• CSE Global employs approximately 2,000 employees worldwide, about 80% of whom are engineers and technicians who are involved in building customized, integrated systems for customers. • This engineering and technical pool is crucial to its core "electrification" business segment which supports the growth of data centers and EVs, and renewable energy projects. • Thus, CSE is a "proxy" play -- not direct play -- on AI, data centers, and renewable energy. All are big thematics, of course. Support for Data Centers: CSE has expanded its capacity significantly to support data center projects notably in the US.

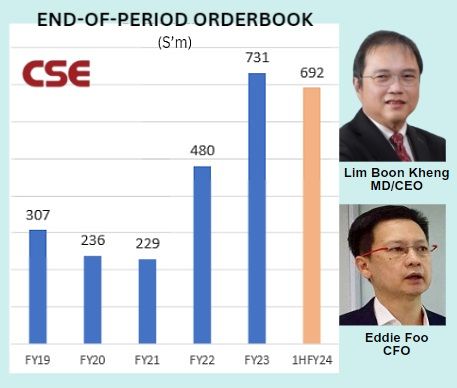

Electrification of Transportation: CSE is involved in projects that support the electrification of transportation, such as electric vehicles (EVs) and trains. • CSE is engaged in projects that enhance electrical infrastructure, which includes working on substations, switchgear, switchboards, and transformers. These projects are crucial for upgrading power systems to meet increasing demand. • CSE has a strong orderbook. See the chart below.  Electrification segment accounted for S$395 m of the 1HFY24 outstanding orderbook. The other segments: Automation (S$191 m), Communication (S$106 m). Electrification segment accounted for S$395 m of the 1HFY24 outstanding orderbook. The other segments: Automation (S$191 m), Communication (S$106 m).• The "electrification" segment has been a significant driver of CSE's growth in recent years. By region, the US contributed about two thirds of 1H2024 group revenue. • CSE counts Temasek Holdings as its No.1 shareholder (~23% stake) and the Singapore Government as one of its clients. Read excerpts of Maybank's 1H2024 results update below .... |

Excerpts from Maybank KE report

Analyst: Jarick Seet

Solid 1H24 justified our conviction

Net margin also improved from 3.2% to 3.5% due to better utilisation of manpower and capacity. An interim dividend of SGD1.25 was declared. CSE, with a yield of 6.1% is on track to deliver better quarters ahead as we expect operating margins to continue to improve as it executes its SGD692.3m order-book, accretive acquisitions and remains one of our conviction picks. We also expect SGD70-100m of large contract orders by end Aug 2024. Maintain BUY. |

| Solid 1H24 points to a much stronger 2H24E |

1H24 saw significant improvement in both its revenue, net profit margins as well as positive cash flow generation of SGD15.8m.

|

CSE |

|

|

Share price: |

Target: |

With a SGD692.3m orderbook remaining at the end of 2Q24, up 32.7% YoY, we expect a better 2H24E due to historic seasonality.

In addition, recognition of margins are always better after the contract concludes as costs are always recognised upfront.

As a result, we expect net margins to improve from 3.5% in 1H24 to potentially 4.0% in 2H24E.

In addition, its accretive acquisition of RFC Wireless is likely to add another SGD1.3m of NPAT to its bottom-line (prorated from July 2024).

| Larger sized orders likely due to capacity expansion |

With the increase in demand from trends such as digitalisation which has led to more data centre projects as well as electrification, CSE has increased its technical resources and production capacity by 50-80% to support the growth in data centre projects.

We expect larger order size contracts with a few likely imminent worth about SGD70-100m.

| Potential buybacks and accretive acquisitions |

CSE offers a unique opportunity to ride the upcycle in attractive growth areas.  Jarick Seet, analystIt also offers a sustainable 6.5% dividend yield.

Jarick Seet, analystIt also offers a sustainable 6.5% dividend yield.

We believe CSE has a clear multi-year growth outlook and we expect further accretive acquisitions, especially in the critical communications segment in the US and Australia.

There is also a strong possibility of management share buy-backs and company share buy-backs.

See CSE's 1H2024 Powerpoint deck here.