BOCOM gives OUTPERFORM to China insurers

BOCOM International said that “mixed performances” were observed for Hong Kong-listed insurers’ earnings in 2010, with casualty insurance business growing strongly on rapid expansion into Mainland China while life insurance business witnessed lower profits due to poor returns from investments and higher provisions.

The brokerage added that it expects both life and casualty insurance businesses to see decent growth in profits in 2011, though slower growth in premium income could curb margins.

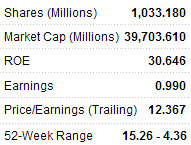

“We maintain our OUTPERFORM rating for the sector and Ping An Insurance (HK: 2318) is our top pick,” Bocom said.

See also: JUST ASK: 'Should My Sis Convert To The CPF Life Annuity?', 'Are Stocks Good Value When Trading Below Book Value?'

BOCOM says GREAT WALL MOTOR ‘key recommendation’

Bocom International said Chinese automakers listed in Hong Kong observed slower growth in 2010 while market share of self-owned brands in China expanded.

The brokerage added that gross margins remained steady and price adjustments were mainly conducted by distributors.

“It is expected that growth will continue to be relatively weak in 2H11 and 2012 with concerns over supply surplus. Investment opportunities stay unsurprising in the absence of new catalysts in 2H11.”

Bocom maintains its MARKET PERFORM rating on Hong Kong-listed automakers, with Great Wall Motor (HK: 2333) its “key recommendation.”

See also: CHINA AUTO SECTOR In ‘Downhill’ Skid: What Analysts Now Say...

BOCOM’S top department store pick INTIME

Hong Kong-listed Chinese department store operators saw their FY2010 core profit up an average 37.2%, while the 2H10 sector core profit growth rate dropped to 32.0% from 39.8% in 1H10 as a result of a low base in 1H09.

Bocom said commission rates declined across the sector but efficiency improved in FY10, with Golden Eagle, Lifestyle, Springland and Intime (HK: 1833) still achieving net margin and ROA expansion.

“First quarter same-store-sales-growth was strong. We expect income growth to remain strong in 2H11 and there is potential for further EPS upward revision.”

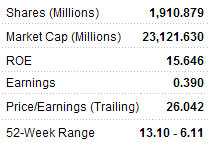

Bocom’s top pick is Intime, with a BUY call, P/E of 26.1x FY11 earnings and a target price of 13.90.

See also: HK-LISTED CONSUMER PLAYS: Inflation Busters Vs Inflation Crashers

UOB KAY HIAN cautions on GEELY MOTOR, GREAT WALL

UOB Kay Hian said that the rise of BYD’s automobile business within a short period and the sudden collapse in 2H10 raised concerns over whether or when other domestic automobile makers like Geely Automobile (HK: 175) and Great Wall Motor will face the same problem as BYD’s in the future.

“Our preliminary answer is no for now as they should have learnt from the lesson of BYD. Geely should slow its expansion to attain more sustainable growth. Great Wall Motor could sustain relatively high growth in 2011, driven by the burgeoning SUV market,” the brokerage said.

Within just five years, UOB said BYD emerged from non-existence in the automobile industry to become the second-largest domestic automobile manufacturer in China, with a leading 5.4% share in the passenger vehicle market in 2009.

“BYD’s exponential growth was driven by rapid store additions and pushing sales to dealers. However, the over-expansion of its sales network resulted in cannibalization and the piling up of inventories at distribution channels, prompting dealers to quit.”

However, UOB said BYD’s competitors are not following lockstep in BYD’s footsteps.

“Geely resembles BYD in terms of sales network expansion. The difference between them is the extent in which they pushed sales to dealers. Geely maintained a lower and more sustainable sales growth. Targeting an industry average sales growth for 2011, Geely will not aggressively add stores this year.”

Meanwhile, Great Wall Motor increased its store count by 70% y-o-y to 410 in 2010, and plans to raise the number to 1,210 by end-2011.

“The company also started to split its sales network into three parts to sell SUVs, comprehensive product lines and sedans. Meanwhile, it targets to grow sales by 39% to 500,000 units, which we believe is attainable given the burgeoning SUV market in China,” UOB added.

See also: BYD: No Sparkplug In Sight For Struggling EV Firm