Excerpts from analysts' report

|

|

Henn Tan, CEO of Trek 2000.

Henn Tan, CEO of Trek 2000. NextInsight file photo.♦ Educational toy, the key game changer. Trek 2000 International Ltd (Trek) secured an initial USD25m deal to provide wireless Flucard modules for Mattel’s (MAT US, NR) educational doll toy, which has been a big hit in China. Mattel plans to introduce the same toy into the US market by the end of 2014. We expect substantially more orders for Trek’s Flucard worth approximately USD50m in 2H14 and USD100m in FY15.

We believe that more of Trek’s products like the Ai-Ball can be incorporated into the toy, allowing parents to monitor their babies wirelessly via smartphones. This may create another potentially significant revenue stream for Trek. Lastly, medical devices are another potential area for Trek to incorporate its wireless Flucard modules.

♦ Cloud Stringers – the “eBay” for journalists. We expect the ramping up of Cloud Stringers, a digital (cloud-based) marketplace that transmits and transacts online content globally, to commence by the end of the year. Furthermore, its partnership with Panasonic (6752 JP, NR) as well as multiple news agencies and freelance journalists could boost the content and number of users of this site. We are positive on this new platform which might be a potential revenue stream and an asset for Trek from 2015 onwards.

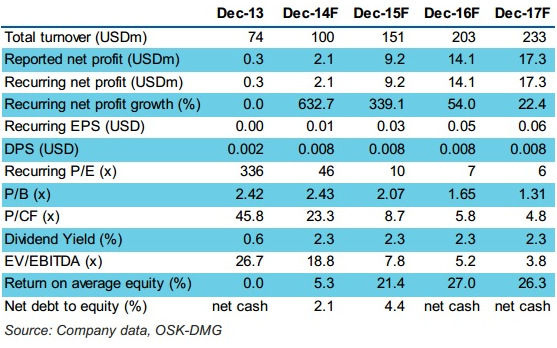

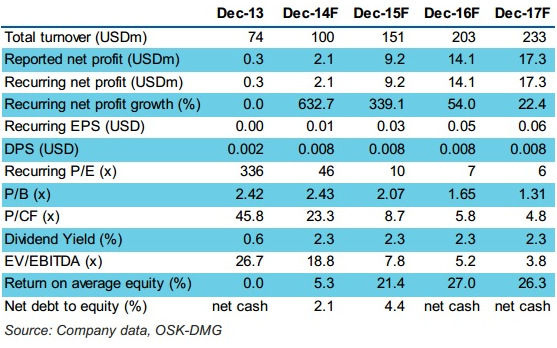

♦ Initiate coverage with BUY and a SGD0.61 TP. We see many positives in place for Trek on the back of the surge in Flucard orders from the Mattel deal. We initiate coverage with a BUY and a SGD0.61 TP, based on a 16x FY15F P/E. We use the expected earnings in 2015 in order to better capture the impact of the Mattel deal.

Its regional-listed peers are trading at an average of 20x FY14F P/E; we ascribe a 20% discount to its peer average, taking into consideration the liquidity of the stock and the relatively smaller scale of the company compared with peers. With a library of 600 patents and a strong and successful research and development (R&D) team, Trek could also be considered a potentially favourable acquisition target by its larger peers.

Its regional-listed peers are trading at an average of 20x FY14F P/E; we ascribe a 20% discount to its peer average, taking into consideration the liquidity of the stock and the relatively smaller scale of the company compared with peers. With a library of 600 patents and a strong and successful research and development (R&D) team, Trek could also be considered a potentially favourable acquisition target by its larger peers.

Execution risk. Despite launching the Flucard in 2010, Trek did not manage to market it well and earnings did not pick up due to its high maintenance expenses of USD10m. The company only managed to secure the Mattel deal this year, which could be the key driver going forward. We believe any new products may face the same execution risk

Full OSK-DMG report here.

Recent story: TREK 2000 in US$25m Rely/Mattel deal; SWISSCO M&A with rig owner