Company Overview

Link to StockFacts company page. |

||||||||||||||||||||

1. What are some notable developments that IREIT Global’s unitholders can look forward to?

• We will continue our efforts to strengthen IREIT’s leases and grow the asset base to achieve a more stable and diversified portfolio that will be well-positioned to provide sustainable income streams to unitholders.

• We will remain steadfast in our active asset management initiatives to engage our tenants early and understand their needs in order to ensure continuity of leases, while constantly keeping a lookout for attractive investment opportunities to complement our existing portfolio.

• The recent entry of City Developments Limited (CDL) as a strategic investor in the manager (50% stake in REIT manager) and units of IREIT (12.4% stake in IREIT) is expected to aid us in achieving our growth plans.

• On 1 February 2019, we have also successfully refinanced our borrowings, taking advantage of the current low interest rate environment to lock in our interests at favourable rates over the long term. IREIT does not have any refinancing needs until January 2026. 18 July 2019

2. How can new shareholders such as City Developments and Tikehau Capital contribute to IREIT Global’s future growth?

• Both Tikehau Capital (TKO) and CDL share a common aspiration of growing and diversifying IREIT’s portfolio in Europe. With the strategic investments, TKO and CDL are able to leverage on each other’s strengths and resources to propel IREIT’s growth.

• TKO has a strong proven track record, local presence and expertise as well as established network in Europe, while CDL offers IREIT a strong brand name and financial support. This greatly enhances the credibility, speed and positioning in the investment process, which are critical in the current competitive European real estate market.

3. Describe IREIT Global’s financial performance/profitability over the past few years.

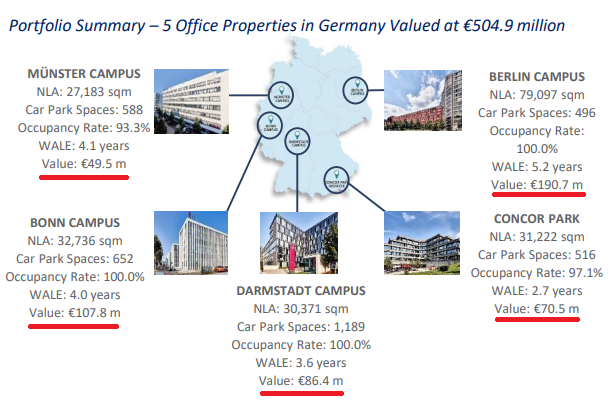

• Rental income streams from IREIT’s portfolio since its listing in August 2014 have been relatively stable and predictable as leases from key tenants are generally committed over a long term with extension options. As at 31 March 2019, the weighted average lease expiry (WALE) for our portfolio stood at 4.2 years.

• The acquisition of Berlin Campus in 2015 contributed positively to the portfolio which resulted in increased income and distribution from 3Q15 onwards.

• The decline in distribution per unit (DPU) from 1Q2017 onwards was driven by the retention of 10% of the distributable income in accordance with the distribution policy set out in IREIT’s prospectus. Net property income and distributable income have remained relatively stable throughout the period.

4. Could you comment on Europe’s current property market? Are there any opportunities which IREIT Global can take advantage of?

• Europe has seen a slowdown in real estate investment activities in 1Q2019 due to the lack of large transactions, limited availability of quality properties, and Brexit uncertainty in the United Kingdom.

• Nonetheless, fundamentals of core European real estate markets, especially office space, have remained sound, supported by low unemployment rate, healthy leasing demand, higher occupancy rates and rising rents. In addition, the low interest rate environment has continued to appeal to investors and support the investment volumes.

• Given the healthy real estate market attributes, high level of buyer interest and favourable lending terms, we may expect some positive spillover effect in secondary markets as well as investment opportunities with upside potential.

5. IREIT Global currently only has exposure to office assets in Germany, are there any plans to diversify into other European countries or other real estate segments/tenant mix?

• The broadening of IREIT’s investment mandate in April 2017 allows us to look at investment opportunities across the office, retail, industrial and logistics sectors, providing us the flexibility and nimbleness to achieve our desired diversification.

