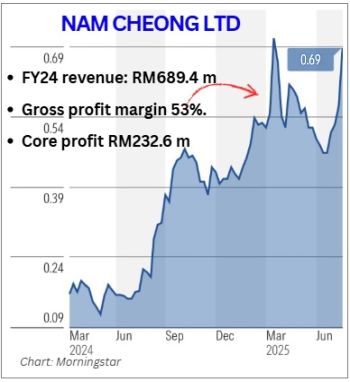

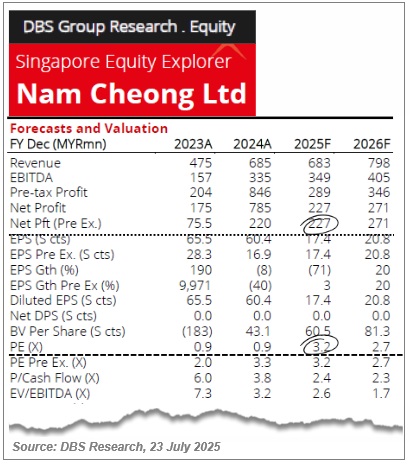

• DBS has emerged as the only house covering the stock, possibly a prelude to other houses taking a look at the Singapore-listco with the youngest and biggest OSV fleet (38 vessels) in Malaysian waters. • DBS analyst Ho Pei Hwa wrote: "We believe Nam Cheong’s fair value should be SGD1.05, based on 6x FY25 PE. This does not reflect the potential valuation of its Miri Shipyard, which could add SGD0.14-1.00/share when OSV newbuilds make a comeback" • She was referring to the Nam Cheong's own shipyard in Miri, Sarawak that is currently only doing ship repairs and producing a few vessels for Nam Cheong's use. It would become busier when OSV operators place newbuild orders as the industry's fleet ages. Read more below.... |

Nam Cheong has made 3 announcements on long-term contracts:

|

Contract Value & Date |

Vessels |

Client/ |

How long |

|

RM1.22 billion |

12 vessels: |

Regional & int'l oil majors |

3 years, starting 2025 |

|

RM317.1 million |

9 vessels: |

Leading regional oil majors |

Up to 2 years, with extension options |

|

USD47.5 million |

3 vessels: |

Environment projects (Middle East) |

Up to 2 years, with extension options |

Excerpts from DBS report

Analyst: Ho Pei Hwa

| The Business |

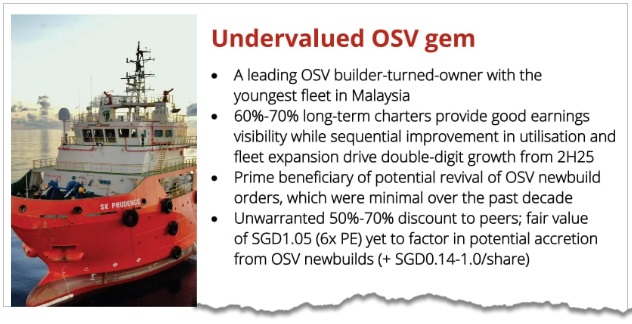

A leading OSV player with the youngest fleet in Malaysia. Nam Cheong operates a fleet of 38 mid-sized offshore support vessels (OSVs) with an average age of just over eight years.

This represents a strong competitive advantage, as peer fleets average 13-15 years of age.

The company benefits from strong earnings visibility due to captive demand from Petronas and a strategic shift towards 60%- 70% long-term charters.

Nam Cheong is also diversifying its geographic presence and product offerings to tap into the buoyant Middle Eastern and Japanese markets, as well as growing demand for green offshore solutions.

| Double-digit growth from 2H25 |

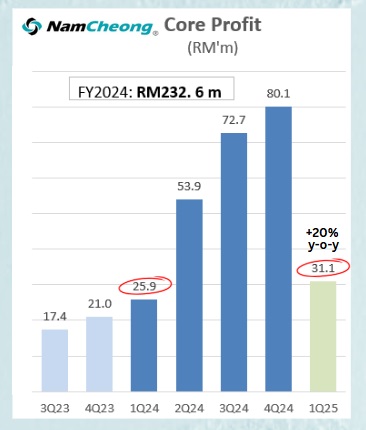

Double-digit growth from 2H25; potential revival of OSV newbuild orders adds tailwind. 1H25 utlisation is expected to be weaker y/y due to vessel downtime for preparations related to long-term charters. Core profit from vessel chartering, excluding "other income and other expenses" and contributions from JVs/associates.

Core profit from vessel chartering, excluding "other income and other expenses" and contributions from JVs/associates.

Ref: NAM CHEONG'S Offshore Vessels Score 20% Profit Boost in Q1, Set to Be Busier in Q2, Q3 ... Utilisation should normalise going into 2H25 and 2026, reaching ~80%, vs. ~60% in 1H25.

This will drive sequential revenue growth of 25%-30% h/h in 2H25 and ~10% y/y in 2026, supported by relatively stable charter rates amid tight supply.

The OSV industry faces increasing pressure to rejuvenate its ageing fleet, ideally keeping vessels under 20 years old.

This revived demand for newbuilds will benefit Nam Cheong’s Miri shipyard, potentially generating RM30-200mn in profit.

|

Full report here.

See also: Petronas’ 5,000-Job Cuts Signal Restructuring, Not OSV Market Slowdown