"We are glad our shipyard and subsea services have remained profitable in the last few quarters. We are cautiously hopeful that earnings from these 2 segments will remain resilient for the rest of the year," said Group CEO Michael See. Its shipyard focuses on repair, conversions and fabrication, and only builds vessels for cabotage markets.

"We are glad our shipyard and subsea services have remained profitable in the last few quarters. We are cautiously hopeful that earnings from these 2 segments will remain resilient for the rest of the year," said Group CEO Michael See. Its shipyard focuses on repair, conversions and fabrication, and only builds vessels for cabotage markets.

Photo by Sim Kih

OTTO MARINE has secured as much as US$131 million worth of new chartering contracts in the current quarter, after it decided to bite the bullet by accepting relatively lower charter rates.

“We expect the average utilization rate of our offshore and subsea vessels to improve from the levels we saw during the two quarters following the fall in oil price in 4QFY2015,” said Group CEO Michael See, in an exclusive interview with NextInsight last week.

He believes oil prices will remain at current levels for some time, and views the contracting of vessels at current market rates a more cost effective solution compared to having idle vessels. "We will review our cost structure to more efficiently support the lower charter rates," he added.

Its most recent charter contract was announced on 11 June: Its wholly-owned subsidiary, Swordfish 1, secured a long-term bareboat charter contract worth US$27 million. The vessel is currently under construction, and will be delivered to an offshore vessel operator in Southeast Asia in the next quarter.

Geographical diversification buffers OSV slump

Swordfish 1 is a DPS-2 work maintenance vessel, able to accommodate 238 men and with a deck crane with lifting capacity of 80 tons. Photo: Company

Swordfish 1 is a DPS-2 work maintenance vessel, able to accommodate 238 men and with a deck crane with lifting capacity of 80 tons. Photo: Company

A second factor that is contributing to its healthy vessel utilization level is having a fleet sophisticated enough to be deployed in diversified geographic regions.

Its strategy of foraying out of Southeast Asia markets has proven sound in the light of of the deterioration of the vessel charter market in Malaysia and Indonesia. Offshore projects there are mainly located in shallow waters. Demand from this market is mostly for vessels with relatively less complex specifications. That means competition is also most challenging there.

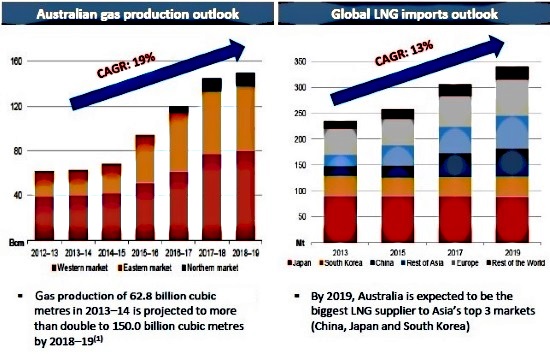

About half of Otto Marine's fleet is deployed in Australia, a market where chartering demand is relatively stable due to the LNG production projects there.

Source: Australia Bureau of Resources and Energy Economics, Sep 2014

Source: Australia Bureau of Resources and Energy Economics, Sep 2014

Another 4 vessels are deployed in North Sea, where few Asian players have successfully ventured because vessels deployed in the North Sea are larger and require DNV classification.

Thirteen vessels are deployed in Africa and Mexico. The Group has been chartering vessels to these two regions since 5 years ago. It enjoys high utilization rates in these two regions, thanks to a strong relationship with local partners.

Vessel ownership versus 3rd party vessels

Another reason the Group is able to improve its vessel utilisation rate under a challenging chartering environment is the ability to maintain a prudent balance between vessel ownership and the use of third-party vessels. During the past 2 months, the Group returned about 8 vessels to ship-owners. Two new vessels were chartered for back-to-back contracts from an oil major.

“We currently own less than 50% of our fleet and intend to increase the proportion of vessels owned to no more than 85%," said Mr See. “Even though third party vessels generate lower margin, they provide the flexibility of returning vessels to ship-owners when charter demand falls." The Group’s strategy is to replace older vessels with new vessels with more advanced technology.

Current levels of vessel market values provide opportunity to buy vessels at competitive rates. Recently, it bought a 4-year old 16,000 bhp AHTS built in Italy (Go Spica). This vessel is currently on a long term charter contract with an international oil major in Australia. It also bought a brand new 16,000 bhp AHTS that was built in Japan. This vessel is also on a long term charter contract.

Dealing with oil price crunch

The Group generated gross profit of US$8 million from its shipyard in 1QFY2015, before extraordinary gain from vessel disposal.

Its subsea services segment generated gross profit of US$2.2 million. However, challenging conditions in shipping and chartering resulted a net loss of US$13.3 million for 1QFY2015 as the oil price crunch had put much pressure on national and international oil majors to negotiate for lower vessel charter rates.