• Diversification is one of IREIT’s four pillars of growth strategy, and we expect it to be achieved via acquisition of new properties, broadening tenant mix and extending our reach across other European countries and asset classes. This will reduce our reliance on a few key tenants as well as strengthening our portfolio against cyclical vagaries of any sector or country.

6. What is IREIT Global’s acquisition strategy? What are some considerations when making strategic investments?

• Our strategy is based on four pillars of growth, namely seeking diversification, taking a long-term approach, achieving scale and leveraging on the local presence of TKO.

• We will consider investment opportunities on a holistic basis, beyond short-term returns, to determine how it will complement IREIT’s existing portfolio and how it will enhance the long-term stability of our portfolio income and strengthen our position as a choice landlord for European real estate.

• We maintain a opportunistic yet disciplined approach in our investments, leveraging on the expertise of TKO and selecting only high quality properties in markets where we can build scale and contribute positively to the overall lease profile of IREIT, and not just for yield accretion in the short term.

7. IREIT Global’s aggregate leverage ratio of 38.0% as at 31 March 2019 has reduced from 40.5% y-o-y, will this have any significant impact on its growth strategy?

• The lower aggregate leverage ratio puts IREIT in a stronger financial position as it pursues its expansion plans.

• Our growth strategy will continue to be premised upon the four pillars of seeking diversification, taking a long-term approach, achieving scale and leveraging on the local presence of TKO.

• Depending on the size of the proposed acquisition, we will employ an appropriate mix of debt and equity to fund the investment opportunity.

8. IREIT Global relies heavily on a few key tenants. What is IREIT Global’s strategy of retaining or attracting key tenants?

• Tenant relationship plays an integral part to the success and resilience of IREIT’s portfolio performance. We actively engage our tenants to foster strong and lasting relationships by anticipating their evolving needs. This includes addressing upcoming lease expiries with the tenants with a view of securing their lease extensions in advance.

• While being attentive to our current blue-chip tenants, we are also focused on expanding and diversifying tenant mix in order to reduce the reliance on a single tenant. In this regard, we will continue to invest in our properties in order to maintain the quality of the assets and attract new tenants.

• We will also actively pursue acquisitions of properties with diversified tenants and end-users.

9. How can investors in Asia keep up-to-date with the property market in Europe, in order to better understand IREIT Global’s business?

• Investors who would like to keep abreast with news on the European real estate market can subscribe to receive news alerts and reports from both IREIT and property consultants such as CBRE, JLL, and Cushman & Wakefield.

• From time to time, we will provide investors with updates and insights on the European economy and real estate market through IREIT’s corporate presentation and results materials, as well as broker meetings and conferences.

• Property consultants also provide a good avenue on the latest developments of the European real estate market and their assessment going forward as they publish readily accessible reports on such topics both on a quarterly and ad-hoc basis.

| 10. What is IREIT Global’s value proposition to its unitholders and potential investors? What do you think investors may have overlooked about its business? • IREIT provides investors a unique opportunity to invest in one of the core European real estate markets (Germany), which is one of the world’s most established investment markets with strong regulatory and legal frameworks. Our current portfolio consists of freehold offices which are amongst the most favoured asset classes in Europe, given the healthy economic backdrop, firm occupier demand and declining vacancy rates. • We believe that Germany is also regarded as one of Europe’s safest and most stable market for investments. • Investors can count on the strong expertise, network and resources of TKO and CDL, both of which have strategic stakes in the manager and IREIT, to build a resilient and sustainable portfolio for them. |

First published on SGX website

10 in 10 – 10 Questions in 10 Minutes with SGX-listed companies

Designed to be a short read, 10 in 10 provides insights into SGX-listed companies through a series of 10 Q&As with management. Through these Q&As, management will discuss current business objectives, key revenue drivers as well as the industry landscape. Expect to find wide-ranging topics that go beyond usual company financials. This report contains factual commentary from the company’s management and is based on publicly announced information from the company.

For more, visit sgx.com/research

For company information, visit www.ireitglobal.com

Click here for FY2019 1st Quarter Earnings Announcements