Photos: Baofeng

SHK: BAOFENG A ‘Shoe In’ for Value

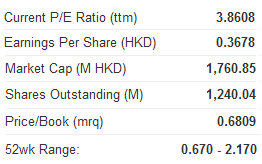

Sun Hung Kai Financial said leading casual footwear maker Baofeng Modern (HK: 1121) trades at a “significant discount” to its Hong Kong-listed peers,

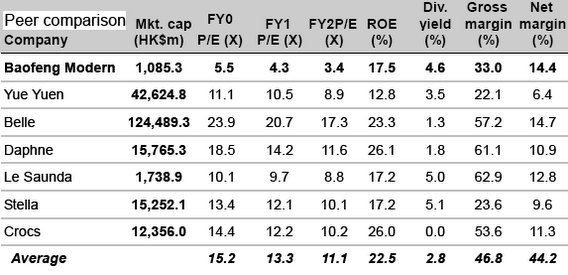

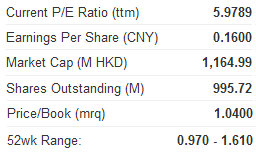

“The stock trades at 4.3X FY12E P/E on consensus numbers, a significant discount to its peers’ average of 13.3X, perhaps reflecting Baofeng’s lack of self-owned stores. The dividend-payout ratio is expected to be ~25% for FY12, with retained earnings used for expansion,” SHK said.

SHK said it recently met with Mr. Raymond Wong, CFO of Baofeng – a leading slipper and sandal designer, manufacturer and supplier in China and owner of the Baofeng and Boree brands.

The firm’s Hong Kong-listed shares currently trade well below Yue Yuen’s (HK: 551) 10.5X, Belle’s (HK: 1880) 20.7X, Daphne’s (HK: 210) 14.2X, Le Saunda’s (HK: 738) 9.7X, Stella’s (HK: 1836) 12.1X and Crocs’ (CROX.US) 12.2X, with the dividend yield at 4.6%.

Management expects to keep the payout ratio at around 25%. The shares have underperformed the benchmark Hang Seng Index by 14.0% in 2012.

“Baofeng will focus on its own brands to improve margins,” SHK said.

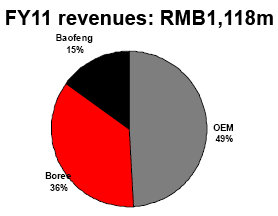

The Boree brand (36% of FY11 revenue) generates 42% gross margin, the Baofeng brand (15% of revenue) 38% margin, while OEM (49% of revenue) makes just a 25.7% margin.

“The focus on own brands will be supported by new, higher-ASP brands such as NBA, Swarovski and FTV. Management expects OEM to maintain stable single-digit growth and guides for up to ~30% top-line growth.

“A growing distribution network, with ~400 new points of sale (POS) is planned for FY12. These include specialty stores, concession counters, department stores, shopping malls and supermarkets on the mainland.”

SHK added that Baofeng will explore growth opportunities elsewhere in Asia, and will likely introduce its brands in the Philippines and Indonesia in 1H12, followed by Thailand, Malaysia and Singapore in 2H12.

“We see this as a strong growth driver given the hotter and more humid weather in Southeast Asia, where consumers can wear slippers on a daily basis.”

Expanding capacity

Production facilities are in the city of Quanzhou, Fujian -- a traditional PRC footwear hub -- and turned out around 44 million pairs of slippers in FY11, with capacity utilization at 80%.

“The company is considering building another factory in inland China, where labor costs are lower. It also targets to add 1-2 more brand partners each year to diversify the product range, perhaps to include apparel or accessories.

“In addition, the company plans to enter the retail business by working with existing distributors to open self-owned stores, eventually opening multi-brand flagship stores,” SHK said.

Baofeng targets the mass market with selling prices at RMB30-RMB80. The sales network currently covers mainland China and Hong Kong, and is expanding to Southeast Asia.

In addition to slippers and sandals, Baofeng also sells other footwear and accessories. Brand partners include:

NBA – exclusive three-year rights to use the official NBA logo in China since May 2011. Products include men’s, ladies’ and children’s slippers and sandals.

Swarovski – two-year deal to use the Made with Swarovski Elements logo. Selling prices are as high as RMB1,500.

FTV – with products to be sold in mainland China, Hong Kong, Macau and elsewhere in Asia, as well as at FTV’s global retail stores. FTV already has ~80 stores in Thailand, which could help accelerate Baofeng’s expansion in Asia.

SpongeBob – with products to be launched in 2012, targeting the under-14s market in Mainland China, Hong Kong and Macau.

Overseas clients include Guess, Tommy Hilfiger, Disney, Walmart and Sears.

OEM revenue as a proportion of total revenue fell from 63% in FY10 to 49% in FY11, in line with the company’s strategy to focus on own-brands.

