Photo: Joey Ng/Google Maps Photo: Joey Ng/Google MapsThis is the facade of a Singapore-headquartered company located in Yishun, which Singapore-based stock investors are not familiar with, even though the group has existed since 1975 after its founding in Hong Kong. Not that it is a smallish company: Far from it, ASM Pacific Technology (ASMPT) has a global footprint with more than 14,000 employees. Its market cap: About S$6 billion currently. That's one of the market's rewards for having delivered consistent annual profits since it was listed in 1989. In this article, we cover the contours of the business, as it is worthy of being more at the forefront of the Singapore (and elsewhere) investment community. In some respects, ASMPT is another rare Singapore-connected technology story as compelling, if not more so, as that newly-minted tech wonder, AEM Holdings, whose market cap has raced from S$25 million to S$1 billion in the past 4 years. Like AEM, ASMPT has global leadership in its business space. As investors cast their gaze forward, they will recognise ASMPT gaining significantly from disruptive technologies to come, including 5G, Internet of Things, Big Data, autonomous vehicles, etc. |

5G networks will enable Industrial IoT & Smart Manufacturing, autonomous driving and a myriad of transformational changes.

5G networks will enable Industrial IoT & Smart Manufacturing, autonomous driving and a myriad of transformational changes.

Investors differ greatly in their familiarity with technology ('Silicon Photonics' anyone? 'Heterogenous Integration'?), so we leave it to you to turn to the copious amount of content on the Internet if you wish to top up your understanding of ASMPT's business (https://www.asmpacific.com/en/).

That effort can be a rewarding jumping point to comprehending its 3Q results which were recently released.

So, briefly, ASMPT is engaged in the design, manufacture and marketing of machines, tools and materials used in the semiconductor and electronic assembly and packaging industries.

Among its wide range of solutions are those which help assemble camera modules for the majority of smartphones makers today (by ASMPT's reckoning).

ASMPT has achieved and maintained clear market leadership at the global level due to a variety of factors. One key reason is its commitment to a multi-pronged strategy of developing a diversified product portfolio to serve a broad range of application markets and a broad customer base.

It has a strong R&D commitment, and management foresight to target investment into specific high growth areas, with strategic M&A activities where required. Steadfast and consistent execution of these strategies throughout many years has also been key.

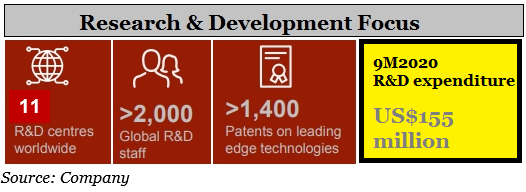

The strong R&D angle is one of those things about ASM that jump out, as the stats show:

With 11 R&D centres worldwide, its R&D expenditure (mainly depreciation of property, plant & equipment, and staff costs) was about US$ 155 million in 9M 2020. This continues a long track record of the company committing approximately 10% of its equipment sales revenues to R&D.

This has yielded more than 1,400 patents on leading-edge technologies.

Listed on the Hong Kong Stock Exchange since 1989, and a constituent of several Hang Seng indices, it's largely known to HK investors and international fund managers. Robin Ng Cher Tat: 10 years as CFO, now CEO.Thanks to the easy reach of the Internet, and with ASM's renewed interest in reaching out to the Singapore investment community, the company could gain traction among Singapore investors.

Robin Ng Cher Tat: 10 years as CFO, now CEO.Thanks to the easy reach of the Internet, and with ASM's renewed interest in reaching out to the Singapore investment community, the company could gain traction among Singapore investors.

A key development has raised the company's Singapore angle: In May 2020, its CFO of the past 10 years, Mr Robin Ng, a Singaporean, was elevated to the CEO post following the retirement of Hongkonger Lee Wai Kwong. Average target price: HK$107.26.

Average target price: HK$107.26.

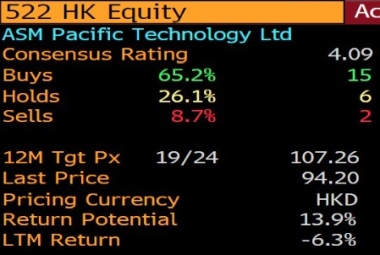

Source: Bloomberg (1 Dec 2020) ASM is tracked by a broad spectrum of analysts. On Bloomberg is a summary of the 23 analysts' recommendations (see table).

We'll provide excerpts of some analysts' reports later but let's get a little more into the business first.

There are 3 business segments in ASMPT, and the company holds strong positions globally in all of them:

| • SEMICONDUCTOR SOLUTIONS: #1 in Assembly & Packaging Equipment Market1 • SMT SOLUTIONS: #2 in SMT Equipment Market2 • MATERIALS: #3 in Leadframe Market3 |

[1] 2019 Worldwide PAE (Packaging, Assembly & Equipment) Market Share. Sources: VLSI, SEMI and ASMPT Market Intelligence.

