- Posts: 114

- Thank you received: 4

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Buy ComfortDelgro for return to normalcy?

5 years 10 months ago - 5 years 10 months ago #25304

by Kapitan

Buy ComfortDelgro for return to normalcy? was created by Kapitan

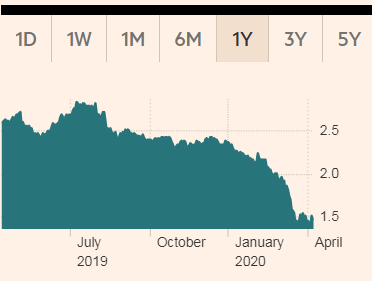

1. ComfortDelgro has lost 36% in value YTD, from $2.36 share price to $1.50.

In market cap terms, CDG went from $5.1 billion to $3.3 billion.

So, it has lost nearly $2 billion in market value, reflecting the fact that people have cut back on rides in taxis, buses and trains.

2. CDG has operations not just in SG but also UK and Australia. All have stay-at-home situations. These are not forever. The streets that are now empty will not stay empty.

It's too much to expect complete normalcy anytime soon but people will travel more freely.

3. As taxi & public transport picks up pace again, CDG's revenue will recover, its taxi rental rebates will end. And these developments will be reflected in the stock. Investor psychology can turn fast. Just my 2 cents.

In market cap terms, CDG went from $5.1 billion to $3.3 billion.

So, it has lost nearly $2 billion in market value, reflecting the fact that people have cut back on rides in taxis, buses and trains.

2. CDG has operations not just in SG but also UK and Australia. All have stay-at-home situations. These are not forever. The streets that are now empty will not stay empty.

It's too much to expect complete normalcy anytime soon but people will travel more freely.

3. As taxi & public transport picks up pace again, CDG's revenue will recover, its taxi rental rebates will end. And these developments will be reflected in the stock. Investor psychology can turn fast. Just my 2 cents.

Last edit: 5 years 10 months ago by Kapitan.

Please Log in to join the conversation.

5 years 9 months ago #25320

by Kapitan

Replied by Kapitan on topic Buy ComfortDelgro for return to normalcy?

Comfort DelGro is proceeding with 5.29 cent final dividend.

Please Log in to join the conversation.

5 years 9 months ago #25343

by josephyeo

Replied by josephyeo on topic Buy ComfortDelgro for return to normalcy?

To date 2 recommendations :

1. Maybank Kim Eng on 18 May. Buy recommendation. Target $1.99

2. Uob KayHian today. Buy recommendation. Target $1.82

For info only. Vested

1. Maybank Kim Eng on 18 May. Buy recommendation. Target $1.99

2. Uob KayHian today. Buy recommendation. Target $1.82

For info only. Vested

Please Log in to join the conversation.

5 years 8 months ago #25353

by Garak

Replied by Garak on topic Buy ComfortDelgro for return to normalcy?

good news: New substantial shareholder Pyrford International emerges at ComfortDelGro

www.theedgesingapore.com/news/company-ne...merges-comfortdelgro

Pyrford specializes in global asset management. Since being established in 1987, our goal has been to provide consistent long-term returns and highly personal service to clients around the globe, including institutional and high-net-worth investors.

www.theedgesingapore.com/news/company-ne...merges-comfortdelgro

Pyrford specializes in global asset management. Since being established in 1987, our goal has been to provide consistent long-term returns and highly personal service to clients around the globe, including institutional and high-net-worth investors.

Please Log in to join the conversation.

Time to create page: 0.247 seconds