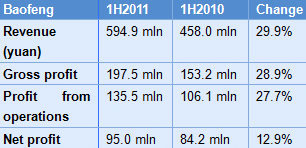

BAOFENG MODERN International Holdings Ltd (HK: 1121), Mainland China’s largest supplier of casual footwear such as slippers with a 6.1% market share, kicked up its first half revenue nearly 30% to 595 mln yuan thanks to a rapid expansion of distribution networks and strong branded business performance.

The company’s CEO also says a new joint marketing deal with the NBA is raising the stakes in basketball-crazy China.

The largest supplier of self-branded slippers in the PRC saw first half net profit rise 12.9% year-on-year to 95 mln yuan.

Revenue from own-brands Boree and Baofeng increased by 83% to 203.9 mln yuan and 73% to 80.6 mln, respectively.

The robust growth is partly attributable to the rapid expansion of the group’s distribution networks and satisfactory performance of the branded businesses.

Meanwhile, revenue from OEM operations rose 3.5% in the first six months to 310.4 mln yuan.

Leveraging on the Baofeng Modern's effective cost management and efficient execution, profit from operations increased by 27.7% to 135.5 mln yuan.

“By leveraging our extensive distribution networks and strong branding, we have successfully penetrated more cities in PRC and increased our market share.

“We will strengthen our Boree and Baofeng brand equity through innovative advertising and promotion activities. More flagship stores will also be opened in tier-one cities like Guangzhou, Shenzhen, Shanghai and Hong Kong to extend our market presence,” said Baofeng Chairman Zheng Liuhe.

Looking forward, he said Baofeng is committed to expanding its Boree and Baofeng branded businesses and to maintain prominence in the PRC’s casual footwear market, and launch innovative strategies.

“In May, we formed an exclusive multi-year partnership with NBA China to launch a line of NBA-designed flip flops, slippers and sandals for adults and children. To further advertise and promote the NBA products in the PRC, Hong Kong and Macau, the group will manufacture and distribute, sell, advertise and promote such products through retail networks in Mainland China, Hong Kong and Macau,” he added.

Mr. Zheng said that to further strengthen its design capability, the group has also engaged an external design house in Italy and collaborates with an external research centre in Dongguan, Guangdong Province to enhance its capabilities to produce a wide variety of designs in line with fashion trends.

“We also intend to expand and improve production capacity to meet growing demand. Advanced new facilities are currently being planned which will increase total capacity significantly in the coming year.”

He added that the continuous upgrading of its Enterprising Resource Planning (“ERP”) system and the Distribution Resource Planning (“DRP”) system will allow Baofeng to monitor the performance of its distributors and serve to enhance the sales growth and develop distribution strategies with accurate information.

“The PRC casual footwear industry has grown steadily over the past years. As consumers become more affluent, they will see casual footwear as fashionable and comfortable footwear and not only as a necessity item. They will be willing to spend more to make themselves fashionable and comfortable.

“We are confident that the group has embarked into an era of rapidly accelerating growth with urbanization and rising disposable incomes as the key driving forces. We intend to continue our efforts to further expand our presence in the worldwide footwear market, especially in Southeast Asia, and we are committed to delivering fruitful returns to our shareholders.”

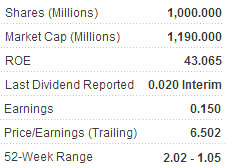

Speaking at a media luncheon in Hong Kong, Baofeng CEO Chen Qingwei said that the company’s share price recently hovering around 52-week lows is primarily due to a lack of understanding about the Hong Kong-listed firm’s primary business.

“The market has unfortunately misunderstood us, mistaking us for primarily an OEM firm with a secondary emphasis on own-brand business.

“In fact, the opposite is true of Baofeng and we remain committed to developing our self-developed brands and proprietary technology, and base our future development upon a heavy reliance on continuous build-up of our self-brands’ awareness and recognition,” Mr. Chen said.

He added that with the spectacular popularity of the NBA in the PRC, and the fact the Mainland China is by far Baofeng's biggest market, the firm is very bullish on the deal it signed with the NBA three months ago.

“It will allow us to piggyback on the NBA brand to boost our own brand recognition.”

