Republished from ThumbTackInvestor with permission

| WHAT MAKES YOU THINK YOU CAN WIN? THE CASE FOR THE TRUE VALUE INVESTOR – LTC CORPORATION & S I2I LIMITED |

Value investing as a concept has really taken off in the past couple of decades.

Graham came up with the science behind it, but Buffett single handedly popularized it and made it mainstream by showcasing results that became the fantasy of investors-wannabe all over the world.

Let me play the devil’s advocate here, and put forth a key concept question: If information is now ubiquitous, and assuming most retail investors have access to the same type of information, at the same time, how does one truly find value and capitalize on it?

If there’s a real discrepancy between the intrinsic value and the price, wouldn’t the numerous eyeballs in the investing realm quickly identify this gap, and take the appropriate action, either by going long or short, such that the net results of their actions would quickly nullify this discrepancy?

Let’s not forget that WB and Graham resided in a very different world from the world today.

Information was not ubiquitous. One could get a real advantage by receiving information faster. Hence, the scuttlebutt method of investing works. Going down to the base level, kicking tyres and doing good old investigative work gives one a true operating advantage. That’s hardly true these days.

Here’s TTI’s answer to my own question.

There are still opportunities because true value investing is simply… difficult. Most people would not be willing to put in the work required to find these opportunities. It’s human nature.

OK, this post is inspired by 2 recent incidents in my life.

|

1) Dad excitedly called me up one fine day to tell me that his buddy recommended him to purchase a trading program. All he had to do was to input the ticker symbol of the stock, and it’d track the share price and tell him when to buy and when to sell. The program apparently has a “very high success rate”.

|

Illogical and without basis.

Yet, that’s the case throughout history, and it’d never change.

Why? Cos it’s easy to do so. The allure of riches without effort is strong enough to overcome human logic. Hell, even I feel like participating in the US Powerball after reading the news!

https://www.washingtonpost.com/news/morning-mix/wp/2017/08/26/a-hospital-worker-won-the-powerball-her-prize-758-7-million-and-police-outside-her-house/?utm_term=.9f3201205371

As the title suggests, I’m gonna make the case for the TRUE value investor.

I use the word “true”, because I don’t think there are many true value investors.

There are many value investors because of WB’s popularity… but there aren’t many who can truly claim to seek out value.

Since SG TTI was set up, I have had the fortune of making friends with and discussing investment ideas with several of my readers. Amongst them, I’d highlight 3 of them as true, blue value investors. And their results (those that I can verify) have been truly stunning.

It’s a pity that I cannot share too much information about 2 of them, as they have both declined to be identified or spoken about at length.

The 1st guy is an UHNW individual, based in HK. Made his fortune at a relatively young age, and now runs a home office managing his own fortune. He shared just 1 idea with me sometime in mid 2016, it’s been slightly over a year, and the ROI sits pretty at 28% right now. (Incidentally, I just recently found out one of my friends works for him. It’s a freaking small world)

The 2nd guy is also based in HK, works in the fund management industry, and although I am not sure what the results of his fund look like, but the 1 idea he shared with me, also sometime last year, has returned close to 32% to date. I can understand why he doesn’t want to be featured, I guess there are all those non-disclosure stuff to consider in his line of work.

The 3rd guy, ah, and now I can showcase verifiable results, is Alain T, and he has contributed a post sometime ago here:

S i2i Investing Thesis

Please go and read that post again before you proceed. Please. It’s important, so that one can understand what it means to be a true value seeker. Go take a look at his work.

Note the date of that post: 29th October 2016

So how did his idea do thus far? I’ll quote a paragraph I wrote in a follow up post after his:

“On top of that, at the end of June, the company did a 1-off capital reduction exercise and returned a cool $ 0.729/share to each shareholder. So if one took up a position then, the returns now would’ve been a real pretty sight. I won’t even do the math here, but if you’d just add ($0.729 + capital gains of about $0.1) / intial vested price of around $1.65, and then annualize the return…. the ROI figure should be eye popping.”

And that was in October 2016.

I won’t even bother to do the math if one had invested before June (I believe Alain did because he brought this idea to me before that). The returns would be several hundred % by now. Yes, several hundred %.

Let’s be critical and assume that one had vested in S i2i at the point the post was published, and not earlier. How had the share price performed?

Share price rose from $1.75 to $3.08 at the time of writing this.

That’s a 76% return in just under 1 year!

And that’s achieved by buying and going to sleep in the market and not doing anything but waiting and sitting tight. No reading and shouting “UP UP UP” everyday. Nothing. Just doing nothing.

I have never seen anyone using squiggly lines prove their long term results to me like this. And I’ve an open mind.

Right now, we can all agree that this kind of returns is outstanding. Anyone would be proud of it.

But what does it entail? Again, as I’ve mentioned above, go read that post again: S i2i Investing Thesis

This is the type of effort and work needed to attain the confidence and arrogance to invest AND stay vested in the face of opposing views.

And that, my friends, is what I call true blue value investing.

Still not convinced?

Recently, with the release of LTC Corporation’s FY17Q4 results, I was updating my thoughts while going through the financials, when I suddenly remembered that Alain T sent me his investing thesis on LTC Corporation as well.

I searched for it on SG TTI and couldn’t find it, before I finally realized that I forgot to post it here! It was sitting in my mailbox after I read it.

Again, it’s a piece of art.

Instead of copying and pasting here, I’ll just attach the report in it’s entirety here.

LTC Corp Thesis by Alain T 10112016

Do download it and take a look. Note the date: 10th Nov 2016.

