Excerpts from UOB Kay Hian report

Analysts: Nicholas Leow & Edison Chen

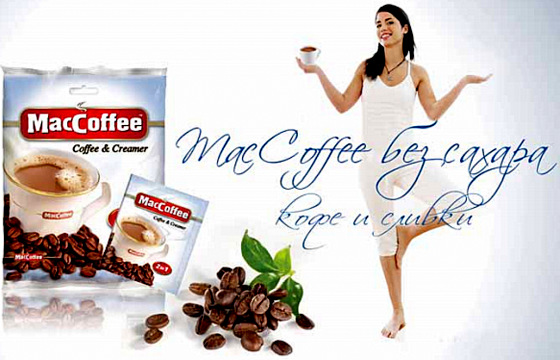

Food Empire's MacCoffee is the leading 3-in-1 coffee product in Russia. In local currency terms, its sales in Russia have grown tremendously at 17% CAGR from 2013 to 2015.Initiate coverage with a BUY on this dominant coffee mix market leader in Eastern Europe with a target price of S$0.78. Food Empire's MacCoffee is the leading 3-in-1 coffee product in Russia. In local currency terms, its sales in Russia have grown tremendously at 17% CAGR from 2013 to 2015.Initiate coverage with a BUY on this dominant coffee mix market leader in Eastern Europe with a target price of S$0.78.

Besides its proven pricing power and US$174.8m in brand value, the CEO is buying back shares aggressively and we believe investors should follow. |

INVESTMENT HIGHLIGHTS

♦ The 2016 comeback is real for this coffee mix leader in Eastern Europe. Food Empire is the instant coffee mix market leader in Eastern Europe and Vietnam with the largest market share in Russia (>50%), Ukraine (>40%) and Kazakhstan (>70%). Most of the weakness in Food Empire’s profits and stock performance in 2014-15 could be attributed to its exposure to the Russian rouble. 2016 will be the comeback year as the company had generated a net profit of US$11.6m in 9M16.

♦ Revival of the rouble swings 2016-17 profits into space. There were two primary causes for the 2014 Russian crisis - falling oil prices and economic sanctions. Oil prices have since stabilised with the rouble firming up as US President Trump looks to lift economic sanctions on Russia. Large retailers such as Ikea have begun pumping billions of dollars in capex into Russia as they bet on Russian consumers to start emerging from hibernation after two years of recession.

Our sensitivity analysis shows that if the rouble reaches 50/US$, Food Empire’s 2017 profit will hit US$17.5m, implying 12.3x 2017F PE and a target price of S$0.88.

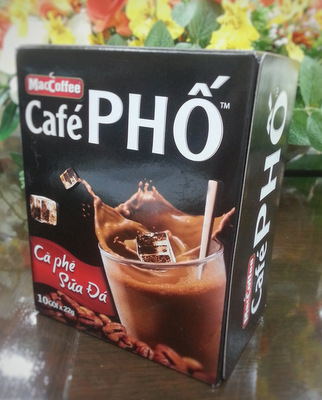

| ♦ Explosive growth in Vietnam |

"Other than the Russian rouble, Vietnam is the next growth driver for Food Empire where sales have been exploding with superstar product, Café Pho. IndoChina revenues nearly tripled from US$10.5m in 2014 to US$29.4m in 2015 and hit US$24m (+40% yoy) in 9M16." "Other than the Russian rouble, Vietnam is the next growth driver for Food Empire where sales have been exploding with superstar product, Café Pho. IndoChina revenues nearly tripled from US$10.5m in 2014 to US$29.4m in 2015 and hit US$24m (+40% yoy) in 9M16."-- UOB Kay Hian report |

♦ Proven pricing power evidenced by brand worth of US$174.8m. Previously valued at US$174.8m during a 2013 valuation by Brand Finance, we believe Food Empire’s brands are huge intangible assets that have been out of investors’ sights.

Food Empire’s local currency sales in Russia have been growing tremendously despite the crisis (17% 2013- 15 CAGR). We think the power of its branding is what allows Food Empire to continuously raise its selling prices by a large extent without losing market share.

♦ CEO buying back shares aggressively. Over just nine days in late-Nov 16, Food Empire’s CEO Sudeep Nair acquired 6,558,400 Food Empire shares in the open market. This brought his collective interest in Food Empire from 7.34% to 8.82% as at end-Nov 16.

We take this as a strong indication of management’s confidence in the future of the company and take his last average purchase price of S$0.432 as a soft share price floor.

VALUATION/RECOMMENDATION

♦ Initiate coverage with BUY and PE-based target price of S$0.78, implying a 38% upside. Our target price is conservatively based on 2017F EPS of US$0.029 and pegged to peers’ average FY17F PE of 19.0x. We note that SGX peers such as Super Group was privatised at about 30x PE while Viz Branz was taken over at 16-17x PE.