|

SINCE MY my introductory writeup on ISOTeam dated 17 Jan 2014 (see article),ISOTeam has soared 51% from $0.390 on 17 Jan 2014 to $0.590 on 27 Feb 2015. Having jumped significantly in the course of 13 months, the next question which naturally comes to mind is whether ISOTeam is overvalued. |

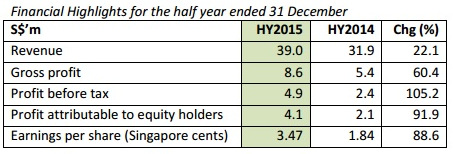

Record 1HFY15 results

ISOTeam released a sterling set of 1HFY15 results on 12 Feb 2015. 1HFY15 revenue and net profit rose 22% and 92% respectively to S$39.0m and S$4.1m respectively. Gross margins improved sharply from 16.8% in 1HFY14 to 22.1% in 1HFY15 due to a better profit margin of R&R completed projects. Management believes that gross margins are likely to stay around these levels in the near term. (See Table 1 below)

2HFY15 results likely stronger than 1HFY15

2H results contributed 55% - 65% for the past two financial years. In addition, ISOTeam has completed four acquisitions in Jan 2015 which are likely to post their maiden contributions to 2HFY15F results. According to UOB Kayhian, these four acquisitions have a total adjusted net profit of about S$1.5m/year at the time of acquisition.

Strong order books and positive outlook

As of 8 Jan 2015, ISOTeam has an order book of S$70.4m, to be progressively delivered over the next two years. It is currently the lowest tenderer for four other projects collectively worth a total of S$30.9m.

Positive outlook

Its outlook continues to be bright as there seems to be more projects to be awarded. For example, according to a Straits Time article dated 10 Jan 2015, the Ministry of National Development (MND) will set aside $20m to upgrade another 9 private estates under its Estate Upgrading Programme (EUP). EUP includes landscaping, construction of ramps for wheel chair uses and enhancing parks and playgrounds etc.

According to another Straits Time article dated 11 Sep 2014, the government will expand its neighbourhood renewal program (“NRP”) to include HDB blocks built between 1990 and 1995. Previously, only HDB blocks built in and before 1989 are entitled for NRP. In other words, another 100,000 households in more than 1,300 blocks will benefit from the programme. There will also be more features included in the NRP such as block repainting and other repairs.

The above measures bode well for ISOTeam’s business prospects.

Potential beneficiary of general election  Anthony Koh (left), CEO of ISO Team, and the GM, Richard Chan, speaking with an analyst. NextInsight file photoMost market watchers are expecting Singapore’s general election to be held in late 2015 or 1H2016. It is not unreasonable to assume that more of the aforementioned projects (i.e. NRP, EUP, upgrading of hawker centers etc) may be rolled out in the near term which should benefit ISOTeam to a certain extent.

Anthony Koh (left), CEO of ISO Team, and the GM, Richard Chan, speaking with an analyst. NextInsight file photoMost market watchers are expecting Singapore’s general election to be held in late 2015 or 1H2016. It is not unreasonable to assume that more of the aforementioned projects (i.e. NRP, EUP, upgrading of hawker centers etc) may be rolled out in the near term which should benefit ISOTeam to a certain extent.

A greater following & emergence of anchor shareholders

ISOTeam has come a long way since my first writeup in Jan 2014. Besides UOB Kayhian, it has since attracted DMG coverage. In addition, it has been featured more frequently in the media with the latest media release dated 23 Feb 2015 (See article)

Besides a greater following from the media and analysts, some reputable names have emerged as substantial shareholders of ISOTeam. For example, Nippon Paint (Singapore) has increased its stake from 2.6% to 5.9% in Dec 2014.

It is noteworthy that ISOTeam is the exclusive applicator for Nippon Paint (Singapore). (You may have read that Mr Goh Cheng Liang, founder of Nippon Paint South-East Asia Group (Nipsea), is Singapore’s richest man with a US$8.2b fortune, ahead of Mr Wee Cho Yaw, second richest man in Singapore with a US$6.9b fortune.)

