For readers not familiar with ASM Pacific Technology, it is headquartered in Yishun, Singapore and has been listed since 1989 on the Hong Kong Stock Exchange.  CEO Robin NgIts current market cap is about HK$42 billion.

CEO Robin NgIts current market cap is about HK$42 billion.

Its CEO, is a Singaporean, Robin Ng, who is leading the charge at an exciting time when megatrends are shaping up in its industry, such as 5G, High Performance Computing, and electrification of vehicles.

(See also: ASM PACIFIC TECHNOLOGY: "At profound inflection point in auto technologies" and other trends)

ASMPT is a global supplier of hardware and software solutions for the manufacture of semiconductors and electronics.

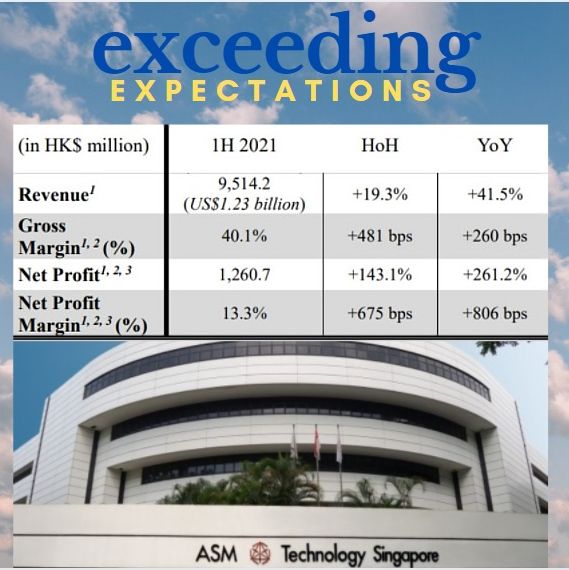

| ASMPT achieved strong overall results for 1H 2021: Half-yearly revenue and bookings broke records, while gross margins spiked up. Charging into 3Q, it is riding on a record order backlog of HK$11.54 billion (US$1.49 billion). Two key factors underpinned these achievements, according to ASMPT. First, a very strong surge in customer demand since the beginning of 2021. ASMPT noted that many customers sought to build more resilient semiconductor supply chains or to meet semiconductor self-sufficiency requirements against a backdrop of reopening major global economies and an enduring need for more silicon content. |

Notes: 1. excluding contribution from Materials Segment, which was deconsolidated and equity accounted since 29 December 2020

Notes: 1. excluding contribution from Materials Segment, which was deconsolidated and equity accounted since 29 December 2020

2. excluding one-off items and related tax impacts recorded in Q4 2020

3. including share of results from Advanced Assembly Materials International, a joint-venture, commencing from the beginning of 2021

| “We leveraged on our global internal and external manufacturing footprint and well-established supply chain partners to deliver strong operational performance. Amidst industry-wide semiconductor shortage and supply chain constraints, we have also built inventories for some key components, instead of relying on a predominantly ‘just-in-time’ inventory management approach. This has effectively strengthened our supply chain resilience and as a result, we have been able to continue fulfilling our commitments to customers.” -- CEO Robin Ng |

Second, the Group’s broad range of Advanced Packaging (AP) solutions experienced a further broadening of its customer base, fuelled by increasing demand from high-end end-user markets and secular growth trends.

Notably, the Group’s AP solutions revenue for the last 36 months (2H 2018 to 1H 2021) has crossed the US$1 billion milestone.

The Group’s AP solutions go beyond advanced placement tools and span across SEMI and SMT segments in support of a whole spectrum of customer needs.

|

Stock price |

HK$101.30 |

|

52-week range |

HK$74.50 – 133.80 |

|

Market cap |

HK$41.5 b |

|

PE (ttm) |

28 |

|

Dividend yield |

3.26% |

|

1-year return |

20 % |

|

Shares outstanding |

410.8 m |

|

Source: Bloomberg |

|

These include 2.5D, 3D-IC, fan-in and fan-out wafer-level packaging and system-in-package (“SiP”) tools, collectively delivering ‘total interconnect solutions’ with industry-leading capabilities to the Group’s customers who serve in highend end-user markets such as for CPU, GPU, XPU and SiP applications.

The strong momentum for the Group’s AP solutions continues, with 1H 2021 Group AP bookings already at more than 80% of the whole of FY2020.

Looking Ahead

Supported by a record backlog and a carefully calibrated capacity expansion plan, the Group expects revenue for Q3 2021 to be in the range of US$730 million to US$780 million and reaffirms that second half 2021 revenue will stay strong.

CEO Robin Ng said: “Externally, structural increases in underlying semiconductor demand from secular growth trends and an overall robust outlook for the industry have combined to give strong momentum for silicon growth.”

He added: “Internally, we continue to reap the benefits of a consistent investment in technology and innovation that has helped build significant in-house capabilities. Coupled with a focused approach for inorganic growth involving both M&A and partnerships, we have become a key partner for customers in supporting their technology roadmaps, opened up served market opportunities, and fuelled revenue growth.”

ASMPT declared an interim dividend of HK$1.30 per share, an 86% increase compared with 1H 2020.

| What some analysts say |

|

Research |

Rating |

Target stock price (HK$) |

|

Macquarie |

Outperform |

$135 |

|

UBS |

Buy |

$147 |

|

Credit Suisse |

Outperform |

$141 |

|

Mizuho |

Neutral |

$110 |

- Macquarie Capital:

Order backlog is increasing, operating margins moving up, secular growth in Advanced Packaging and mini-LED.

We think market is too concerned by the cyclical component of growth and underestimates sustainable growth in Advanced Packaging and mini-LED.

We base our new price target of HK$135.00 (previously HK$162.60) on 3.6x 2022E BVPS (previously 4.6x) for a 20% ROE. Maintain Outperform. - UBS:

Record order backlog provides solid base for outlook. We derive our PT for ASMPT based on 20x 2022E PE (previously 23x), as we now estimate 9.5% 2022-25E EPS CAGR (vs. previous 11.2%). - Credit Suisse:

Stay OUTPERFORM. We see the near-term risk/reward attractive given the market has already priced in the annual peak in bookings from a very high base in 1Q21, with GM/earnings improvement should support the share price.

Key risks: a delayed capex cycle, execution risk, worse COVID 2nd wave, and forex risk. - Mizuho Securities:

We foresee strong sales and solid margins for ASMPT in 2H21, but we are conservative on its 2022 outlook due to high sales base in 2021 and IC backend equipment market cycle. We remain positive on advanced packaging and SMT business for ASMPT in 2022.

We downgrade ASMPT to Neutral from Buy. We cut our price objective toHKD110 (17x 2021-22E P/E) from HKD145 (24x 2021-22E P/E) as we expect its EPS to decline 11% YoY in 2022 after a strong growth in 2021.

For more, see company's 1H2021 presentation material here.