Excerpts from latest analyst reports...

SAMSUNG SECURITIES says HK consumer listcos all about Inflation Busters vs Inflation Crashers

Event: The main debate during full-year 2010’s results season revolved around inflation. We believe that the market will reward stocks that prove able to resist the ravages of inflation through pricing power—we call these -- Inflation Busters, and punish those that suffer margin deterioration -- Inflation Crashers.

Impact: In this report, we identify stocks that we believe will be able to mitigate the negative effects, or fall prey, to inflation in 2011.

Action: We reiterate our BUY calls on China Yurun, Sparkle Roll, and Emperor Watches (Inflation Busters) and our SELLs on Tingyi and Hengan (Inflation Crashers).

The HK-listed consumer sector contains 107 stocks and encompasses diverse business models from pork processing to high-end watch and jewelry retailers. However, we think that there is a key investment theme that cuts right through the sector -- inflation.

2010 results highlight the differences between two sets of companies:

Inflation Busters: These are groups that are able to mitigate the effects of inflation by passing through ASP increases, showing brand strength and advantageous market positioning, and continue to improve sourcing efficiencies. These stocks performed well after results and our top picks consist of inflation-busting stocks that we find attractively priced.

Inflation Crashers: These are companies for which inflation is visibly biting into margins. Our high-conviction SELLs are on companies for which we see continued margin deterioration in 2011, combined with relatively unattractive valuations.

Results roundup: Hit, beat or missed?

Our strategy team believes that China is well on the way to controlling inflation and that the economy is already cooling. This does not, of course, mean that there is no need to be vigilant re inflation (indeed, we think that the PPI in March will still be above 7% and the CPI closer to 5.5%), just that inflation is no longer out of control.

Nevertheless, inflation continues to be a key concern for investors, and we think that the ability of business models to mitigate cost pressure via leveraging brand strength to raise ASPs was a key factor in companies’ being able to hit or beat market expectations during 2010 results season.

Likewise, we think that companies that missed market expectations fell afoul of increasing cost pressures, and were unwilling or unable to pass through inflation to distributors and/or consumers in the form of higher prices.

Amongst our coverage universe, the 17 sets of reported results across February and March 2011 were a mixed bag; eight companies missed market consensus expectations, seven hit expectations, and two beat:

Companies missed for a variety of reasons, but we think that the most notable are China Mengniu and Tingyi, both of which missed due to wider-than-expected gross margin contraction due to cost input inflation and managements that were not able to raise selling prices.

The largest surprise on the upside was China Yurun, which beat consensus EPS expectations by 11% on the back of higher-than-expected hog slaughtering volumes and strong GPM.

Trends in a nutshell

The main trends we see and our current view, by sub-sector, are as such:

Apparel and Sportswear

We are selectively positive on the apparel and sportswear sub-sector, for brands that can mitigate inflation via increased ASPs, or are even able harness inflation; where the brand specifically targets Chinese consumers benefitting from labor price hikes, e.g., Peak Sport and China Xiniya.

We think that inflationary trends can actually favour some mass-market brands, as this increases disposable income for workers in lower-tier Chinese cities, putting more money into the hands of the target audience.

All four of our stock picks show a commitment to branding via continued investment in R&D, A&P and the roll-out of flagship and specialty stores (eg, Peak Sport’s rolling out basketball specialty stores). Brand power enables ASP hikes, eg, Xiniya raised ASPs by 23% in 2010.

Department Stores

We are cautious on the department store sub-sector, despite some encouraging same-store-sales figures, due to three key risks:

1. Execution of aggressive new store-opening plans

2. Declining concessionaire commission rates

3. Increasing competition from both more new store openings and newer mall retail formats

Same-store-sales to be replaced by new store openings as key growth driver

In 2010, Golden Eagle posted 25% YoY net profit driven by superior SSSG (same-store-sales growth) of 25% and stable margins. On the other hand, Parkson delivered 15% YoY in core earnings growth, delivering the slowest SSSG of 11.4% reported in the HK-listed department store sector.

All HK-listed department store operators have ambitious expansion plans in 2011, with Parkson and Golden Eagle announcing accelerated build-out plans during their 2010 results. This trend highlights increasing competition for customers and for good retail locations, in our view.

Luxury Retail

We are overwhelmingly positive on the luxury retail sector, where we see continued impressive trends driven by the ―wealth-creation‖ effect and pent-up demand, e.g., in Jan and Feb 2011 combined, HK retail sales of watches & jewelry grew by 38.4% YoY (source: HK Census and Statistics Dept.). Indeed, the luxury retail sub-sector seems immune to the negative effects of inflation.

