- Posts: 302

- Thank you received: 39

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Best World

- lotustpsll

- Offline

- Elite Member

-

Less

More

8 years 6 months ago #23996

by lotustpsll

Replied by lotustpsll on topic Best World

Feedback for the BOD of Best World on some risk matters :-

- Pay close attention to regulatory compliance in the Direct Selling business. This is the key risk in the sector. Better still, establish a Regulatory Risk Compliance division that reports direct to the CEO.

- Education of members is crucial and a comprehensive training programme should be implemented. Training on Regulatory Compliance rules should be made mandatory.

- Drop the obsession with market share targets. If the products are good and the members are properly trained these will drive the business forward. Pushing for market share alone (as announced in its Annual Reports) will likely lead to disciplinary and compliance issues. Case studies on such poor corporate governance is rife in the corporate world.

It is opportune for the Management to review its risk policies and practice and to learn from the errors of its competitors (in China and Taiwan).

The current share price drop is a good reminder that regulatory compliance should not be messed with and short term traders will readily pounce on suspected offenders (even though it is just a rumour).

- Pay close attention to regulatory compliance in the Direct Selling business. This is the key risk in the sector. Better still, establish a Regulatory Risk Compliance division that reports direct to the CEO.

- Education of members is crucial and a comprehensive training programme should be implemented. Training on Regulatory Compliance rules should be made mandatory.

- Drop the obsession with market share targets. If the products are good and the members are properly trained these will drive the business forward. Pushing for market share alone (as announced in its Annual Reports) will likely lead to disciplinary and compliance issues. Case studies on such poor corporate governance is rife in the corporate world.

It is opportune for the Management to review its risk policies and practice and to learn from the errors of its competitors (in China and Taiwan).

The current share price drop is a good reminder that regulatory compliance should not be messed with and short term traders will readily pounce on suspected offenders (even though it is just a rumour).

Please Log in to join the conversation.

- martinluthos

- New Member

-

Less

More

- Thank you received: 0

8 years 6 months ago #24003

by martinluthos

Replied by martinluthos on topic Best World

Correct Singapore stocks value is very tough to determine. Every stock comes with a price tag but smart investors must know is it worth to buy the stock! If you correctly determine the worth of stock, which you are interested to buy, you can also determine the future results that a stock can help you achieve.

The first method, which you can follow, is:

Price to earnings ratio:

With the help of long-term average valuation metric you can compare the price to earnings ratio (PE ratio) of the Singapore stocks you are about to buy. Whenever with the help of Share trading signals, you can compare the PE ratio and check if it is worth buying the stock.

The straight times index can define the market scenario and keep an eye on recent PE ratios. The proxy representation can be fetch from PE ratio of the SPDR STIETF which is exchange traded fund tracking continues fundamentals of the straight times index.

Some facts related to PE ratios:

1. Current PE ratio of SPDR STIETF is 13.1

2. Long term average PE ratio was 17

3. Highest PE ratio in 1973 hit to 35

With these mentioned facts, investment stock picks suggests, that at this moment, the Singapore stocks are reasonably economical so investors who follow share tips for Singapore stock markets, suggest it is a good time to invest in stocks.

The Secondmethod, which you can follow to determine the true value of stocks, is:

Finding net-to-net stocks:

Basically the stocks with the current market capitalization lower to the net current asset value of the stocks falls in this category.

Net current asset value = (Total current assets – total liabilities)

At some certain point of time investors can find the best bargain Singapore stocks where, they can get the stocks at a very cheap price.

On such stocks, investors get a cheap discount on current assets net to current liabilities of the company; current assets include cash and inventory of the company. In this case, the company’s fixed assets are falling into a category of quarrel.

Some facts about net-net stocks:

2nd half of 2007, net-net stock fell to its lowest that is 50, and this was the time when investors and the market observed, the peak position of the Straits Times Indexof great financial crises.

One of the highest point was observed of the value 200, in the year 2009’s first half. During this time, Straits Times Index managed to reach above the crises.

Currently the net-net stock position is around 95, this holds us with a conclusion that the Singapore stocks are not too expensive, thus, this is a smart decision taking time where with the help of latest stock picks of Singapore stock market you can opt to but the best stocks.

