Excerpts from analyst reports...

OSK: Initiating BAOFENG with BUY

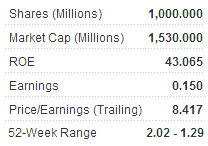

OSK Research is beginning coverage of Baofeng Modern International Holdings Company Ltd (HK: 1121) with a BUY recommendation and a target price of 2.72 hkd.

“Baofeng is riding the high wave. Originating as an OEM enterprise, Baofeng is one of the largest suppliers of slippers and flip-flops in China. It has also expanded business into in-house branded products under two brands namely Baofeng and Boree,” OSK said.

The brokerage said that according to Frost & Sullivan, Baofeng was ranked 1st among suppliers of slippers and flipflops in Mainland China with a market share of 6.1% in terms of sales in 1H10, and it was also ranked 1st among suppliers of own-branded slippers and flip-flops in the PRC with a market share of 4.3% in 1H10.

“We project EPS to grow at a CAGR of 29% for FY11e-13e, primarily driven by a CAGR of 25% top line growth during the same period and GPM expansion.”

Shifting focus from OEM to in-house brands The company has shifted its resources from OEM business to in-house branded products. Baofeng rolled out its fashionable slippers and flip-flops in China under Boree brand in 2007 and Baofeng brand in 2009, respectively.

Sales from this business have surged at a CAGR of 99% from Rmb20m in FY07 to Rmb314m in FY10.

“We expect contribution from this business to increase to 61% in FY13e from 38% in FY10. In May 2011, Baofeng has signed a cooperation agreement with NBA, we believe it will help boost the company’s sales going forward. We project EPS to grow at a CAGR of 29% for FY11e-13e.”

OSK said it projects a CAGR for Baofeng of 25% for top line for FY11e-13e, primarily driven by POS expansion and improving same store sales growth for in-house branded products business.

“We project 5-10% yoy growth for OEM revenue in the coming years. We expect GPM to expand to 35% in FY13e from 33% in FY10, primarily driven by increasing proportion of inhouse brands business.”

Initiation with BUY Given the significant portion of revenue from slippers and flipflops business, OSK said it thinks there are no perfect peers for Baofeng.

“As such, we believe sportswear and ladies’ footwear manufacturers would be close comparables to Baofeng. As Baofeng’s earning history with its branded businesses is brief, we value Baofeng at a 25% discount to the mid-range of sportswear and ladies’ footwear peers at 9-15x FY12e P/E,” OSK added.

See also: HK BANKS, SA SA, CHU KONG STEEL: What Analysts Now Say...

KINGSWAY: BAOFENG’S valuation ‘undemanding’

Kingsway Group said that Baofeng Modern International (HK: 1121) has an “undemanding” valuation.

“Baofeng is No.1 in fashionable slippers/sandals in China. During 1H11, 'Boree' and Baofeng collectively accounted for some 4.3% market share in China. Boree targets the mid-to-high end market with retail ASP of RMB150-250 and 560 POS as at Jun 2011. Baofeng targets the mass market via wholesale channels at a retail ASP of RMB30-50, supplementing Boree’s more affluent customer base.”

Kingsway added that Boree’s and Baofeng’s revenues rose 164% and 150% in 2010, respectively.

Exclusive partnership with NBA Baofeng obtained a three-year partnership deal with the NBA selling slippers/sandals in China, of which it is exclusive for men and woman. Baofeng will launch a new collection featuring NBA teams and All-Star Game logos and mascots in 2H11.

“Management expects an ASP of RMB100-200 and 40-45% of gross margin (after profit sharing) for this product line. We believe this new product line can further enhance Baofeng’s brand equity and extend its customer base to men’s market,” said Kingsway.

Deepening relationship with Disney “Baofeng’s renowned OEM client base enables cooperation potential for the group’s retail channel," said Kingsway.

"Baofeng has started distributing Disney’s licensed slippers and sandals in some of its retail shops.”

Expanding into premium segment Baofeng plans to launch a premium “Boree” line with Italian designs in 1H12. The ASP is expected to be RMB 400-500.

Solid OEM business Baofeng is the largest slipper exporter in China serving Disney, Guess (exclusive), H&M, Walmart, Sears, etc. It was also the licensed manufacturer and retailer of the 2010 Shanghai World Expo.

The OEM business generated RMB 519m of revenue in 2010 (63% of total).

Store and capacity expansions drive top-line growth Baofeng targets to expand its Boree store count to 800 by end-2011 from current 560. It will also boost its current production capacity of 50m pairs by 94% to 97m pairs by April 2012, Kingsway said.

Improving sales mix expands margins Brand revenue (for Boree and Baofeng) accounted for 37% of group revenue in 2010 but management expects the ratio to increase to over 50% in 2011 driven by store expansion and launching of new products.

Gross margins of Boree, Baofeng and OEM business were 41%, 37.5%, and 28.7% in 2010, so higher contribution from self-owned brands should help improve the group margin, which stood at 33% in 2010.

Undemanding valuation Baofeng is currently trading at an undemanding valuation of 7.5x PE for 2011 compared with 18x for Daphne (210 HK), 13x for Le Saunda (738 HK), and 27x for Belle (1880 HK).

“We believe the market has not priced in its brand business, leading to re-rating potential,” Kingsway said.

See also: AJISEN: HK-Listed Noodlemaker Denies Margins ‘Souped-Up’

GUOCO: HKEx still SELL, target cut

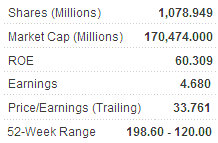

Guoco Capital said it is reiterating its SELL call on Hong Kong Exchanges and Clearing Ltd (HK: 388) and cutting the target price cut to 124 hkd from 141 on weak earnings expectations.

“Share price of HKEx underperformed the Hang Seng Index by 4.0% over the past three months mainly due to sluggish stock market turnover. Stock market turnover and IPO fund raisings are key earnings drivers for HKEx,” said Guoco.

Average daily turnover of the stock market was $66.7 bln hkd in July and $72.3 bln for the first seven months of 2011, compared with $69.1 bln for the whole year of 2010.

“We estimate average daily turnover for year 2011 at $72.6 bln, up 5% yoy. According to HKEx information, Hong Kong’s IPO fund raisings reached $190 bln in the first seven months of 2011, representing 42% of the full year amount of $450 bln in 2010.”

Considering a negative outlook for stock market in the third quarter, Guoco said it believes the IPO fund raisings for year 2011 may drop to $300-350bn, down 22%-33% yoy.

“HKEx will release interim results on August 10. We forecast interim earnings to rise 15% yoy to $2.586 bln thanks to a 15% yoy increase in average daily turnover of the stock market. Our full year earnings forecast is $5.336 bln, up 6% yoy. Our 2011EPS forecast is $4.96 which is 8% below Bloomberg’s estimate.”

Guoco said it expects to see earnings downgrades after interim results announcement.

“Our earnings forecast implies the counter is presently trading at 2011 PER of 32x with a dividend yield of 2.8%. Compared with PE multiples of 12x for the Hang Seng Index and 10x for the HSCEI, valuation of HKEx is certainly expensive.”

See also: FOCUS MEDIA: Singapore, Hong Kong Ad Firm's HK Placement 20x PE