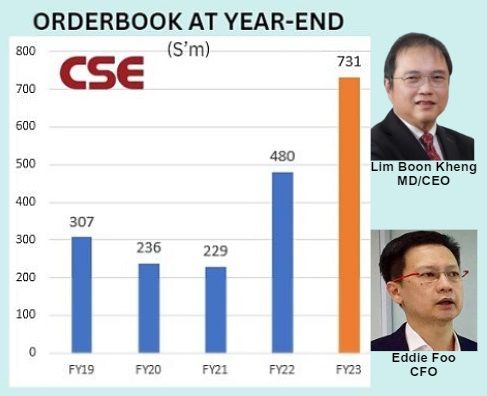

• Artificial Intelligence is probably the hottest investment theme around. Related to AI are data centres. Then there is electrification. These 3 are hot. • Singapore-listed CSE Global (market cap: S$261 million) is a "rare proxy" play -- not direct play -- on these sectors, says Maybank KE in a report today. • Take a look at the record orderbook of this systems integrator providing electrification, communications and automation solutions across various industries globally.  Electrification segment accounted for S$434 million of the FY23 orderbook. The other segments: Automation (S$192 million), Communication (S$105 million). Electrification segment accounted for S$434 million of the FY23 orderbook. The other segments: Automation (S$192 million), Communication (S$105 million).• "Electrification" -- CSE provides solutions related to power distribution and electrical control systems. This segment has been a significant driver of the company's revenue growth, particularly due to rising demand in the data centre, power, utility, and energy storage markets. • CSE, which counts Temasek Holdings as its No.1 shareholder and the Singapore Governmnent as one of its clients, has released its 1Q2024 order update, and Maybank gives its take below. |

Excerpts from Maybank KE report

Analyst: Jarick Seet

Solid 1Q growth + order wins

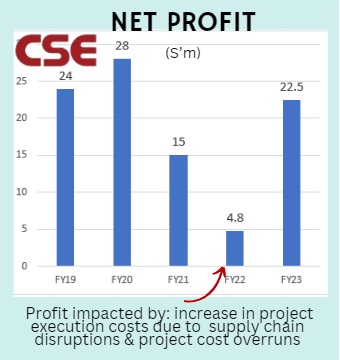

1Q24, seasonally its weakest quarter, saw revenue rise 24% YoY to SGD197.5m, above our blended YoY projection of 17%. With better operating leverage due to strong revenue growth, as witnessed in FY23, we believe margins should continue to improve from 3.1% In FY23 to 3.5-4.0% in FY24E. This would justify our 26% core FY24E EPS growth. CSE remains one of our conviction picks and is a rare proxy for electrification/AI/data centres. Maintain BUY. |

| Electrification will be major growth driver |

For 1Q24, the electrification segment secured about SGD82.9m of new orders, or about 44.5% of total order intake.

|

CSE |

|

|

Share price: |

Target: |

Management expects demand for electrification solutions to remain robust given the strong pipeline of projects.

We expect electrification to be one of the main growth drivers for CSE in the next 2-3 years.

| A key beneficiary of AI boom and data centres |

CSE’s recent SGD49.2m plant extension is for the design, engineering, fabrication, installation and integration of power management systems and solutions for data centres in the US.

CSE’s recent SGD49.2m plant extension is for the design, engineering, fabrication, installation and integration of power management systems and solutions for data centres in the US.

We think its client is one of a handful of main cloud providers in the US and believe it will likely win more data centre contracts from existing and new customers.

AI technology and data centres require huge amounts of energy to develop and run and will benefit power management system integrators like CSE.

| Conviction pick – attractive 6.5% FY24E yield |

CSE offers a unique opportunity to ride the upcycle in attractive growth areas.  Jarick Seet, analystIt also offers a sustainable 6.5% dividend yield.

Jarick Seet, analystIt also offers a sustainable 6.5% dividend yield.

We believe CSE has a clear multi-year growth outlook and we expect further accretive acquisitions, which could accelerate its growth.

There is also a strong possibility of management share buy-backs and company share buy-backs.

At 7.6 FY25E P/E on a 6.5% dividend yield, we think it is under-valued and even the CEO bought back shares in 2023 at higher prices than current levels.

Full report here.