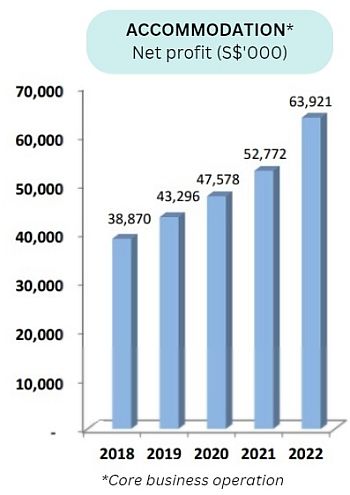

• The Covid-19 pandemic, which exposed the infection risks of living quarters for foreign workers, led to the Singapore government decreeing tighter standards for their accommodation. Centurion's accommodation profit has been turning up even through the pandemic.• The reopening of borders is contributing to surging demand for the workers' living quarters owned by Centurion Corp, the largest Purpose-Built Workers accommodation (PBWA) provider in Singapore and Malaysia. Centurion's accommodation profit has been turning up even through the pandemic.• The reopening of borders is contributing to surging demand for the workers' living quarters owned by Centurion Corp, the largest Purpose-Built Workers accommodation (PBWA) provider in Singapore and Malaysia. • Thus, profits and revenue have been climbing for Centurion. In Singapore, its worker accommodation business accounts for two-thirds of its total revenue. • The S$365-million market cap company has been gaining investor attention, with its stock (43.5 cents) up 27% year-to-date. CGS-CIMB, which says it is cheap and good, has a target price of 58 cents while Lim & Tan Securities, 55 cents. Read on ... |

Excerpts from CGS-CIMB report

Analysts: Ong Khang Chuen, CFA & William Tng

Centurion Corporation (CENT)

For a good night’s sleep

■ CENT is riding on favourable industry dynamics post-border reopening, amid ongoing regulatory reforms to improve migrant worker housing standards.

■ Initiate with Add and a TP of S$0.58. Re-rating catalysts include higher dividend payout and successful capital recycling strategy execution. |

||||

| Leading international worker and student accommodation provider |

Centurion Corporation is a provider of purpose-built worker accommodation (PBWA) and purpose-built student accommodation (PBSA), with 66,572 beds over 36 properties in 6 countries as of 1Q23.

We believe CENT is an unappreciated beneficiary of various macro trends, e.g.:

| 1) strong demand recovery post-border reopening, 2) undersupply of beds across operating geographies, 3) PBWA regulatory reforms spurred by pandemic handling experience, and 4) growing awareness for migrant workers’ welfare. |

| SG PBWA tightness to persist; QBDs lease extension likely |

Singapore’s purpose-built dorms (PBDs) saw a c.30% rent growth YTD, while running at full capacity as foreign workers returned and escalating rents for public flats prompted some employers to move their Malaysian workers to PBDs, according to The Straits Times.

| 30% RENT GROWTH |

| "Singapore’s purpose-built dorms (PBDs) saw a c.30% rent growth YTD, while running at full capacity as foreign workers returned and escalating rents for public flats prompted some employers to move their Malaysian workers to PBDs." -- CGS-CIMB |

We believe the supply tightness in Singapore will persist in the medium term, given the government’s intention to progressively de-densify existing PBWA (transition plan to be announced end-2023F), and with new supply only progressively entering the market in 2025.

As such, we see a good likelihood that CENT’s quick build dorms (QBDs), which were part of the government’s temporary solution to meet housing requirements of foreign workers during the pandemic, to be extended beyond current lease terms (3+1 years) in our forecast period.

The Singapore market contributed 66% of CENT’s FY22 revenue.

| Border reopening boosts PBSA occupancy and rent growth |

| 4.9 X PE |

| "Centurion's valuation is undemanding, in our view, at 4.9x FY24F P/E, or a 57% discount to RNAV." -- CGS-CIMB |

CENT’s PBSA unit is observing strong pre-bookings for the upcoming academic year (AY) 2023/24, with the return of international students, especially from China.

Post-asset enhancement initiatives (AEI), we expect CENT’s PBSA’s financial occupancy to further recover to 94%/85% in the UK/Australia for FY24F (FY23F: 90%/80%) while rents could grow another 10-15% in the upcoming AY (academic year).

Rising interest in the PBSA asset class led to cap rate compression in recent years, providing good opportunity for CENT to unlock value.

| Initiate with Add; dividends likely to return to pre-Covid levels |

Ong Khang Chuen, CFAWe initiate coverage on CENT with an Add and a TP of S$0.58, based on a blended valuation (P/E and RNAV), which we believe better accounts for both CENT’s strong near term earnings potential and potential asset recycling in Malaysia to accelerate AUM growth via its asset-light model.

Ong Khang Chuen, CFAWe initiate coverage on CENT with an Add and a TP of S$0.58, based on a blended valuation (P/E and RNAV), which we believe better accounts for both CENT’s strong near term earnings potential and potential asset recycling in Malaysia to accelerate AUM growth via its asset-light model.

Its valuation is undemanding, in our view, at 4.9x FY24F P/E, or a 57% discount to RNAV.

Re-rating catalysts include progressive resumption of DPR to pre-pandemic levels of 40-50% and successful execution of its capital recycling strategy.

Downside risks include higher-than-expected increase in financing costs, and a slowdown in the construction/O&G sectors impacting worker requirements.

Full report here.