| It's been just 8 months or so since Nam Cheong Limited got past a stormy weather of financial restructuring over a debt that once threatened to sink it. The Singapore-listed offshore support vessel (OSV) operator has emerged leaner and stronger, with half of its debt forgiven by creditors. Better yet, operating largely in Malaysian waters, it has been able to catch the 2024 wave of higher charter rates in a booming offshore oil and gas market that still has a long run ahead. OSVs are used for a variety of services for offshore oil, gas, and wind operations. They carry workers and supplies like fuel and heavy machinery to and from offshore operations, and accommodate crew for extended periods of time. Nam Cheong is thriving, as its 3Q2024 results affirmed:

|

The OSV market is on fire right now with charter rates at multi-year highs, which works in Nam Cheong’s favor:

| • There’s little supply of new vessels on the horizon. Building them takes 2-3 years and financing is hard to get in the first place. Newbuilding is a long-term investment decision as the assets have a 20+ year lifespan, and now there are ESG considerations in play. • This tight supply is being made worse by underinvestment in newbuilds in past years and by an aging fleet. |

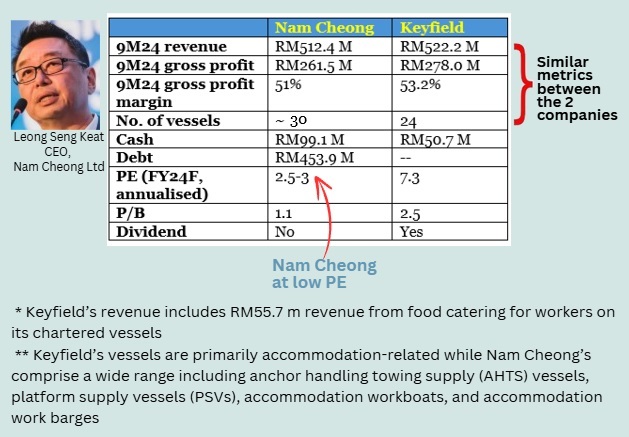

Many Bursa Malaysia companies with OSV businesses also operate other sectors in the oil & gas industry -- but Keyfield International is a good comparable to Nam Cheong. Both are primarily OSV owners.

As the table below shows, their operating metrics are very similar, notably the 50+% gross margins:

Key Financial Highlights for 3Q2024

| What Stayed Within Expectations |

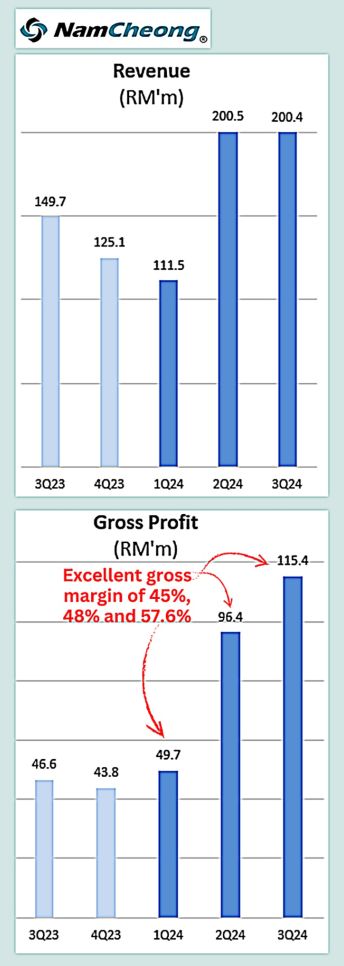

Gross profit growth in 2024 has outpaced revenue growth, leading to excellent gross margins. 1. Strong Revenue Growth

Gross profit growth in 2024 has outpaced revenue growth, leading to excellent gross margins. 1. Strong Revenue Growth

Nam Cheong's revenue growth for both the quarter and year-to-date aligns with expectations set during the first half of the year.

The company has benefited from higher daily charter rates and increased demand for larger vessels, as predicted by industry analysts and Nam Cheong's own outlook earlier this year.

This trend is consistent with global market conditions, where OSV operators everywhere have been able to command elevated rates due to tight supply and rising offshore activities.

2. Improved Vessel Utilization

The company has maintained high vessel utilization rates, particularly for its larger vessels.

This is a continuation of the favorable market conditions that Nam Cheong highlighted during its 1H2024 earnings release.

3. Debt and Financial Restructuring

As at end-3Q24, Nam Cheong held significant debt burden of RM454 million, a substantial reduction from RM1.0 billion at end-2023, thanks to the restructuring agreement.

In 3Q2024, Nam Cheong pared down the debt by RM41.6 million, and used RM62 million of cash mainly to buy a vessel. It ended up with RM99.1 million cash as at end of the quarter.

The debt limits the company's ability to declare dividends and do share buybacks —unlike some of its peers like Keyfield.

The OSV market remains buoyant with expectations of further increases in daily charter rates due to tight vessel supply and rising demand for offshore energy services. Nam Cheong says in its 3Q24 release: "Regional energy companies have ramped up offshore capital expenditure for new hydrocarbon projects and infrastructure maintenance in Asia-Pacific, boosting demand for offshore support vessels. "This momentum is expected to continue, with several planned final investment decisions, potentially amounting to US$ 100 billion for offshore gas production in Southeast Asia, projected to materialise by 2028." Higher operating costs could continue but softening interest rates may decrease finance costs. While investors will track the progress of its debt repayment, Nam Cheong looks attractively valued compared to peers like Keyfield International, trading at a lower price-to-earnings ratio after accounting for one-off gains.  The current stock price of 37.5 cents is below the 40-cent price at which shares were issued in March 2024 to creditors as part repayment of debt. Unlike post 2Q2024 results, the stock has corrected (from 48 cents in mid-Oct to 35 cents recently) after the 3Q24 results release. It would not surprise if Nam Cheong sees a re-rating if it continues to deliver on its earnings, steps up its investor engagements and achieves analyst coverage. Or even do a secondary listing on Bursa where peers trade above 10x PE. See: NAM CHEONG: Jumps 100+% in 2 months as 1H results point to low valuation |