- Posts: 3

- Thank you received: 0

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

sino grandness - undervalued stock

11 years 3 months ago - 11 years 3 months ago #21288

by jackphang

Replied by jackphang on topic sino grandness - undervalued stock

I believe it is the business strategy that allows aggressive sales (credit sales) or longer term of repayment so that Sino Grandness could easily park/put their stocks in various points of sales (PoS), as well as to fully utilizing the facility in the factory so that the average cost of production of each units could be reduced hence increasing the gross profit margin.

What I am most worried about is only the delay of IPO as well as the next funding to make payment to bond holders (if IPO fails by next year). Hopefully another white warrior will come and rescue???

Nonetheless, this is a very good attractive counter, just that the fear of falling (due to the IPO and its worst case scenario of penalty of few hundred million) will let many investors feel uncomfortable when they are sleeping.

What I am most worried about is only the delay of IPO as well as the next funding to make payment to bond holders (if IPO fails by next year). Hopefully another white warrior will come and rescue???

Nonetheless, this is a very good attractive counter, just that the fear of falling (due to the IPO and its worst case scenario of penalty of few hundred million) will let many investors feel uncomfortable when they are sleeping.

Last edit: 11 years 3 months ago by jackphang.

Please Log in to join the conversation.

11 years 3 months ago - 11 years 3 months ago #21301

by min1xyz

Replied by min1xyz on topic sino grandness - undervalued stock

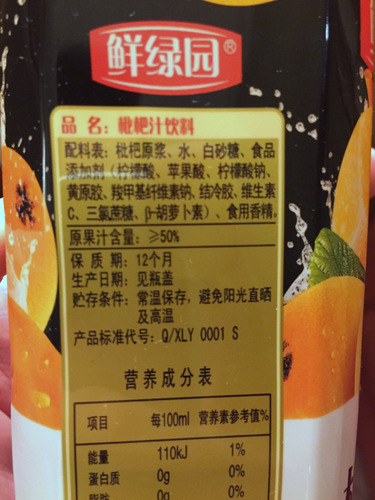

A Sino Grandness shareholder, now in Hangzhou, China, on a working trip, wishes to share these pictures he took today at the Tesco supermart near Holiday Inn City Centre.

-- Sino Grandness' loquat juice bottles are at levels 2 and 4 -- pretty high up.

Words say ..."for production date, see date on bottle cap."

-- Prodn date June 27 this year.

Comments anyone?

-- Sino Grandness' loquat juice bottles are at levels 2 and 4 -- pretty high up.

Words say ..."for production date, see date on bottle cap."

-- Prodn date June 27 this year.

Comments anyone?

Last edit: 11 years 3 months ago by min1xyz.

Please Log in to join the conversation.

11 years 3 months ago #21304

by stirling

Replied by stirling on topic sino grandness - undervalued stock

I believe Sino Grandness's operations is presently at a turning point having made substantial capex in the past 2 years to support it's beverage and canned food division. These expansions were funded from placement and cash flow from working capital. Its operating cash flow is also affected due to its aggressive move into the distribution network of the big retailers. While collections may take longer I think the credit risk can be mitigated by its high margins.

Moving forward, with minimal capex it's free cash flow should start to build up. This could also be the reason why management is confident to declare dividends as one of the terms under the placement agreement with the Thai investors.

At present PE, when the free cash flow starts rolling in , I think the company can effectively pay off its bonds. That's the beauty of consumer stocks e.g. QAF, Super, etc...

Vested.

Moving forward, with minimal capex it's free cash flow should start to build up. This could also be the reason why management is confident to declare dividends as one of the terms under the placement agreement with the Thai investors.

At present PE, when the free cash flow starts rolling in , I think the company can effectively pay off its bonds. That's the beauty of consumer stocks e.g. QAF, Super, etc...

Vested.

The following user(s) said Thank You: Dongdaemun

Please Log in to join the conversation.

11 years 3 months ago - 11 years 3 months ago #21313

by Mel

Replied by Mel on topic sino grandness - undervalued stock

Many invasive audits already done in previous years to satisfy the CB holders

Will the due diligence by HKSE be stricter in light of recent events?

