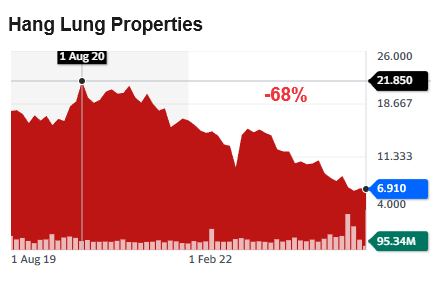

• There's a Hong Kong stock that dishes out dividends as steady as it goes. • Take a look at its dividends in the chart below. Keep in mind that 2020-2022 were pandemic years.  • The dividend yield is a juicy 11+% on the recent stock price of HK$6.91 of Hang Lung Properties (market cap: HK$33 billion, or S$5.7 billion). • Hang Lung Properties has a portfolio which comprises properties in Hong Kong and in nine Mainland cities -- Shanghai, Shenyang, Jinan, Wuxi, Tianjin, Dalian, Kunming, Wuhan, and Hangzhou.  Chart: Yahoo!Over the past few years, the stock has done badly, crashing 68% since its most recent peak in Aug 2020 during the pandemic -- and there's even a "significant increase in short positions" according to a May 2024 article by Smartkarma. Chart: Yahoo!Over the past few years, the stock has done badly, crashing 68% since its most recent peak in Aug 2020 during the pandemic -- and there's even a "significant increase in short positions" according to a May 2024 article by Smartkarma. • That can be attributed to a real estate downturn in HK and China amid the pandemic. • The question for income investors eyeing the 11+% yield is, can Hang Lung Properties continue with its dividend of 78HK cents/share this year and in the next few years? Interestingly, the controlling shareholder, the Chan family, has been increasing its stake by opting for scrip dividends. In a 12 July report, CGS delves into this topic. See excerpts below... |

Excerpts from CGS report

Analysts: Raymond CHENG, CFA, Will CHU, CFA & Steven MAK

Hang Lung Properties Ltd

DPS likely to be maintained in FY24-25F

|

■ Our analysis shows that HLP is able to maintain its DPS in FY24-25F, in the event that HLG still opts for scrip dividend for some of its entitled dividends. ■ We expect HLP to expedite property sales in HK and China to reduce debt. ■ Reiterate Add, with a lower TP of HK$10.6, now based on a 60% discount to NAV (previously 55%). |

Our calculations show that HLP is able to keep its DPS at HK$0.78

We think that Hang Lung Properties (HLP) is able to maintain its DPS at HK$0.78 in FY24-26F.

|

Hang Lung Properties |

|

|

Share price: |

Target: |

HLP’s parent Hang Lung Group (HLG, 10 HK, NR, CP: HK$8.6) opted to receive scrip dividend of HK$0.6 per share in FY23 for almost all of the HLP shares it holds, resulting in a HK$1.6bn cash savings for HLP.

If HLG continues to opt for scrip dividend in FY24-25F for half of the HLP shares it owns, we estimate HLP could save HK$1.2bn cash p.a. in FY24-25F (see Fig 1 for detailed calculations), which could be used to pay down debt.

Coupled with its effort to speed up property sales, we expect HLP’s net gearing to fall from 32% at end-2023 to 28% at end-2025F and 26% at end-2026F.

We expect faster property sales to help reduce debt

We expect HLP to attempt to sell off the remaining 172 units of The Aperture in HK in FY24F.

| Parent opted for scrip dividend |

| Hang Lung Properties’ parent Hang Lung Group opted to receive scrip dividend of HK$0.6 per share in FY23 for almost all of the HLP shares it holds, resulting in a HK$1.6bn cash savings for HLP. |

We also believe that HLP will pursue sales of its apartments (Hang Lung Residences) in Wuxi and Wuhan in China, riding on the Chinese Government’s recent policies (517 policies) aimed at stimulating property sales and reducing residential inventories.

Cash receipts from property sales should contribute to faster debt reduction for HLP, in our view.

Slightly lower rental growth expectation in FY24F

On the back of a continued market-wide decline in spot rents for HK offices and a sluggish growth outlook for HK non-mass market retail, we project a low single-digit yoy decline in rental income from HLP’s HK investment properties (IP) in FY24F.

Meanwhile, we expect its rental income from China IP to be largely flattish yoy in FY24F as high-end retail performance in Tier-1 cities, with more solid economic growth, should be more resilient than that in lower-tier cities.

| Reiterate Add; trading at 11.7% FY24F dividend yield currently We cut our FY24-26F EPS by 9-15% and cut NAV/share by 5% to HK$26.5 to reflect:

Our TP falls to HK$10.60 as we widen our discount to NAV by 5% pts to 60% to account for delayed profit recovery in a higher-for-longer interest rate environment. We, however, reiterate our Add rating for HLP for its ability to maintain stable DPS, which translates into an 11.7% FY24F dividend yield. Key downside risks include unexpected DPS cuts and a jump in interest expense. Stronger-than-expected rental reversions are a key re-rating catalyst. |

Full report here.