Excerpts from latest analyst reports....

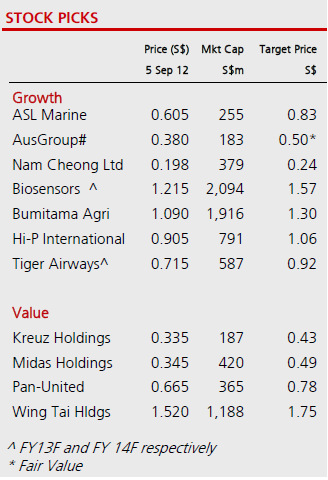

DBS Vickers highlights its top picks of small and mid cap stocks

We believe there are opportunities within cheaper and higher growth SMCs to outperform this market.

We continue to favour stocks with tangible earnings growth. Go for stocks that better the 12% FY13F growth expected of SMCs.

Our picks are Bumitama, Tiger Airways and Hi-P.

Next, go for SMCs that have discounted the negatives, currently trades at depressed valuation but with visible catalysts.

Our picks are Midas, Wing Tai and Pan United.

Finally, go for stocks within the O&M industry because the sector enjoys strong order books and earnings visibility.

Recent interest for the large cap O&M plays could also filter down into the SMC space.

Our picks are Nam Cheong, Kreuz and ASL Marine.

We also take this opportunity to spotlight a new name Ausgroup. The company should enjoy a rising order book while margin improvement keeps profit growing.

We project a FY13F earnings growth of 28%. Ausgroup is amongst the lowest valuation O&G plays at 5x FY13F PE.

We see a potential target of 50cts based on 8x forward earnings that is 20% discount to sector average.

Recent stories:

AUSGROUP: FY2012 net profit up 88%; pays special dividend

Oil & Gas Buzz for ASL MARINE, KEPCORP, TECHNICS, MTQ, MENCAST, CH Offshore

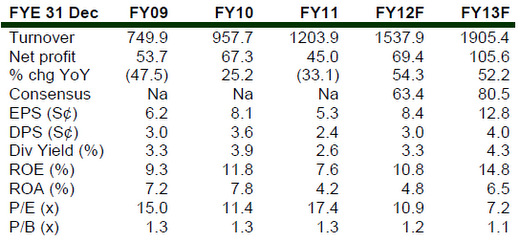

DMG & Partners says "Hi-P’s a sure bet...."

Analysts: Edison Chen & Terence Wong, CFA

The month of September promises to be a very exciting one for consumers. With major OEMs like Apple, Motorola, Amazon, Nokia launching a new generation of signature products, the new battle for mobile device market share has begun.

Out of the three OEMs that have unveiled new products, the market has voted with two winners and one loser emerging.

The two winners, Motorola and Amazon, are believed to be amongst Hi-P’s top three customers, along with Apple.

Together with Apple’s highly anticipated unveiling of iPhone5, Hi-P is in a favourable position like no other.

And let us not write off Hi-P’s former largest customer just yet.

Research In Motion (RIM) could still rebound from the launch of BlackBerry (BB) 10 in the first quarter of next year. As such, we believe that Hi-P is poised for phenomenal growth starting from 2H2012 onwards.

Recent story: HI-P INTERNATIONAL confident of higher revenue, profit in FY12