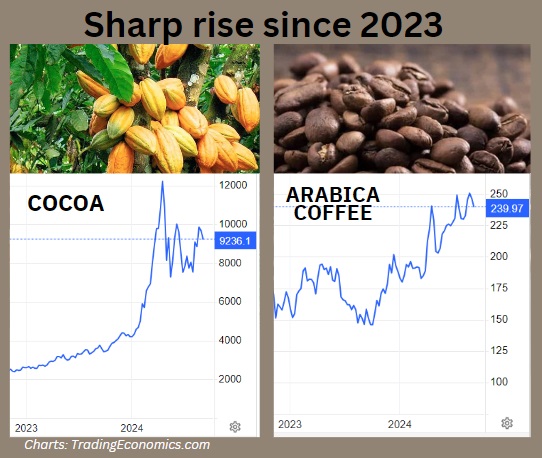

• That bar of Cadbury and Toblerone at the supermart has cost more. Producer Mondelez said it raised chocolate prices up to 15% last year and was considering additional price hikes in 2024. • Similarly, for Nescafe, as coffee bean prices have risen. These are not isolated examples. Throughout the food industry, higher coffee and cocoa ingredients (chart below) have translated into higher prices of end-products.  • There's usually a time lag between higher end-product prices and raw ingredient price hikes. That's why gross margins of Singapore-listed Delfi and Food Empire get compressed initially but can be expected to normalise later. At this juncture, analysts are adjusting stock recommendations based on the margin impact, as typified by UOB KH's reports recently on Delfi and Food Empire. See excerpts below.... • In the case of Food Empire, analysts and investors are yet to comprehend how an unusual but significant entry of a strategic investor recently could lead to large benefits for the company.  For more on Ikhlas Capital, see The Edge article.To recap, private equity fund Ikhlas Capital will inject US$40 million into a special purpose vehicle wholly-owned by Food Empire in exchange for 5-year redeemable exchangeable notes at 5.5% annual interest. For more on Ikhlas Capital, see The Edge article.To recap, private equity fund Ikhlas Capital will inject US$40 million into a special purpose vehicle wholly-owned by Food Empire in exchange for 5-year redeemable exchangeable notes at 5.5% annual interest.Food Empire said on 20 Aug 2024 it will work with Ikhlas Capital "to develop the Group’s long-term ASEAN strategy with the aim of value creation for all stakeholders. "The Group will tap into Ikhlas Capital’s vast network to open doors to valuable partnerships and business opportunities in the region". Iklhas Capital, by the way, has exposure to the unusually structured takeover offer currently on the table for Singapore-listed Silverlake Axis. |

Excerpts from UOB Kay Hian reports

Analysts: John Cheong and Heidi Mo

| FOOD EMPIRE |

• Continued margin pressure from higher coffee prices. The global coffee market is expected to face further price increases next year.

The ongoing Russia-Ukraine conflict may also add to logistics and distribution costs.

FEH will need time to stabilise prices to maintain revenue and margins, which are partly determined by varying stock levels amongst retailers, before it can raise prices in the Russia market.

We therefore expect gross margins to remain muted at 29-30% for 2024-26. • Leveraging on strategic partnership with Ikhlas Capital. FEH plans to increase leverage by issuing US$40m of five-year redeemable exchangeable notes at 5.5% annual interest with private equity fund manager Ikhlas Capital in the form of a special purpose vehicle.

• Leveraging on strategic partnership with Ikhlas Capital. FEH plans to increase leverage by issuing US$40m of five-year redeemable exchangeable notes at 5.5% annual interest with private equity fund manager Ikhlas Capital in the form of a special purpose vehicle.

Beyond capital injection for future expansion plans, management expects Ikhlas Capital’s local expertise and network in Southeast Asia to help the group accelerate growth and scale both regionally and internationally.  Ikhlas Capital chairman Nazir Razak (second from left) with Food Empire chairman Tan Wang Cheow (in jacket). Photo: LinkedIn

Ikhlas Capital chairman Nazir Razak (second from left) with Food Empire chairman Tan Wang Cheow (in jacket). Photo: LinkedIn

• Expanding manufacturing footprint; well-positioned to capture rising demand for instant coffee. FEH has announced plans to build a second snack production factory in Malaysia by 1H25, and its first coffee mix production facility in Kazakhstan by end-25.

According to Allied Market Research, the global instant coffee market is expected to grow at a CAGR of 6.4% to reach US$60.7b from 2023 to 2032, attributable to busier consumer lifestyles and changing consumer preferences.

By region, we note that Southeast Asia has the largest growth potential with a projected 3.7% CAGR to reach US$6b by 2029, while South Asia is the fastest growing at 6.7% CAGR to reach US$0.9b in the same year.

Given FEH’s growing market presence in these markets, we think that FEH is well-positioned to meet the rising global demand for instant coffee.

Full report here.

| DELFI |

• Cocoa prices still above pre-pandemic levels... Cocoa futures continue to trade near US$9,800/tonne, around three times the price a year ago.

This is driven by persistent worries over tight supply and dry weather in the key producing regions of West Africa.

During the briefing, management shared that the current prices are unsustainable, and expects farmers to be encouraged to improve cocoa production.

Management is of the view that prices near US$4,000/tonne are likely fairer for stakeholders. To safeguard its margins, Delfi has implemented pricing adjustments in May 24, reduced trade promotions and practiced tight operating cost management.

To safeguard its margins, Delfi has implemented pricing adjustments in May 24, reduced trade promotions and practiced tight operating cost management.

• …but margin contraction is imminent. Additionally, it has a prudent practice of hedging its raw materials as far forward as possible. However, we note that any future price increase would depend on competition and overall market condition.

With cocoa prices having maintained elevated levels ytd, we opine that margins will continue to face pressure.

• Continuing to make strategic investments and launch new products. Delfi continues to invest in initiatives aimed at building its brands and strengthening routes-to-market, recognising these efforts as strategically crucial for long-term growth.

It has also committed to US$25m-30m in capex spend for capacity expansion in 2024.

Additionally, management may consider pursuing inorganic growth via acquisitions.

Full report here.