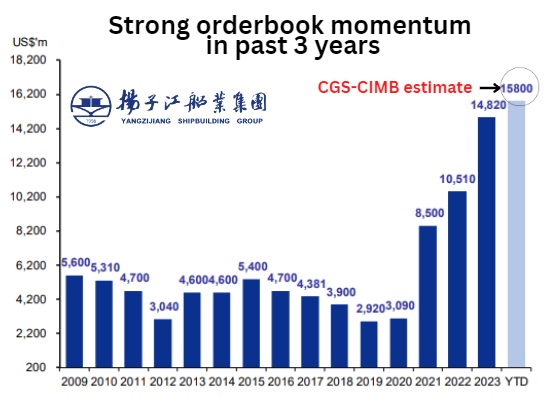

| • There continues to be positive newsflow for Yangzijiang Shipbuilding. • Firstly, it has finally sold a rig that a customer had terminated a contract on way back in 2016. CGS-CIMB has learnt that the rig was sold for US$80 million in Nov 2023. • Secondly, Yangzijiang said on 17 Jan that it has been awarded a contract to build six containerships for a Japanese customer. CGS-CIMB estimates the total contract value to be about U$1 billion, bringing Yangzijiang’s order book to a whopping US$15.8 billion.  Source: CGS-CIMB Source: CGS-CIMB• Read more in excerpts from CGS-CIMB's latest report below ... |

Analyst: Lim Siew Khee

| Yangzijiang Shipbuilding -- Record-high FY23F net profit likely ■ We lift our FY23-25F EPS by 7-9% to incorporate one-off gains from jack-up rig sale and higher shipbuilding margins. Higher DPS is a rerating catalyst.

■ We raise our 2024F order win forecast to US$4.5bn (from US$4bn) in view of the latest six 13k dual fuel containership orders worth c.US$1bn. ■ Reiterate Add and TP of S$1.96, based on a 2x CY24F P/BV. |

||||

| Stranded jack-up rig finally sold, estimated gain of Rmb250m |

The heightened jack-up rig market finally led to the sale of YZJ’s stranded rig in Nov 23.

We estimate the after-tax gain from the sale to be c.Rmb250m (c.US$35m), which will be reflected in the FY23F financials (please see page 2 for details).

| Thesis of low steel price and inverse direction of ASP still intact |

Steel prices remained steady in the last 3 months of 2023 at Rmb3,950/metric tonne.

YTD’s prices are around Rmb4,067/metric. Conversely, newbuild prices have remained firm.

If we benchmark the latest contract win by YZJSB for six units of 13k dual-fuel containerships to industry trends (by Shipping Intelligence), it should fetch US$173m/vessel or US$1bn of total contract vs. newbuild prices 6 months earlier in Jul 23 at US$171m/ vessel (Fig 6).

Structural demand for green energy vessels and shipowners’ profitability could keep ship prices firm, in our view. We turn slightly more positive on the quantum of margin expansion as YZJSB progressively executes orders from 2H21.

We expect higher shipbuilding gross margins (GM) for FY24F of 24.5% and FY25F of 25.5% (previously 24-25%).

| Efficient execution may see margins expand and more orders |

Upside to our margins could also come from operating efficiency, in our view.

On average, from striking steel to completion, YJZSB takes c.10 months to build a <100k dwt bulk carrier and 14-16 months for a +20k TEU containership.

With the order book currently at about U$15.8bn, we expect operating leverage and efficiency from its solid execution track record to potentially reduce the construction months to 13-14 months for large-scale containerships.

This could also mean yard capacity can be maximised to take in more orders. We now expect FY24F order intake to be at US$4.5bn (from US$4bn previously).

Yard capacity is generally full until 2027F but we believe efficient yard planning could still see some delivery slots available for mid-size ships in 2026F.

|

Full report here.