|

Posted by 'mervynsim" in NextInsight forum

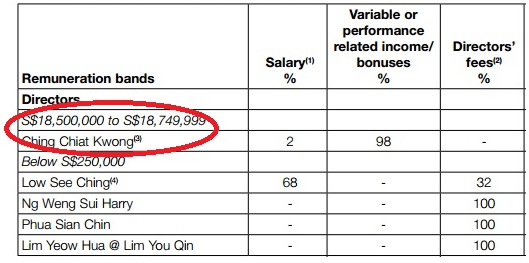

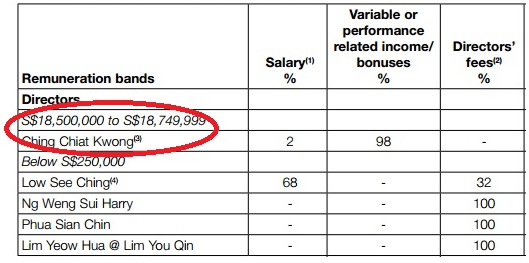

According to Oxley's 2014 annual report, Ching's remuneration this year is above $18.5m! This will likely make him Singapore's highest paid CEO this year!

Meanwhile, a look at the top 20 shareholder list as of 19 Sep 2014 versus 11 Sep 2013 shows that Koh Wee Meng has dropped out of the list. His wife, Lim Wan Looi, has reduced her stake from 33m shares to 9.9m shares.

|

|

Posted by 'Sumer' in NextInsight forum:

Ching Chiat Kwong, Chairman & CEO of Oxley.Yes, Mervyn, I am surprised by the high figure, which could make some retail investors uneasy. Ching Chiat Kwong, Chairman & CEO of Oxley.Yes, Mervyn, I am surprised by the high figure, which could make some retail investors uneasy.

I wrote in another thread (2nd liner prop counters) earlier about Oxley and had exited my remainder holding in the stock after the company cancelled its stock split proposal, which had been a hoped-for catalyst.

The bulk of Oxley’s RNAV is in unlaunched projects, and hence this prop stock is riskier than several other prop developer counters.

Meanwhile, poor sentiment seemed to be pervading the whole market and there is a risk all and sundry will be dragged down the slope. For prudence, I am keeping cash above 30% of total investment.

|

Oxley Holdings reported net profit of S$306.9 million for FY2014 (ended June 2014) up 195% y-o-y. Its FY2014 results presentation slides are here.

Top CEO pay in Singapore in 2013 (Source: Business Insider Singapore) :

1. Piyush Gupta, DBS Group Holdings –S$9.2 m; company net profit S$3.5 billion.

2. Wee Ee Cheong, United Overseas Bank – S$9.2 m; company net profit S$3 billion

3. Kwek Leng Beng, City Developments – S$9 m; company net profit S$683 million.

4. Lim Kok Thay, Genting Singapore – S$9 m ; company net profit S$707 million.

5. Samuel Tsien, Oversea-Chinese Banking Corporation – S$8.8 m; company net profit S$2.8 billion.

Recent story: Terence Wong: I am buying OXLEY @ 49% discount to RNAV

Lvin Yong: Simon Cheong of SC Global developments also drew a similar salary back then when the market was hot. Nothing new. Minority shareholders WILL ALWAYS get the short end of the stick Unless more shareholders are willing to turn activist like Carl Ichan, this trend will remain unchanged.

Ley San Lau: Frankly he was the one who singlehandedly built up the company from scratch. The company performed exceptionally well n his bonus tied to a% of his sterling performance. I dont see what is the problem with that. I still earn a healthy profit. If you want to compare it with hong fok who sits n do nothing and just give themselves exorbitant director fees year after year.

Or compare it an underperforming unit trust who will shamelessly charge opaque management fees even tho they are not contributing to the fund. Now that's really ridiculous. After the way he sold oxley bizhub, 3% bonus is not exactly too much. Huttons agents sometimes even earn 6-8% commission on some projects!