So how has this idea done?

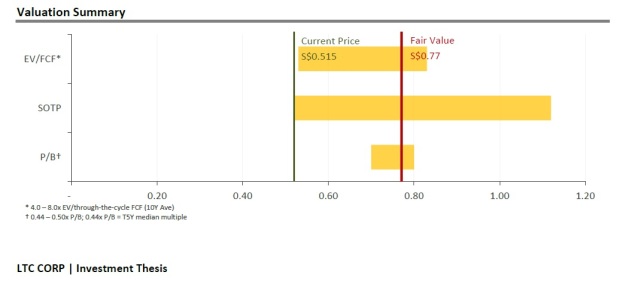

Share price then was $0.55, today’s it sits pretty at $0.685, giving a return of 24.5% in just under 10 months!

But in reality, his thesis was written way earlier. I’ll just cut and paste the concluding segment:

So if one bases it on the $0.515 entry price, his returns right now would be even higher at 33%.

At this point, I’ll squeeze in my updated analysis on LTC Corporation.

Both Alain T and myself were in agreement then, that LTC’s superior FCF generation ability meant that their debt would be quickly eliminated, and in subsequent quarters, without having to pay off debt, LTC would be extremely cash rich.

I’ve opined about that in several posts, but this is the most recent one: LTC Corporation – FY17Q2 Results. Let’s Analyze…

Thus far, FY17Q4 results have confirmed that our thesis remains on track.

|

($’000) |

FΥΟ9 |

FY10 |

FY11 |

FY12 |

FY13 |

FY14 |

FY15 |

FY16 |

FY17 |

|

Interest-bearing loans and borrowings |

49,311 |

40,117 |

22,932 |

41,181 |

28,056 |

4,792 |

13,940 |

6 |

0 |

|

Interest-bearing loans and borrowings |

8,827 |

1,584 |

15,991 |

1,001 |

45 |

16,750 |

34 |

56 |

6 |

|

total debt (current + Non-current) |

58,138 |

41,701 |

38,923 |

42,182 |

28,101 |

21,542 |

13,974 |

62 |

6 |

Total debt was pretty much eliminated with a single year’s FCF in FY16, and that has been brought down to a negligible $6k as of FY17.

The excess cash has accrued in the balance sheet:

|

($’000) |

FΥΟ9 |

FY10 |

FY11 |

FY12 |

FY13 |

FY14 |

FY15 |

FY16 |

FY17 |

|

Fixed deposits |

1,885 |

2,502 |

2.435 |

9,152 |

7,561 |

7,788 |

15,914 |

16,853 |

33,915 |

|

Cash & bank balance |

24,609 |

9,843 |

10,202 |

13,420 |

20,641 |

31,215 |

28,880 |

17,519 |

14,939 |

|

Cash holdings |

26,494 |

12,345 |

12,637 |

22,572 |

28,202 |

39,003 |

44,794 |

34,372 |

48,854 |

At $48.9mil of cash and cash equivalents, it’s at its highest since FY09, and at the same time, debt is at it’s all time low (or rather, zero)

Of course, the key risks lies in the utilization of this cash. Management has not been great managers of cash. ROE figures remain in the low single digits, and while earnings have improved, they haven’t been great.

In his thesis, Alain was kind enough to give management some time to prove the USP acquisition would be successful. I’ll quote from his report:

“Potential for poor capital allocation to destroy value. The fact that LTC is cash rich and could begin to rapidly accumulate even more cash as debt repayments subside makes management’s capital allocation abilities pivotal going forward. The first use of said cash was to add a new retail business segment last year. While the jury is still out on that investment (see Appendix for further analysis), management’s use of cash is an important metric to track going forward as it weighs heavy on LTC’s future intrinsic value.”

Well, I ain’t so kind.

I’ve railed at how asinine that move was ever since it was announced and very unfortunately, I’m still right. Oh boy, how I wish I can eat my words.

Despite paying a nice premium to acquire a struggling RETAIL business, our total returns from it thus far has been a loss after 2 years.

Even now, the book value is 162.82 cents, while the share price is 68.5 cents. LTC trades at a 58% discount to book value! To top it off, this 68.5 cents comprises 31.2cents of cash and cash equivalents. Even now, the book value is 162.82 cents, while the share price is 68.5 cents. LTC trades at a 58% discount to book value! To top it off, this 68.5 cents comprises 31.2cents of cash and cash equivalents. |

Still, we bet that with the tremendous amount of FCF that builds up in LTC’s balance sheet each quarter, the share price simply HAS to increase. It’d be ridiculous not to.

The company is severely undervalued, and as long as the FCF generation holds up, this undervaluation has to be corrected. If the management maintains at status quo, logically, the share price has to rise in tandem with the cash that builds up in the balance sheet.

If the management wakes up tomorrow and decides to be more shareholder friendly, the share price can shoot through the roof.

It is hard to see the share price dropping, as the amount of cold hard cash in its books acts as a floor.

This is the type of dynamics that I like. Draw or win. There’s no lose. Not a bad deal.

But then, this post is not about LTC or S i2i.

It’s about true value investing.

I’d encourage anyone who wants to make their next investment, to go stare at the 2 investing theses above, and think about this for a moment. There are guys like these 3 folks out there, doing this kinda work. (I wish I can share the other 2’s)

They are looking at the same things as you are.

Since the stock market is a negative sum game, you’re technically stepping in the ring to compete with them, figuratively, each time you make an investment (or punt, in some cases)

What makes you think you can win?