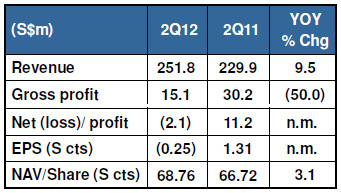

HI-P INTERNATIONAL stock jumped 11.6% to close at 82 cents yesterday after the company reported a S$2.1 million net loss for 2Q -- but it maintained its guidance of higher revenue and profit for FY12.

This strongly suggests a solid recovery in 3Q and 4Q, despite a continuing fall in business from an erstwhile big customer, Research in Motion.

Based on its guidance, Hi-P is saying it would achieve in excess of the S$1.2 billion in revenue and S$45 million in net profit it clocked in 2011.

Hi-P is set to embark on new programmes as a contract manufacturer for tablet computers, smart phones, sports digital devices, etc. Its key customers include Apple.

Among the factors contributing to the loss in 2Q was a one-off cost of S$1.0 million in relation to the retrenchment of workers as Hi-P ceased its business operation in Mexico.

For the press release and powerpoint presentation, click here.

The following are highlights of the Q&A session between Hi-P management and analysts and fund managers at Fullerton Hotel yesterday:

Q: For your new programmes in 2H, are you seeing any reduction in orders, or delays?

A: Yes, there will be some delays, which will have a slight impact on volumes. It's coming from more than one customer.

Q: Regarding your guidance for revenue and profit for FY12, how much buffer is there to address possible delays from customers?

A: There is a buffer. One of our customers' business has dropped tremendously and hit us badly. Our people are working very hard to bring in more business from other customers. For the whole year, we believe our revenue will be higher than last year. Bottomline will also be better. We have pretty good confidence in that.

Unless extreme circumstances happen, we have confidence that the bottomline will be better than last year.

Q: The customer with problems -- how big a portion does it affect your business?

A: For the whole year, its contribution may drop 70-80%. But they do have a project for mass production in 2H.

Q: Please give a sense of how this customer impacts you. I think this customer could well die in the next 6 months.

A: I can't give you the details but let me answer you in this way. If you know our history, we once depended on a customer for 60-70% of our business. When it went down, we suffered -- but we fought and overcame the situation.

With regard to the current customer we are facing problems with, for the whole year, our Group revenue will still increase. Even in the extreme situation you mentioned, next year Hi-P will be able to maintain its good shape still.

Q: Is your guidance for 2H predicated on the customer being able to ramp up significantly in 2H?

A: They have a project with us -- we have made the assumption that if this project does not kick off, we will still be able to achieve better total revenue and bottomline than last year.

Q: Each time a major customer dies on you, you have to fight back and pick new horses and claw your way onto their backs. What do you have in place in your company to enable you to keep on doing this?

A: You asked a good question. Over 20 years ago, I made a presentation. That time we served Seagate and we were doing well. Someone told me, don't depend on one customer. I listened and worked very hard to diversify our customer base.

I have instructed my staff, we need to diversify our customer base. At the same time, any company that can give us big business -- we will take it. We have three business units -- for each one, we will have at least three major customers, to hedge our bets. We are making good progress and have acquired 4 new customers.

Q: Today, how much does your single largest customer account for your revenue?

A: Top 10, is 85-90%. Top 5, 70%.

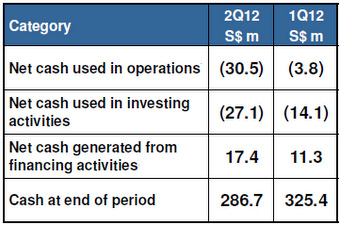

Q: Your capex this year is still going to be S$180 million?

A: Yes, there's still S$70 million left for capex in 2H with more in 3Q than 4Q.

Q: Please tell us more about your business in medical devices and lifestyle products. How much do they account for your revenue and the growth prospects?

A: Medical devices -- we are just making inroads, so contribution is not significant. For lifestyle products, we are making good progress and contributing a good percentage of the overall revenue. Next year, it will grow steadily and we are in the process of acquiring new customers.

Q: Why did you close your Mexican plant? How much losses have you suffered?

A: We have been in Mexico since 1997. We have scaled down operations there in the last 2-3 years. The business is not significant. We decided to close it as our lease is ending in October.

In total yes, we had a loss on our investment. But in the last few years, we broke even.

Recent stories:

HI-P, BIOSENSORS, ROXY-PACIFIC: What analysts now say.....

HI-P INTERNATIONAL: Record S$180 m capex this year for strong business growth