[2] 2019 Worldwide SMT (Surface Mount technology) Market Share. Source: SEMI.

[3] 2018 Worldwide Lead Frame Market Share. Sources: SEMI and ASMPT Market Intelligence.

The SMT (surface mount technology) Solutions business was acquired from Siemens in 2011. ASMPT progressively realised its synergistic potential and it has proved a solid success, currently accounting for more than 40% of ASMPT's revenue.

The momentum continued in 2013 when ASMPT acquired printer specialist DEK, one of the world’s leading suppliers of screen printing equipment for the SMT and semiconductor industries. ASMPT integrated DEK into its SMT Solutions, aligning the printing and placement processes in electronics manufacturing processes to offer greatly enhanced quality and efficiency.

In 2014, ALSI was 100% acquired, adding multi-beam laser dicing and grooving technology to its portfolio of offerings.

ASMPT's M&A action spiked in 2018 when it made three investments:

| • ASM NEXX, Inc., 100% acquired from Tokyo Electron, providing advanced features and capabilities supporting Advanced Packaging Markets with highly productive and accurate plating and sputtering tools. After acquisition, its revenue achieved a record year in 2019, and the business continues to do very well. • ASM AMICRA Microtechnologies of Germany, also 100% acquired. A worldwide leading supplier of ultra-high precision Die Attach Equipment specializing in submicron placement accuracy (±0.3µm@3s). • A new space -- software for smart factories -- opened up for ASM when it invested strategically in Critical Manufacturing of Portugal. |

After a breather, in Aug 2020, ASM invested strategically in Shenzhen-based SKT Max to complement Critical Manufacturing.

All these are highly technical businesses and you can find out more through the links embedded in the write-up above.

ASM, looking further ahead, has also invested in start-ups (X-ray inspection and 3-D printing), and entered into strategic collaboration with IBM Research (AI chip technology) and SAS (data analytics) and many other undisclosed leading companies.

All that gives us an idea of how ASM has emerged as a global player and continues to fortify its status.

The recent mix of customers spans the world and numerous industries. In short, it's a highly diversified business with its top 5 customers accounting for 15.5% of 9M2020 revenue.

ASMPT’s diverse customer base is a key differentiator, as this means it is not overly dependent on the fortunes of one or two key customers.

Its customers include the world’s leading telecommunication and Information Technology providers and major camera module makers.

• Revenue: HK$11.97 billion (+4.7% y-o-y). • Net profit: HK$624.7 million (+56.0% y-o-y). Check out lots of details in this Powerpoint presentation here. |

||||||||||||||||

Curiously, despite being founded in HK and listed there and headquartered there for many years, ASM shifted its HQ to Singapore in 2011.

As a growing global company operating across three continents and more than 30 countries, it saw value in Singapore’s excellent business environment, ample and cosmopolitan talent pool and strategic location for the future.

In Singapore, it operates two plants in Yishun, with a headcount of 1,400 approximately, representing over 9% of the total group headcount, including R&D teams.

The company’s largest R&D team continues to be in Hong Kong, where it works out of spanking new premises at Gateway in Tsing Yi that were unveiled in 2019. Its HK R&D Centre comprises about 30% of the company’s total R&D headcount, the largest among ASMPT’s eleven R&D centres globally.

OK, time for an idea of how some analysts view ASM's stock, including the risk factors:

We are closing our UW call and upgrading ASMPT to Neutral. We expect 2H20 to be better-than-feared with no meaningful equipment order delay or cancellation even post Huawei restrictions, thanks to the backfill orders from other leading OEMs. The recovery in auto and overseas demand also strengthened willingness for near-term capex expansion in non-China OSATs/IDMs. Traditional LED is seeing some recovery as well. However, CIS momentum is likely to stay muted, while China localization investment may also see a near-term pause. Therefore, we see limited further downside and upgrade the stock to Neutral with a Dec-21 PT of HK$95. |

Reiterate Buy with PO of HK$115 and 3.6x target P/B We reiterate Buy on ASM Pacific Tech (ASMPT), which is one of the largest semis equipment suppliers in Asia. |

Stay EW, but outlook is constructive: The company guided 4Q revenue to be US$530-590mn (-4% to +7% Q/Q, +2% at midpoint), of which the guidance midpoint is 8% better than our estimates and 7% better than Street consensus. The 3Q B/B (book-to-bill) ratio was 1.06 (vs. 0.85 in 2Q) – the second-highest 3Q number historically. ASM Pacific's share price is correlated with the B/B ratio. While poor 3Q EPS could be a drag on the stock price in the coming days, we would look to turn more constructive should the B/B ratio remain above 1. |