang and Yasuo Nakane, CMA Following a more detailed review of Lenovo’s IBM server and Motorola acquisitions (assuming completion in 3QFY15), we factor our assumptions of their impact into our financial model. We raise our FY15E and FY16E sales by 10% and 21% and cut EPS estimates by 13% and 11% to US$8.37 and 9.71 cents to reflect the possible P&L impact of these acquired businesses and their share dilution (7.75%). We hold a more positive view on Lenovo to turn around these two businesses and believe investors may underestimate its execution and IBM/Google’s support to help the integration. We reiterate our Buy rating with a new target price of HK$10.4 (from HK$12). Valuation and risks: We base our target price on 16x FY15E EPS. We award a higher P/E multiple to Lenovo than to its peers (9-14x) because of its robust earnings growth and market share gains from its PC business, potential upside from its server operation and strong smartphone and tablet shipments.

Downside risks: weaker demand for PC, smartphone, server and tablets, and channel inventory  Recent story: Overweight JU TENG, go Neutral On LENOVO -- Analysts |