| The key takeaway from the table below is that, since 2010, 2H profits for Best World International have always been much higher than 1H profits. With no exception. The question is: Will it continue to be so this year?

|

|||||||||||||||||||||||||||||||||||||||||||||

The thing about this year is that 1H profits were massive -- a 63% surge y-o-y.

Investors can, understandably, have reservations about 2H continuing the past trend of 2H profits jumping higher than 1H.

The same reservation would have been felt by investors in 2015 after the 1H profit surged 168% y-o-y.

In fact, it would have been keenly felt in 2014 too. (1H profit was up 51% y-o-y).

But in both years, the 2H proved to be a roaring success.

|

|

CIMB |

Maybank |

DBS V |

|

Forecast 2017 net profit |

$44m |

$44m |

$41m |

|

Target stock price |

$1.80 |

$1.88 |

$1.45 |

Will it be different this time because the base has become so much higher?

Are the three research houses which cover Best World playing it safe in their forecasts?

The latest CIMB and Maybank Kim Eng reports both forecast full-year profit of $44 million, implying that 2H will be about equal to 1H.

DBS Vickers forecasts $41 million -- ie, it expects 2H to be lower than 1H.

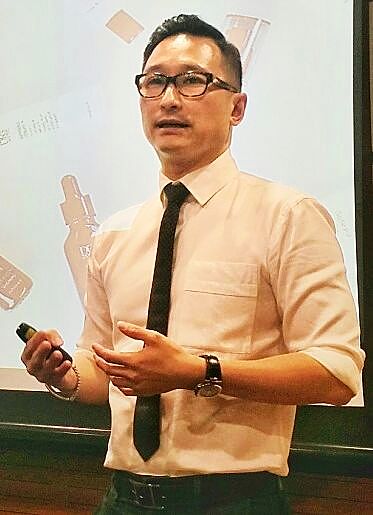

If Best World does indeed deliver 2H2017 earnings that are much higher than 1H, there is upside for analysts to raise their target prices. Huang Ban Chin, Chief Operating Officer of Best World. NextInsight file photoBest World's chief operating officer, Huang Ban Chin, didn't overstate things when he said in an interview with Business Times last week: “The company is on track to hit analyst targets of S$41 million to S$44 million of net profit for 2017. This translates to a 20-30 per cent improvement from 2016.”

Huang Ban Chin, Chief Operating Officer of Best World. NextInsight file photoBest World's chief operating officer, Huang Ban Chin, didn't overstate things when he said in an interview with Business Times last week: “The company is on track to hit analyst targets of S$41 million to S$44 million of net profit for 2017. This translates to a 20-30 per cent improvement from 2016.”

After being queried by SGX, Best World said: "....the above statement should be interpreted that since we have achieved profit attributable to owners of the parent company of S$21.7 million for 1H2017 and based on our past achievements, where second half of the year is stronger than the first half of the year, the company is on track to meet analyst targets."

What drove profit growth in 1H2017 was demand for Best World’s DR’s Secret range of skincare products in China.

This will continue to be the thrust in 2H2017, as Best World widens its outreach to Chinese consumers.

For more insights, read the analysts' reports by clicking on links in the article.

Growth for China is likely sustainable and this will be the key catalyst to support the share price.