See also:

BAOFENG ‘Buy’ On 2011; PRC CONSUMER Plays ‘Mixed Bag’

OSK Stays ‘Buy’ On BAOFENG; BOCI Cuts CHOW SANG SANG Target

MISS ASIA Contestants Lend ‘Hand’ To China’s Top Slipper Play

BAOFENG: Aiming To Crystallize New Orders With Swarovski

SHK: VST Dividends Best in Sector

Sun Hung Kai Financial said IT distributor VST Holdings (HK: 856) continues to attract shareholders thanks to its practice of rewarding investors better than its peers.

“We recently hosted an investor road show for VST. We invited Mr. William Ong, CFO, to share the company’s views on the growth prospects for the firm and his outlook for the year.

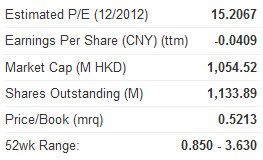

"The equity has outperformed the HSI by 85% YTD but continues to trade at levels below its closest peers,” SHK said.

The research house added that ECS (ECS.SP), its Singapore-listed subsidiary, will report results this month.

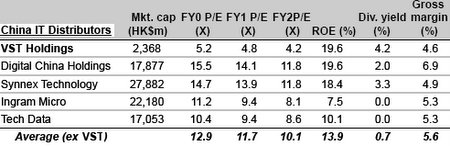

VST is now trading at a P/E of 4.2X FY12 consensus earnings, a “significant discount” to its peers’ average of 10.1x. Its closest peers, Digital China (HK: 861) and Synnex (2347.TT), trade at 11.8X forward P/E.

The dividend yield is 4.2%, the highest in the group.

“The reinstatement of the dividend has raised interest in the stock. Average daily trading volumes since annual results announcement are 6.98 million shares compared to 3.45 million for a similar period last year.

“Going forward the dividend should be supported by the firm’s HK$1.57 billion cash balance, strong free cash flows and management’s commitment to at least maintain dividends. We expect dividend support will limit downside risk from any short term earnings weakness,” SHK added.

Singapore-listed ECS accounts for about 70% of VST’s revenues, including all enterprise segment revenues.

“A recovery in HP business and enterprise revenues should drive margins up. As rough top-line guidance for FY12, the CFO pointed to growth estimates for the IT hardware sector of 10%-15%.

Mean reversion of working capital and gearing. In 2011, the company significantly lowered its working capital days mainly from taking advantage of market supply shortages of HDD in the second half.

However, the company expects working capital days will revert back to normal levels of 30 days. Additionally the firm is targeting net gearing ratio of 0.50 versus 2011 year end of 0.11, longer term.

See also:

HONG KONG Looking To 'Steppe' Up Inner Mongolia Investment

VST: Making ‘IT’ Happen In PRC; Shares Soar 26%

VST Holdings: IPads, China Market Propel 1H Sales

SHK: COMTEC Showing Tenacious Profitability

Sun Hung Kai Financial said pure-play wafer manufacturer Comtec Solar (HK: 712) is resiliently staying in the black despite a market slowdown.

“Comtec has remained profitable despite wafer average selling prices slumping as low as 30 US cents/W in 2H11,” SHK said.

It added that despite the difficult industry operating environment, the company currently manages breaks even on its P-type mono wafers – but just barely -- and maintains a double-digit gross profit margin on its N-type wafers.

ASP has stabilized at ~US¢35/W.

“The company expects a market turnaround after 2H12 as: 1) consolidation will force out uncompetitive players and ease the supply glut, 2) it sees the debt crisis easing in Europe, which could unleash liquidity for solar projects, 3) installations should reach 4-5 GW in China in 2012.”

See also:

COMTEC Kept ‘Buy’ By Bocom On Tariff Immunity; 3 Big Banks All 'Buy'

COMTEC ‘Outperform’ On Wafer Niche; FOCUS Helps Out Mercy Relief

Bocom: 'Buy' Kept on COMTEC

Bocom International says it is maintaining its "Buy" recommendation on Comtec Solar (HK: 712) after strong recent results.

First quarter revenue grew 17.5% QoQ to RMB218.53 million while gross profit was RMB30.30 million, representing a gross margin of 13.9%.

Excluding the other losses of approximately RMB170.12 million related to the repurchase of convertible bonds and issuance of new warrants, the adjusted net profit was RMB10.38 million.

"Such a gross margin and net profit were positive surprises, against the backdrop of the European debt crisis and excess capacity in the industry. We believe the increase in the shipment of 'Super-Mono Wafers' may be the key profit driver," Bocom said.

It added that the "excellent competitiveness" of Comtec and the future development of the Japanese market may bring new growth momentum.

"We maintain the company’s earnings forecasts, with FY12/13E core EPS of RMB0.11/0.14. We keep our TP at HK$2.05, corresponding to FY12E P/E of 15.0x."

See also:

COMTEC SOLAR: Economic Cloudcover Not Obscuring Wafer Demand

COMTEC SOLAR: ‘Buy' With 134% Upside, Says Yuanta; But 'Hold' Says UOB