JinHou Soo contributed this article to NextInsight

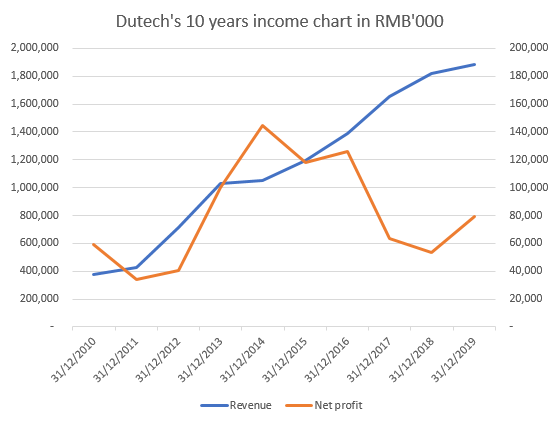

| Dutech is renowned for being an acquisition specialist. In the past, it was able to turn around a loss-making acquiree (Format in 2011), or create synergies to expand their business rapidly, as in the case of DTMT in 2014 and Krauth in 2015. All 3 acquisitions are masterstrokes of a genius not only because they propelled revenue up 5x over the past 10 years, but because Dutech never overpaid for any of them. Alas, Dutech finally had a serious bout of indigestion after the acquisition of Metric Group in Oct 2016.  Dutech CEO Dr Johnny Liu (in red tie) at a past year AGM. Dutech CEO Dr Johnny Liu (in red tie) at a past year AGM. NextInsight file photo |

Metric Group was an insolvent loss-making company, and this affected Dutech’s profitability badly in 2017 and 2018.

2019 saw an uptick in profit and it is the purpose of this article to investigate if Dutech has regained its mojo.

Dutech is an S-chip listed on SGX but headquartered in Shanghai. It is the largest safe manufacturer in Asia, and this product is parked under the High Security Segment. Among the many purposes they serve, Dutech’s safes are used in ATMs. Dutech supplies to Diebold Nixdorf, which controls 35% of the global ATM market. |

Dutech’s management has been cognisant of the decline in ATM demand as cashless transactions grew.

To manage it, they have started the Business Solutions Segment, which supplies automated terminals such as self-service kiosks, ticket vending machines, parking terminals etc.

Over the years, Dutech has managed to grow the revenue of this segment well, but its profitability is no match for the High Security segment.

However, a closer look at the numbers shows significant improvement in profitability for the Business Solutions segment in 2018 and 2019.

It is not immediately apparent due to hefty kitchen sinking exercises undertaken in 2018 and 2019 for Metric Group. Without these, core profit improved in 2018 and surged in 2019.

|

|

in RMB '000 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

High Security |

Revenue |

821,346 |

849,717 |

795,393 |

967,394 |

920,989 |

|

Profit from operation |

133,114 |

156,821 |

78,729 |

76,783 |

120,956 |

|

|

Margin |

16% |

18% |

10% |

8% |

13% |

|

|

Business Solutions |

Revenue |

372,402 |

540,493 |

861,141 |

855,547 |

961,170 |

|

Profit from operation |

18,639 |

12,771 |

3,373 |

1,825 |

19,293 |

|

|

Impairment |

|

|

|

13,676 |

41,982 |

|

|

Gain on bargain purchase |

|

4,352 |

|

|

|

|

|

Core profit from operation |

18,639 |

8,419 |

3,373 |

15,501 |

61,275 |

|

|

Margin |

5.0% |

1.6% |

0.4% |

1.8% |

6.4% |

The strong result for 2019 occurred in H2, but headline profits are unspectacular because they are obscured by large impairments.

These aren’t poor quality accounting profits either.

In 2019, Dutech booked free cash flow of RMB 193m, or an incredible 38% of its market value, or 83% of its enterprise value.

This surge in cashflow results in net cash per share rising from RMB 48c at end 2018 to RMB 77c at end 2019, equivalent to 54% of its share price.

|

in RMB '000 |

31/3/19 |

30/6/19 |

30/9/19 |

31/12/19 |

|

Revenue |

397,338 |

496,878 |

490,887 |

490,077 |

|

Impairment |

|

|

-5,560 |

-36,398 |

|

PBT |

12,047 |

34,550 |

47,493 |

37,418 |

|

Net profit |

8,774 |

20,714 |

38,326 |

11,295 |

|

EPS (rmb cents) |

2.46 |

5.81 |

10.75 |

3.17 |

|

Core profit |

8,774 |

20,714 |

43,886 |

47,693 |

|

Core EPS (rmb cents) |

2.5 |

5.8 |

12.3 |

13.4 |

|

|

|

|

|

|

|

Net cash from operation |

(9,823) |

2,100 |

124,173 |

117,726 |

|

Capex |

(12,481) |

(11,452) |

(8,166) |

(8,529) |

|

Free cash flow |

(22,304) |

(9,352) |

116,007 |

109,197 |

At SGD 28c, Dutech trades at PE 6.4 over 2019’s EPS, at PE 4.2 excluding impairment, and at PE of 2.8 if H2 results are annualised.