We remain positive on the luxury goods retailers in 2011, as revenue growth should be driven by increased tourism to Hong Kong on the back of continual relaxation of mainland travel restrictions.

We rate Emperor at BUY and Haidian at BUY. We indentify Emperor as an Inflation Buster stock and one of our top picks in the Consumer Sector.

Food & Beverage

We prefer well-positioned upstream players (eg, China Yurun) over downstream processors (eg, Tingyi) due to superior pricing power.

2010 results were somewhat disappointing for downstream processors (China Mengniu, Tingyi, Want Want), but upstream processors (China Yurun) surprised on the upside.

Sales held up strongly as consumers continued to spend on name-brand foods, which are considered better quality. This is particularly important, as food safety remains an issue in China. However, the larger-than-expected rise in raw material costs resulted in lower gross profit margins.

Food processors were also wary of raising prices as China’s CPI reached high levels. This is evidenced by the price hikes late in 2010, although key raw material prices had risen steadily during the year. This resulted in deteriorating profitability.

Downstream food processors’ 2010 earnings were, on average, 6.7% below consensus and 4.4% below our expectations.

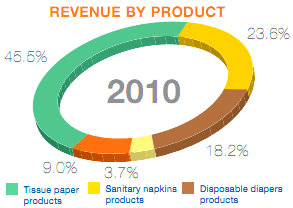

Household and Personal Care

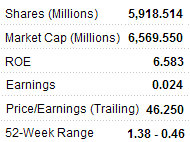

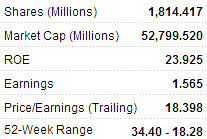

We prefer inflation busting Vinda over Hengan.

Margin contraction in tissue paper should continue

We see a 4.8 percentage point drop in both Hengan and Vinda’s tissue paper businesses, depressed by higher wood pulp costs, which climbed to historical high levels in mid-2010, and where costs are showing no signs of retreating (NB, wood pulp generally accounts for 50-65% of the COGS in tissue paper production).

We forecast that Hengan’s tissue business’s gross margin will fall to 32.1% in 2011e and 33.5% in 2012e, from 42.1% in 2010 and 31.6% in 2009, assuming wood pulp costs of US$733/ton and US$755/ton this year and next.

On Vinda, we project that gross margin will decrease to 27.6% in 2011e and 29.1% in 2012e, from 29.5% in 2010 and 34.2% in 2009, based on wood pulp cost assumptions of US$800/ton and US$824/ton this year and next.

We prefer Vinda over Hengan, as Vinda has been leveraging its pricing power to pass through cost inflation to distributors and consumers. In contrast, Hengan doesn’t have any immediate plans to raise ASPs for its tissue paper products, as the company aims to gain market share.

We maintain our SELL on Bawang; the worst seems to be over, but we still cannot see any real signs of recovery.

Inflation-busting top picks: Yurun, Emperor Watch, and Sparkle Roll.

We have three inflation-busting top picks in the sector:

China Yurun (1068 HK, 15% upside to target of HK$32.00)

We argue that Yurun is positioned to be a key industry consolidator:

At its 2010 results, the company continued to demonstrate its ability to gain market share amidst industry consolidation.

The group’s expansion plan to nearly double slaughtering capacity to 70m heads by 2015 is well underway, according to the company.

2010 results proved Yurun’s inflation busting status, in our view. Not only did the company successfully pass through higher costs on upstream products with higher ASPs, but Yurun also lifted downstream margins through a shift in product mix and increasing sales to hotels.

Yurun’s multiple share placements in the past have raised questions about the chairman’s commitment to the business. We think that market concerns are overdone, as the chairman began to buy back shares in Feb 2011, demonstrating his commitment to the business.

Emperor Watches & Jewellery (887 HK, 26% upside to target of HK$1.39)

We view Emperor as an effective way to play the investment theme of surging luxury goods demand in mainland China and Hong Kong. Indeed, the luxury retail sub-sector seems immune to the negative effects of inflation:

Stripping out a non-core loss of HK$199m related to the revaluation of its convertible bonds, Emperor Watch posted 2010 core net profit of HK$325m, up 66% YoY, mainly driven by buoyant mainland tourist arrivals in Hong Kong and decent progress in new PRC store rollout.

Company guidance remains overwhelmingly positive. Emperor Watch was able to confirm the locations of 10 new planned stores in mainland China for 2011 (four more since our previous update in Feb 2011) at the 2010 analyst’s briefing.

We expect more announcements regarding new store openings in the coming months as the company continues to scout for prime locations both in Hong Kong and the PRC.

See also:

SPARKLE ROLL Making Fortune From China's Millionaires

HENGDELI: A Hong Kong-Listed Firm To Watch

MING FUNG Jewelry Sees Hengdeli Tieup As Golden Opportunity