The last word:

Every stock has its own worth, which defines that how it will perform in future, and you as a smart investor can follow Singapore stock picks and make investment decisions for designing your most profitable portfolio of stocks registered with Singapore stock market.

The first method, which you can follow, is:

Price to earnings ratio:

With the help of long-term average valuation metric you can compare the price to earnings ratio (PE ratio) of the Singapore stocks you are about to buy. Whenever with the help of Share trading signals, you can compare the PE ratio and check if it is worth buying the stock.

The straight times index can define the market scenario and keep an eye on recent PE ratios. The proxy representation can be fetch from PE ratio of the SPDR STIETF which is exchange traded fund tracking continues fundamentals of the straight times index.

Some facts related to PE ratios:

1. Current PE ratio of SPDR STIETF is 13.1

2. Long term average PE ratio was 17

3. Highest PE ratio in 1973 hit to 35

With these mentioned facts, investment stock picks suggests, that at this moment, the Singapore stocks are reasonably economical so investors who follow share tips for Singapore stock markets, suggest it is a good time to invest in stocks.

The Secondmethod, which you can follow to determine the true value of stocks, is:

Finding net-to-net stocks:

Basically the stocks with the current market capitalization lower to the net current asset value of the stocks falls in this category.

Net current asset value = (Total current assets – total liabilities)

At some certain point of time investors can find the best bargain Singapore stocks where, they can get the stocks at a very cheap price.

On such stocks, investors get a cheap discount on current assets net to current liabilities of the company; current assets include cash and inventory of the company. In this case, the company’s fixed assets are falling into a category of quarrel.

Some facts about net-net stocks:

2nd half of 2007, net-net stock fell to its lowest that is 50, and this was the time when investors and the market observed, the peak position of the Straits Times Indexof great financial crises.

One of the highest point was observed of the value 200, in the year 2009’s first half. During this time, Straits Times Index managed to reach above the crises.

Currently the net-net stock position is around 95, this holds us with a conclusion that the Singapore stocks are not too expensive, thus, this is a smart decision taking time where with the help of latest stock picks of Singapore stock market you can opt to but the best stocks.

The last word:

Every stock has its own worth, which defines that how it will perform in future, and you as a smart investor can follow Singapore stock picks and make investment decisions for designing your most profitable portfolio of stocks registered with Singapore stock market.

Please Log in to join the conversation.

8 years 5 months ago - 8 years 5 months ago #24014

by Val

Replied by Val on topic Best World

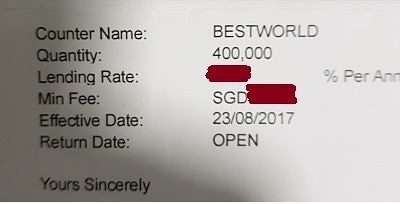

We’ve all heard of short-sellers jumping on a stock when negative news emerges. They did that to Best World after the SAIC statement on pyramid selling.

Friend at broking house told me short-selling has been going on. Targeting BW. Another friend's BW stock was borrowed from her CDP acct.

Another case -- more than 500,000 shares from his broker account has been loaned out.

Short-sellers will have to buy back from open market when they need to cover up.

Let's see:

Check out the price in 10 days or 10 weeks time. Should be much higher than $1.19 today:

Friend at broking house told me short-selling has been going on. Targeting BW. Another friend's BW stock was borrowed from her CDP acct.

Another case -- more than 500,000 shares from his broker account has been loaned out.

Short-sellers will have to buy back from open market when they need to cover up.

Let's see:

Check out the price in 10 days or 10 weeks time. Should be much higher than $1.19 today:

Last edit: 8 years 5 months ago by Val.

Please Log in to join the conversation.

- lotustpsll

- Offline

- Elite Member

-

Less

More

- Posts: 302

- Thank you received: 39

8 years 5 months ago #24016

by lotustpsll

Replied by lotustpsll on topic Best World

BW must implement a progressive share buyback program if the group is confident of its future. The recent buybacks were too timid and this will only embolden the shorties.

Strategic share buyback is a good defense measure and also serve to create shareholder value.

Strategic share buyback is a good defense measure and also serve to create shareholder value.

Please Log in to join the conversation.

Time to create page: 0.275 seconds