Admittedly, just adding back the impairments to the net profit is a bit simplistic without considering tax implications.

But consider this, the tax rate for FY2019 is abnormally high, double the typical rate, which is caused by large deferred tax of RMB 22.5m.

A quick check on all the tax jurisdictions of the company shows that none of them charges such a high rate.

This may suggests that the effective tax rate may revert to typical rates moving forward, and that the addition of impairment back to net profit may not be a poor reflection of core profit since the foregone profit should not be charged as high a rate as 2019’s.

|

in RMB '000 |

31/12/15 |

31/12/16 |

31/12/17 |

31/12/18 |

31/12/19 |

|

PBT |

149,435 |

160,500 |

67,164 |

67,198 |

131,508 |

|

Tax |

-31,435 |

-34,396 |

-2,905 |

-14,072 |

-52,399 |

|

Effective tax rate |

21% |

21% |

4% |

21% |

40% |

Does 2H19 mark the turning point in Dutech’s fortune?

Admittedly, I don’t know. Management attributed the strong 3Q19 and 4Q19 to changes in product mix for Business Solutions and High Security segments respectively.

However, they did not divulge the specific products driving the strong profitabilities. Without this information, it is difficult to ascertain if the magnificent H2 results can be sustained through the Covid 19 pandemic.

It is the author’s opinion, that the High Security segment may be adversely affected but the Business Solutions segment may benefit. For the former, since cash is a known transmission pathway for the virus, the pandemic will accelerate the decline in cash transactions and thus ATM demand. Management has confirmed this assessment through the AGM Q&A disclosed on 24/6/20.

However, businesses may invest in more unmanned, automated solutions to reduce face-to-face interactions and this should drive demand for self-service kiosks and unmanned parking terminals that are parked under the latter segment.

It should be noted, however, that public transport usage has declined due to the pandemic and their automated public transport solutions may be affected. Incidentally, management has disclosed that this segment saw a 40% drop in revenue in Q1 so it is entirely the author’s conjecture that this segment may be a Covid winner.

On a side note, they are the OEM manufacturer for FallBrook Technologies’ NuVinci continuously variable plenetary gear that are used in premium bicycles. Since bicycle sale has benefitted from the pandemic, this product should do well.

JinHou SooDespite the uncertainty on the sustainability of their performance, it is of some comfort that insiders have been buying. JinHou SooDespite the uncertainty on the sustainability of their performance, it is of some comfort that insiders have been buying. From 24/4/20 to 23/6/20, Dr Hedda Juliana im Brahm-Droege has purchased a total of 300,700 shares at a cost of SGD 74,184, according to public disclosures. Dr Hedda is a non-executive director representing the 3rd largest shareholder Droege Capital GmbH with an 8% stake. I note the announcement of another insider purchase for 683,400 shares on 15/6/20. This purchase does not seem to correspond to Dr Hedda’s purchase and it might be an off-market transaction because the total open market transaction on that day is merely 252,700 shares. At the time of writing, the identity of the purchaser is unknown. |

On the negative side, management has guided that 1Q20 will be hit by lockdown measures in China. Also, they are affected by US tariffs against Chinese goods, which are fortunately mitigated by productions plants in Philippines and Vietnam.

Is this the turning point for Dutech’s fortune? We will know in time to come.

It took Dutech 3 years to turn around Format. After a lackluster 2017 and 2018, perhaps it is time for Krauth and Metric Group as well.

One can only hope that if this marks a successful reversal, shareholders are allowed some time to enjoy its sweet success before Dutech embarks on another loss-making acquisition.

Other financial metrics (inclusive of impairments):

|

Share price |

SGD 0.28 |

|

Market capitalization |

SGD 99.8m

|

|

EV |

RMB 233.7m |

|

PE (TTM) |

6.4 |

|

EV / EBIT |

1.8 |

|

ROE |

8.0% |

|

ROIC |

14% |

|

Price to book |

51% |

|

Dividend yield |

3.6% |