Singapore technology stocks had a good day last Friday: • UMS: $1.46 (+5.80%) • Frencken: $1.42 (+3.65%) • Aztech Global: 84 cents (+3.07%) • AEM: $2.76 (+1.85%) • Micro-Mechanics: $1.66 (1.84%) • Venture Corp: $13.99 (+0.79%) This came after Nasdaq-listed Applied Materials (AMAT) gave an upbeat guidance that pointed to an earlier-than-expected semiconductor industry recovery. The industry has been on a year-long decline due to factors including weak user demand and bloated inventory of semiconductors used in a wide range of products, including computers, smartphones, and cars.  |

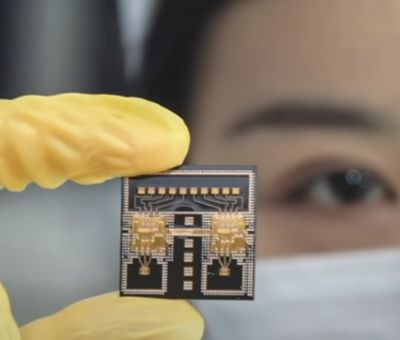

AMAT -- which supplies equipment, services and software for chip manufacturing -- gave its business outlook after it reported 1QFY24 results that beat Wall Street expectations.

A DBS analyst report on Friday said: "AMAT is a good proxy of future semiconductor demand as it supplies equipment to major semiconductor manufacturers the likes of TSMC, Samsung Electronics, and Intel."

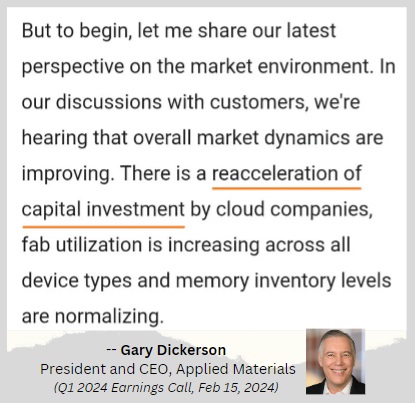

It added: "Data points affirming industry recovery: (i) reacceleration of capex by cloud companies (ii) increasing fab utilization, and (iii) normalizing memory inventory levels."

UMS stands to benefit as AMAT is its key customer while Venture too will benefit as a downstream recovery play.

DBS said industry recovery bodes well for other equipment and component providers such as Frencken, Grand Venture, and AEM.

However, AEM could be a laggard as market sentiment could still be affected by the recent negative news about its inventory shortfall, according to DBS.