Besides Nippon Paint (Singapore), Singapore Tong Teik (Private) Limited, a natural rubber trading company founded in 1964 and based in Singapore, took a 6.4% stake in ISOTeam in May 2014. Readers who have followed the news on UE E&C, a construction / property developer, would be familiar with Singapore Tong Teik (Private) Limited which has acquired a significant stake in UE E&C.

Thus, its acquisition of a substantial stake in ISOTeam is likely to be in line with Singapore Tong Teik (Private) Limited’s long term business interests.

Figure 1: Four *acquisitions completed in Jan 2015

* In the latest announcement dated 27 Feb 2015, Accom, Accom International and Rong Shun have been renamed as ISOTeam C&P Pte. Ltd, ISOTeam Access Pte. Ltd and ISO-Landscape Pte. Ltd.

* In the latest announcement dated 27 Feb 2015, Accom, Accom International and Rong Shun have been renamed as ISOTeam C&P Pte. Ltd, ISOTeam Access Pte. Ltd and ISO-Landscape Pte. Ltd.

Online handyman service portal rollout in 3Q CY2015

ISOTeam is rolling out its online handyman service portal in 3Q CY2015 to provide a one stop solution portal for plumbing, air conditioning, general repairs, tile works etc. This is a step forward to its vision of being a complete building and maintenance team.

Besides the usual risks which you can find in my previous writeup and ISOTeam’s prospectus, here are some which I deem to be noteworthy.

Risks

Illiquidity is still an issue

Based on its latest annual report 2014 which did not take into account of the recent placement and share issuance, the top 20 shareholders have about 90.4% of ISOTeam’s outstanding shares. Ave 30D and 100D volume amounted to around 285,000 and 212,000 shares respectively. This is not a liquid company where investors can enter or exit quickly.

Rising costs

Rising costs, attributed mainly to labour costs, are likely to rise in the medium to long term as our labour market is likely to be tight. However, in the recently announced budget, the foreign workers' levies will be held off to next year. This eases rising costs in the short term.

Notwithstanding the rising labour costs, ISOTeam should be able to maintain their gross margins at around 21% due in part to their recent acquisitions and economies of scale. Furthermore, their R&R projects are typically short term in nature around 9-14 months where they should not be too adversely impacted by rising labour costs.

Seemingly high valuations vs. their construction counterparts

ISOTeam trades at an annualised FY15F PE of around 9.6x. This seems pretty high vis-à-vis some of the construction companies. However, ISOTeam's core business is in building refurbishment and upgrading whereas some of their construction peers focus more on new build construction. Thus, this is not an "apple to apple" comparison. Furthermore, the business demand for building refurbishment and upgrading is also different from new build construction.

According to UOB Kayhian’s estimates, after accounting for the recent acquisitions and placement, ISOTeam is likely to have a strong net cash position of around S$13-15m. Stripping out the net cash position of S$13m, ISOTeam trades at an annualised FY15F PE of around 8.1x.

It is noteworthy that ISOTeam’s financial year end is in June, thus FY15F ends in June 2015. In addition, if ISOTeam continues to register earnings growth in FY16, coupled with a full year contribution of its aforementioned acquisitions (i.e. Accom etc), its PE should trend lower over time.

Technical outlook

ISOTeam with the last closing price of S$0.590, is near to its record intraday high of S$0.605 on 18 Feb. ISOTeam exhibits a clear uptrend as depicted by its rising exponential moving averages. It has spent the month of February consolidating its gains between S$0.565 – 0.605. Any breakout to the upside / downside with volume expansion has an eventual measured technical target of S$0.645 / 0.525 respectively. As the prevailing trend is up, the probability of an eventual upside breakout outweighs that of a downside break.

Supports: $0.575 / 0.565 / 0.55 – 0.555

Resistances: $0.605 – 0.610 / 0.645 – 0.650

Conclusion

Although ISOTeam has appreciated 55% since my last writeup, its defensive and revenue-recurring business (also mentioned in my previous writeup), potential record FY15F results, more contract wins and analyst coverage may be some of the possible catalysts for its share price.

Nevertheless, its lack of liquidity, seemingly high valuations relative to construction companies and sharp share price performance over the course of 13 months may be some noteworthy factors for readers to consider.

Recent story: ISOTEAM: Vote of confidence from strategic business partner