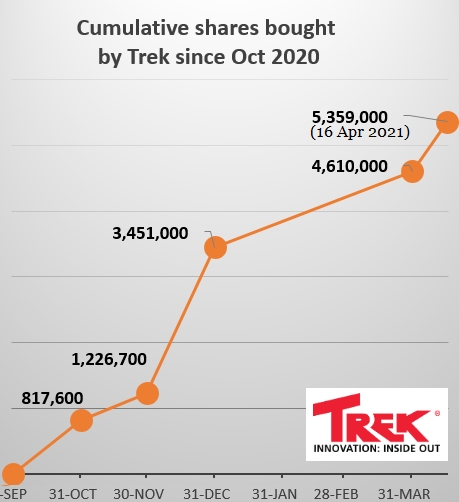

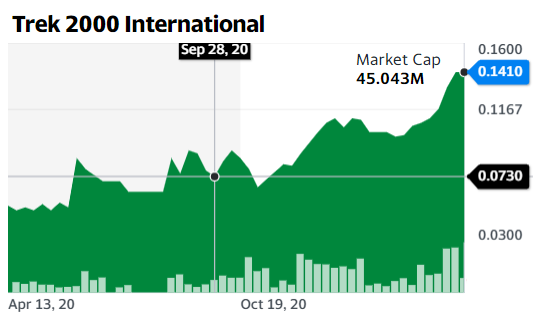

| In our 23 Dec 2020 article (TREK 2000: Strong share buyback helps lift stock price), we noted that Trek 2000 International had been on a buying spree of its shares in the open market since Oct 2020. That helped significantly to lift its share price by 33%, from 7.7 cents to 10.2 cents then. In 1Q 2021 and till date, Trek continued to buy back its shares.  No prizes for guessing which way the stock price has moved.  Chart: Yahoo! Chart: Yahoo! |

Trek 2000 is an industry leader, innovator, original inventor and patent owner of the ThumbDrive® (i.e. USB Flash Drive) and FluCard®, board director of SD Card Association and co-chairman of iSDIO forum. It offers state-of-the-art design solutions ranging from Interactive Consumer Solutions, Wireless, Anti-piracy, Compression and Encryption to sophisticated Enterprise Solutions all catering to the fast changing digital industry.

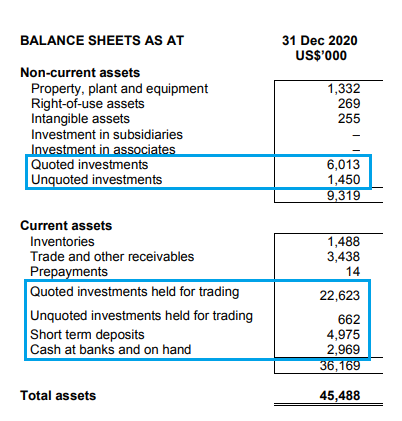

Trek's balance sheet continued to stay quite pretty: Zero borrowings and nearly US$39 million (about S$52 million) in real solid assets which comprise cash, bonds, quoted and unquoted funds (as highlighted below):

Its NAV as at end-FY2020 was 12.52 US cents, or 16.7 SGD cents. That's still above its current trading stock price of 14.1 cents.

Trek, in March 2021, announced a sizeable deal to supply a full suite of IoT-enabled digital storage solutions to Starsway, a leading digital storage device OEM/ODM manufacturer based in Shenzhen, China.

It's a one-year US$10 million contracts to supply its IoT modules to Starsway. This is significant relative to the FY2020 revenue of the entire Trek group of US$25.4 million.

All this is not to say Trek is a stock to buy by investors, although the company has the large resources to continue to buy back its stock and may continue to do so.

There are other issues to note, including:

| • FY2020 was Trek's third consecutive year of pre-tax losses. While revenue increased by 1.3% y-o-y to US$25.4 million, net loss attributable to owners of the Company was US$1.3 million (FY2019: US$1.4 million). • CAD investigation and court cases involving four former top executives. • It's on the SGX watchlist. End-2021, Trek will reach the third and final year to meet the criteria to exit the watchlist, failing which Trek may be delisted or suspended from trading. The exit criteria: Volume-weighted average price of at least S$0.20 and an average daily market capitalisation of S$40 milion or more over the last 6 months. |