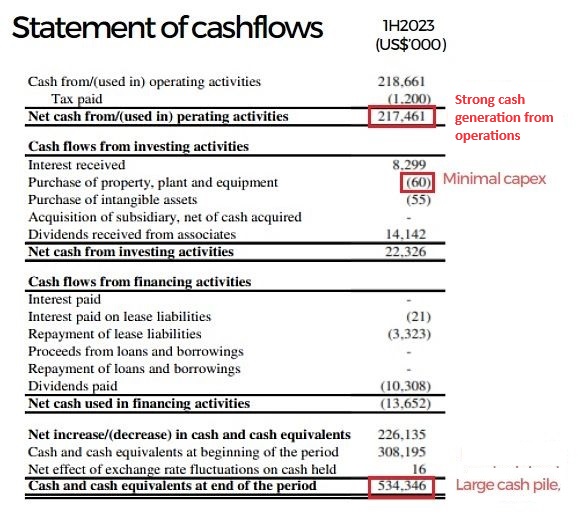

| • China Aviation Oil has a very long history on the Singapore Exchange, having listed way back in 2001 and a few years later filing for bankruptcy on huge losses from speculative options trading. Soon after, it was resuscitated financially and led by a new board. • The Covid pandemic dealt a blow to its business which depends on aviation travel. With domestic and international travel picking up pace, CAO’s supply volume of jet fuel should rise accordingly. • Its business has been low in capex (zero for the past 3 years and forecast at US$2 million this year) and high in cash generation, leading to a cashpile which is about 96% of its current market cap (S$740 m). • However, margins are thin from operating a cost-plus model whereby it earns a fixed margin for every unit of fuel it supplies. Read more what Phillip Securities says below.... |

|

• CAO also markets jet fuel to airports outside China, and engages in international trading of jet fuel and other oil products, as well as carbon credits. |

Screenshot of a section of CAO's cashflow statement for 1H23. The cashpile of US$534.3 m is the equivalent of S$711 million, or 96% of its current market cap.

Screenshot of a section of CAO's cashflow statement for 1H23. The cashpile of US$534.3 m is the equivalent of S$711 million, or 96% of its current market cap.

Excerpts from Phillip Securities' 11-page initiation report

Analyst: Peggy Mak

• International passenger traffic in China is up 18 fold YTD September 2023 and only 33% of pre-pandemic levels. We expect international travel volume recovery to gain pace in FY24e, fuelling demand for jet fuel at international airports.

• China’s jet fuel consumption has risen by CAGR of 8.4% over the last 10 years. More airports have been added over the years to cope with the rise in air travel demand. We think CAO could potentially expand its footprint to international airports in other Chinese cities. |

|||||

Hightlights

• China air travel demand rebounded after borders re-opened in early 2023. Air travel volume surged by 80% YoY in the first eight months of 2023, after the lifting of Covid mobility restrictions, thereby pushing up consumption of jet fuel.

The recovery is led by domestic travel. International flights are still at 20-30% of pre-Covid levels.

As more international flights are restored, we expect jet fuel demand at the major international airports in China to return to pre-Covid levels by FY25e. About 60% of petroleum and refined products are imported.

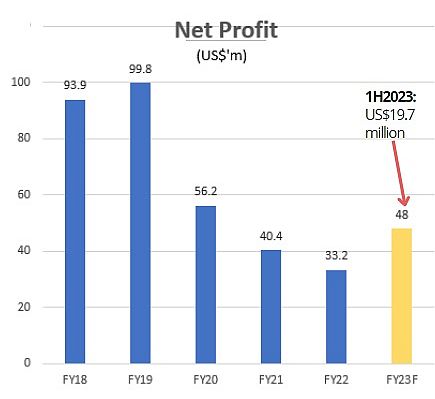

2023 profit forecast by Phillip Securities. Translates to a 1.7 S'pore cent/share first & final dividend pay-out. CAO has a dividend policy to pay out 30% of the Group’s annual consolidated net profits attributable to shareholders.• CAO could potentially supply jet fuel to more international airports in China. China’s jet fuel consumption has risen at a 10-year CAGR of 8.4% from 2011-2021, and 9.7% if year 2020 were excluded, mirroring the growth in air travel demand.

2023 profit forecast by Phillip Securities. Translates to a 1.7 S'pore cent/share first & final dividend pay-out. CAO has a dividend policy to pay out 30% of the Group’s annual consolidated net profits attributable to shareholders.• CAO could potentially supply jet fuel to more international airports in China. China’s jet fuel consumption has risen at a 10-year CAGR of 8.4% from 2011-2021, and 9.7% if year 2020 were excluded, mirroring the growth in air travel demand.

Correspondingly, China has been adding airports at a CAGR of 3.4% over the last 10 years.

CAO mainly supplies to the five key international airports currently, but we think it has potential to expand its footprint to international airports in other Chinese cities.

• The three major Chinese carriers plan to grow their fleet by 6-18.5% in the next three years. Air China, China Eastern Air and China Southern Airlines together account for twothirds of China air transport volume.

We think the fleet expansion plan signals optimism that rising affluence and mobility and increased urbanization will underpin demand for air transport.

Peggy Mak, research manager, Phillip SecuritiesInitiate coverage with a Buy recommendation and TP of S$1.01. Our TP is based on the discounted cash flow model. Peggy Mak, research manager, Phillip SecuritiesInitiate coverage with a Buy recommendation and TP of S$1.01. Our TP is based on the discounted cash flow model.Its operations are asset-light. The balance sheet comprises mainly cash (as at Dec 22: S$0.49/share), investments in associates and working capital. We expect ROIC to rise to 10% in FY23e and 14.4% in FY24e(FY22: 5.6%). |

Full report here.