ANALYSTS CALLS on Super ranged from 'Neutral' to 'Buy' after the leading 3-in-1 instant coffeemix manufacturer posted strong earnings growth for 3Q10.

Consensus target price was S$1.54, translating to an upside of 26% based on its last close price of S$1.22.

DMG – concerns on rising costs

Analysts: Tan Han Meng and Terence Wong

DMG downgraded Super to ‘Neutral’ this week, citing concerns on rising costs of raw materials after six consecutive quarters of gross margin expansion.

DMG's target price was S$1.24.

Super had expanded its 3Q10 gross margins by 7 percentage points year-on-year to 39%, but DMG is estimating that Robusta coffee beans have increased up to 38% to US$1,800 in Oct, compared to Super's cost of US$1,300+ per ton during 3Q10.

Likewise, palm kernel oil prices, estimated to have cost Super US$800+ a ton in 3Q10, have risen up to 13% to reach US$900.

Nonetheless, DMG revised its target price upwards to S$1.24 (from S$1.06).

DMG’s view is more conservative than analysts from Standard Chartered and Kim Eng, who believe that Super’s new higher-margin products will also help to sustain margins despite higher material costs.

Kim Eng – new products to maintain group margins

Analyst: Gregory Yap

Kim Eng maintained its ‘Buy’ call on Super last Fri, with a far more aggressive target price of S$1.80.

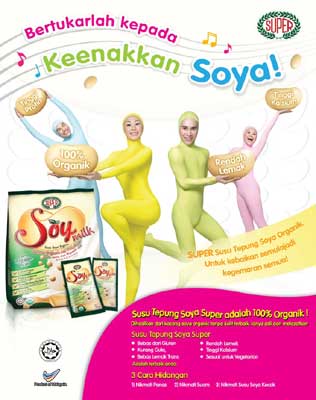

The new products include organic instant soy milk and Ipoh white coffee for markets such as Thailand and Myanmar.

Margins for these products exceed 50%, according to Kim Eng, compared to 40% of its traditional tea and coffee mixes.

Standard Chartered – buoyant prospects in China

Analyst: Pauline Lee

Standard Chartered analyst Pauline Lee maintained her ‘Outperform’ call on Super last Fri with a target price of S$1.58.

The analyst likes Super’s buoyant prospects for non-diary creamer ingredient sales in China, which rides on rising domestic consumption.

|

Super’s 3Q10 non-dairy creamer sales to China had risen 7-fold quarter-on-quarter, following capacity expansion by 25,000 metric tons per annum at its Wuxi plant in Sep.

”Driven by strong demand from China, ingredient sales are growing faster than we expected and already account for 20% of total revenue (compared to 10% in 2Q10),” said the analyst.

It plans to invest US$20 million in new factory in Wuxi, which is slated to produce up to 75,000 metric tons of non-dairy creamer a year.

About 25,000 metric tons of non-dairy creamer capacity production will be shifted from its Singapore factory to Wuxi, and the new factory is expected to be ready by Aug next year.

She also highlighted its potential on new demand in the HORECA (Hotel/Restaurant/Café) space.

Related story: SUPER: 3Q10 Ingredient Sales Surge 47% To S$14.5 Million On Headway In China