Will Uni-Asia Group report a V-shaped recovery for 1H2021 after a terrible 2020?  Executive Chairman Michio Tanamoto at a virtual 1QFY2021 business update.The Covid-19 pandemic devastated its previously-promising hotel operating business, which has fallen into the Japanese equivalent of Chapter 11, completely wiping out Uni-Asia's stake. Executive Chairman Michio Tanamoto at a virtual 1QFY2021 business update.The Covid-19 pandemic devastated its previously-promising hotel operating business, which has fallen into the Japanese equivalent of Chapter 11, completely wiping out Uni-Asia's stake.But the pandemic also brought on a boom in shipping rates, benefitting Uni-Asia's dry bulk segment. Since 4Q2020, shipping rates have taken off and continue to stay elevated, so Uni-Asia is riding on a recovery, V-shaped or otherwise. In its 1Q2021 business update presentation, Uni-Asia tantalised investors with this headline: "Utilise capabilities across all assets to achieve V-Shape Recovery". It is the second time the headline has been used, the first being its recent FY2020 AGM presentation slides. |

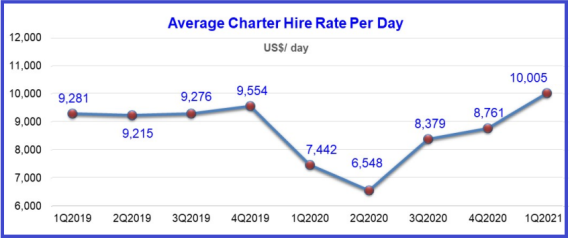

Uni-Asia didn't give revenue and profit figures in its 1Q21 update but showed a V-shaped chart of its charter hire rates: Source: Company

Source: Company

The recovery is in line with the rise in Baltic Handysize index and the recovery of China's industrial production.

According to Clarksons Research, China’s dry bulk imports account for about 40% of global dry bulk trade in 2020. Executive Director Iwabuchi Masahiro and CFO Lim Kai Ching.10 wholly-owned ships: The Baltic Handysize Index has surged by some 5-6X (from 200+ points to 1,200+ points currently) from a year ago, while Uni-Asia's average charter hire rate has risen less dramatically.

Executive Director Iwabuchi Masahiro and CFO Lim Kai Ching.10 wholly-owned ships: The Baltic Handysize Index has surged by some 5-6X (from 200+ points to 1,200+ points currently) from a year ago, while Uni-Asia's average charter hire rate has risen less dramatically.

There is some catching up to do, which will happen when charters are renewed in 2021 and/or 2022.

Uni-Asia wholly owns 10 dry bulk carriers which are roughly equally split in terms of their charter schemes: one-third index-linked, one-third short-term time charter and one-third, more than a year.

Assuming freight rates stay elevated, Uni-Asia will enjoy further increases in its charter hire rates in 2Q2021 and beyond.

| What is Uni-Asia's strength in dry bulk shipping? |

|

|

|

Stock price |

66.5 cents |

|

52-week range |

40 – 68.5 cents |

|

Market cap |

S$52 m |

|

PE |

-- |

|

Dividend yield (ttm) |

1.5% |

|

1-year return |

40% |

|

Price/NAV |

0.3 |

|

Source: Yahoo! |

|

8 jointly-owned ships: Uni-Asia holds minority stakes in 8 other dry bulk ships.

It and expects that strong charter rates will result in strong cashflow which translates into stronger divdends from the joint-investment entities that own the ships.

There is another ship-related revenue stream: Uni-Asia specialises in arranging finance (including for ships and container boxes) and is working to close deals in 2021 so as to generate fee income.

Uni-Asia has other businesses -- including investing in properties in Hong Kong and building small residential projects in Japan.

For its commentary, see the 1Q2021 presentation slides here.