Cedric Yang contributed this article to NextInsight

For anyone who knows accounting and is a seasoned investor, you can see the positives from this FY.

1 [CASH ITEM] Is it because revenue dropped by 42.6%? That will be a big concern, meaning demand for ISDN' s products have dropped significantly. No, instead revenue dropped by 15.8%, roughly equivalent to a general market slowdown experienced in China due to its lock down and supply chain problems. 2 [CASH ITEM] Is it because of an increase in operating expenses? That will be a big concern with a reduction of revenue. No, instead admin and distribution expenses (2 main big business expenses) both dropped year-on-year by 7.6% and 4.4%, respectively. |

So why did the EPS fall? 3 reasons:

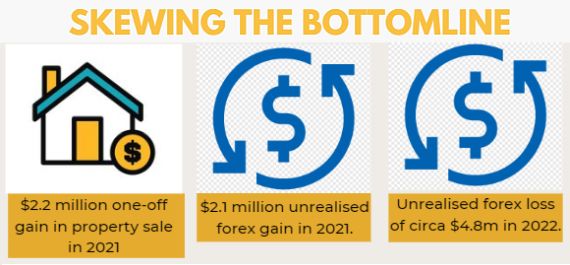

1 [CASH ITEM] In FY 2021, there was an one-off cash gain from the sales of property circa $2.2m, which was recognised under "Other operating Income". This cannot be put into consideration when studying the business of the company because property transactions are not part of ISDN' s business operations.

2 [NON CASH ITEM] In FY 2021, there was an unrealised FX gain of circa $2m. Again this cannot be put into consideration when studying the business of the company because foreign exchanges are not part of ISDN' s business operations.

However, it is an important cashflow parameter of any international company, needing to manage its FX well. I will elaborate on this below.

| Positive 2023 expected |

| "The unrealised FX loss ($4.8m) provides a low base for FY 2023 outperformance. I am confident with China reopening, Southeast Asia (especially Vietnam) being China+1, commercialisation of their nascent hydropower plants, and future hydro construction having unpurchasable know-hows, ISDN's 2023 will be one to look out for." |

3 [NON CASH ITEM] In FY 2022, there was an unrealised FX loss of circa $4.8m. One year fluctuation from FX unrealised gain of $2m to unrealised loss of $4.8m should give investors the insights that

1) FX is volatile

2) FY 2022 was an extraordinary year with high interest rates, thereby unusually strong USD and SGD.

In business, the way to manage FX risks is to not be FORCED to realise losses.

Theoretically, the way businesses manage such risks is to have strong international cash reserves (ISDN combined cash reserves stands at circa $56.5m) and good credit so the company could pay off its liabilities (payables, loans etc) via a stronger currency instead of the weaker ones (such as RMB and RUP in this case).

In its press release, ISDN said it has policies to manage its exposure to FX risk.

Now, should investors worry about the drop in EPS? Let' s dive in.

|

Although investors are generally short-term minded and the market is filled with emotional traders, long-term investors should take refuge in the prudency of the company and its longer term automation segment's tailwinds in rising China & Southeast Asia.

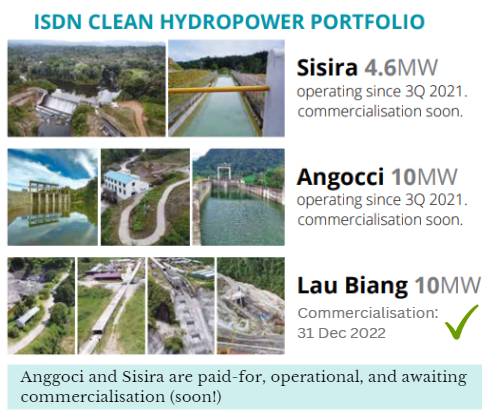

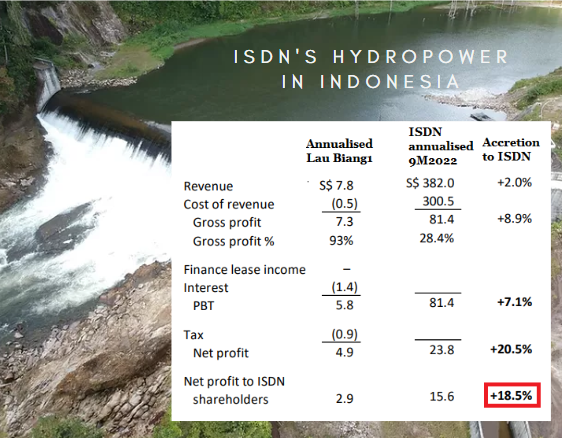

Additionally, the commercialisation of hydropower project in Indonesia, Lau Biang1, is bringing significant earnings to the table, circa $2.9m (see table below).

Add that to the impending commercialisation of Anggoci and Sisira projects which can bring an estimated $3.5m earnings for the remaining FY 2023, I' m confident of the future prospects of ISDN. Adapted from ISDN presentation slide. Lau Biang 1 figures based on ISDN estimates (S$m). The electricity is sold to the Indonesian state electricity company PLN, which can be adequate for roughly 12,000 homes.

Adapted from ISDN presentation slide. Lau Biang 1 figures based on ISDN estimates (S$m). The electricity is sold to the Indonesian state electricity company PLN, which can be adequate for roughly 12,000 homes.

The unrealised FX loss provides a low base for FY 2023 outperformance. I am confident with China reopening, Southeast Asia (especially Vietnam) being China+1, commercialisation of their nascent hydropower plants, and future hydro construction having unpurchasable know-hows, ISDN' s 2023 will be one to look out for.

Only investors that stick through with the company and understand its business and future deserves to win with the company.

Cedric Yang's previous articles include: "My Investment Thesis for ISDN and AEM in Tough Times" -- Part 1