This is not an issue as Sino Grandness is well prepared for it. The listing requirements for Chinese companies have already been tightened significantly in the last few years.

In fact, Garden Fresh has already been audited twice by a Big 4 auditor – once in Oct 2011 and a second time in Jul 2012 – when they raised funds from the convertible bond holders (essentially just Goldman and another large investor). The investors’ auditors were extremely stringent to the extent of interviewing Sino Grandness’ customers and suppliers to cross-verify the company’s claims. Unlike share placements, where

the due diligence is usually done on a cursory basis, private equity funds are significantly more stringent with the checks, especially when they are also investing in a private company; in this case, Garden Fresh, a private subsidiary of Sino Grandness.

From 1+ year ago:

research.maybank-ib.com/pdf/documentrg/S...call_280813_2796.pdf

Will the due diligence by HKSE be stricter in light of recent events?

This is not an issue as Sino Grandness is well prepared for it. The listing requirements for Chinese companies have already been tightened significantly in the last few years.

In fact, Garden Fresh has already been audited twice by a Big 4 auditor – once in Oct 2011 and a second time in Jul 2012 – when they raised funds from the convertible bond holders (essentially just Goldman and another large investor). The investors’ auditors were extremely stringent to the extent of interviewing Sino Grandness’ customers and suppliers to cross-verify the company’s claims. Unlike share placements, where

the due diligence is usually done on a cursory basis, private equity funds are significantly more stringent with the checks, especially when they are also investing in a private company; in this case, Garden Fresh, a private subsidiary of Sino Grandness.

From 1+ year ago:

research.maybank-ib.com/pdf/documentrg/S...call_280813_2796.pdf

Last edit: 11 years 3 months ago by Mel.

Please Log in to join the conversation.

11 years 3 months ago #21325

by Mel

Replied by Mel on topic sino grandness - undervalued stock

Nice one by bro Tipster789 at Sharejunction: This is One Beverage Company possible target of M & A from Global as well as China F & B companies.

Even China MinZhong is doing loquat juice, but remember , Sino G is this segment Market Leader.

And it is easy to expand Garden Fresh product range. Like Loquat Green Tea, Loquat Student Drink, Loquat Ladies Drink..etc :woohoo:

Even China MinZhong is doing loquat juice, but remember , Sino G is this segment Market Leader.

And it is easy to expand Garden Fresh product range. Like Loquat Green Tea, Loquat Student Drink, Loquat Ladies Drink..etc :woohoo:

Please Log in to join the conversation.

11 years 2 months ago #21347

by BNN

Replied by BNN on topic sino grandness - undervalued stock

for Jack ...

& Stirling, who wrote: "At present PE, when the free cash flow starts rolling in , I think the company can effectively pay off its bonds. That's the beauty of consumer stocks e.g. QAF, Super, etc..."

I am not sure if the company can generate enuff FCF to pay off Convertible Bonds I & II. Its strong business growth continues to require lots of working capital.

However, the company can obtain bank borrowings to pay off the CBs, assuming the banks view the company as being real and creditworthy. In all likelihood, this is the case.

In addition, Sino Grandness can place out shares to strategic investors. The Thais, who will soon be in the game, won't be the last, you can be sure.

Then there is the IPO of Garden Fresh which is supposed to happen before June 2015 and is the original route by which the CB holders are to be paid off.

& Stirling, who wrote: "At present PE, when the free cash flow starts rolling in , I think the company can effectively pay off its bonds. That's the beauty of consumer stocks e.g. QAF, Super, etc..."

I am not sure if the company can generate enuff FCF to pay off Convertible Bonds I & II. Its strong business growth continues to require lots of working capital.

However, the company can obtain bank borrowings to pay off the CBs, assuming the banks view the company as being real and creditworthy. In all likelihood, this is the case.

In addition, Sino Grandness can place out shares to strategic investors. The Thais, who will soon be in the game, won't be the last, you can be sure.

Then there is the IPO of Garden Fresh which is supposed to happen before June 2015 and is the original route by which the CB holders are to be paid off.

Please Log in to join the conversation.

Time to create page: 0.282 seconds