When asked if the possibility of a general strike by NBA players during the upcoming season would impact the benefit of the deal, he said that professional basketball, especially as it is packaged in North America with its 30 teams all sporting unique colors and logos, means that nothing can diminish the popularity of the sport in the world’s most populous country.

“The NBA is certainly strong enough to survive a possible strike,” he said, adding that this made Baofeng even more proud of its achievements as the NBA was the first to reach out to Baofeng with the joint branding proposal.

“The NBA deal allows us to design, manufacture and market slippers sporting the logos of all 30 teams. We fell this will really take off in the PRC, Hong Kong and Macau where the deal is in place.”

He said NBA-crazed Mainland China would continue to be the company’s largest market overall going forward.

“Asia is home to roughly half the world’s population. It will be our biggest area of business development for many years to come with the PRC and Asia in general being our biggest growth markets for at least the next five years.”

As for points-of-sale (POS) positioning, Baofeng is moving forward aggressively.

“A lot of department stores already recognize us as a sales leader in the slippers/sandals market which helps our positioning in retail spaces as well as boosts our bargaining power,” Mr. Chen said.

But he said Baofeng was by no means putting all its eggs in the Mainland China basket.

“In Southeast Asia, there are no winters, so slippers and sandals can and are worn year round. And with growing links to the NBA, we feel we can really take off with brand-building, sales and co-branding.”

He said that the cachet the NBA logo carries definitely pays off for partner firms.

“For every 10 people that passes by one of our stores which prominently displays the NBA logo out front, I would guess that one or two would be very tempted to come in and see what is going on, and in the process they will immediately be surrounded by our products.”

He said own-branded products were the way to go for companies like Baofeng that are committed to quality growth over quantity growth.

For our OEM business, margins are around 25-28%, but for own-brands it is 38-40%. We expect the NBA-branded slippers to enjoy even higher margins at around 38-44%, so it should be obvious why we are so bullish on own-brands and co-brands.

“Besides, the OEM business is much more captive to raw material costs and yuan currency fluctuations.”

Baofeng was not too worried about the major sportswear players taking away market share.

“Adidas and Nike all make sandals and similar casual footwear, but their ASPs are around 300-400 yuan per pair. Ours are closer to 200, so there will always be a market demand for our products.”

And growing orders from major retailers were also helping Baofeng be more upbeat about future prospects.

“We are selling a lot of slippers to Walmart. We believe we will grow more quickly this year,” Mr. Chen said.

See also: BAOFENG MODERN, HKEx: What Analysts Now Say...

Excerpts from latest analyst report...

KINGSWAY RESEARCH: Initiating coverage of BAOFENG with 'buy' call

Kingsway Research said it is beginning coverage of Baofeng Modern (HK: 1121) with a BUY recommendation and a target price of 1.9 hkd, representing a 67% upside potential.

First mover to capture rising fashionable slipper market Kingsway Reseach said fashionable slippers have emerged quickly.

“Baofeng, being China’s largest OEM slipper manufacturer, has successfully seized the opportunity and developed the largest fashionable slipper franchise in China. Its ‘Boree (宝人) and ‘Baofeng’ (宝峰) brands collectively enjoyed the highest market share with 7.1% in 1H10.

“In our view, what sets it apart from peers are its superior design capabilities and first-mover advantage.”

Replicating its success in other segments Baofeng plans to launch NBA-licensed products, children's products, and a premium series in 2012 to expand its product portfolio and widen its customer base.

In particular, its three-year exclusive partnership with the NBA has significant potential as NBA slippers had a market share of 2.4% in 1H10, nearly one-third of Baofeng’s overall business.

Brand business yet to be priced in ”We expect the high-margin brand business to account for 68% of revenue and 78% of gross profit in 2013 from 48% and 59% in 1H11, respectively,” Kingsway said.

As a result of improving business mix, it expects the gross margin and core net margin to reach 37.2% and 15.4% by 2013 from 33% and 12% in 2010, respectively.

”The stock currently trades at 6.1x 2011E PE which we believe has not factored in the high-margin brand business. In addition, it has net cash of HK 0.8 per share, equivalent to 70% of the current share price,” Kingsway said.

It added that it forecasts 42% core net profit CAGR in 2010-13 largely driven by the fast expanding retail business.

“Thus, we believe Baofeng poses a solid re-rating story which we see 67% upside from the current share price.”

See also: VST Holdings: IPads, China Market Propel 1H Sales